尊享借币产品说明文档

OKX尊享借币业务,旨在为VIP5等级及以上客户在原有余币宝杠杆借币基础上额外提供稳定低息的借贷服务。

1、 什么是尊享借币

尊享借币于2024年5月30日全面升级,支持利率在固定借贷期限30天内保持不变。这意味着借款方在贷款期间的利息金额是固定的,为借款方提供可预测性和稳定性。

升级后的尊享借币采取“出借方挂单,借款方吃单”的模式。出借方在出借订单簿上挂单,并设置该笔出借订单的数量和利率。借款方可以按照利率下单并调整借款额度,系统将按照借款方设置的借贷利率下单。下单后,借款订单将和市场上的出借订单匹配,借款订单在出借订单簿匹配到的加权平均利率就是该笔借款订单的利率。

当借款订单匹配成功并通过扣息校验,即开始计算借贷期限。利息会在借款订单匹配成功时立刻被收取,借款方可以在下单时查看预估利息。

升级后的尊享借币依然采用额度模式,并不是直接将借贷金额添加到交易余额中。实际产生的借贷将计入跨币种或组合保证金账户模式下的负余额或单币种账户模式下的逐仓负债。

例:客户有1BTC,想要开10倍杠杆做多BTC(假设1BTC=100USDT)。客户要用1个BTC做保证金借1,000USDT买来10个BTC等价格上涨。交易完成后,账户里的资产为11BTC,负债为1,000USDT。如果不使用尊享借币,该等1,000USDT的负债只能从余币宝池子中借出。

但是,余币宝借币是有额度的,以上示例中,如果余币宝的借币额度只剩下500USDT(余币宝里USDT被别人先一步借走了,或者正在被自己别的仓位占用),即使保证金足够,用户在余币宝资金池最多只能借到500USDT,只能买5BTC,10倍杠杆交易失败。有了尊享借币后,可借的额度增加了,比如尊享借币给的借币额度是500USDT,那客户就可以成功完成10倍杠杆的交易。完成交易后,客户资产仍为11BTC,负债仍为1,000USDT,但这里的负债,有500USDT是从尊享借币池子里借的,另外的500USDT是从余币宝池子里借的。

另外,即使尊享借币锁定了足够的额度,但保证金不足时也不能成功交易。如果保证金只剩下0.1BTC,即使尊享借币锁定500USDT,最多也只能借到100USDT(包括余币宝和尊享借币)。尊享借币锁定的并不是资金,而是额度,实际借币的数量会根据保证金的数量变化,保证金不足时,对实际借币数量会产生影响。

2、 概览

支持客户范围:VIP5等级及以上客户群体。

单笔订单最低借款额:1万美金等值。

支持借币币种:USDT、BTC、ETH、USDC。

支持账户类型:统一账户模式下的单币种账户、跨币种账户、组合保证金账户(注意切换账户类型必须先还清尊享借币)。

3、借币

3.1 尊享借币限额

尊享借币限额是用户余币宝杠杆借币限额之外的一个独立额度。用户的母账户和子账户均可锁定借币,多个子账户将共享母账户尊享借币限额,但其总和不可超过母账户总尊享借币限额。

VIP 5 | VIP 6 | VIP 7 | VIP 8 | |

USDT | 10,000,000 | 11,000,000 | 12,000,000 | 13,000,000 |

USDC | 2,000,000 | 2,200,000 | 2,400,000 | 2,600,000 |

BTC | 50 | 55 | 60 | 65 |

ETH | 2,500 | 2,750 | 3,000 | 3,250 |

3.2 借币使用

尊享借币服务开通后,用户可通过两个独立的资金池进行借贷:尊享借币和余币宝杠杆借币。在计算利息时,平台会根据用户的借贷总额、尊享借币以及杠杆借币额度的大小,将借贷划分到两个资金池中分别计算负债和利息。当尊享借币和余币宝杠杆借币共存时,尊享借币的额度会被优先使用。

例:用户A的一个子账户总共借了 5,000 USDT:

真实负债 | 尊享借币锁定额度 | 尊享借币负债占用 | 余币宝杠杆借币负债占用 | |

场景1 | 5,000 USDT | 0 | 0 | 5,000 USDT |

场景2 | 6,000 USDT | 6,000 USDT | 6,000 USDT | 0 |

场景3 | 15,000 USDT | 7,000 USDT | 7,000 USDT | 8,000 USDT |

场景1,用户没有尊享借币额度:负债将占用余币宝杠杆借币资金池,其借贷计息逻辑与线上杠杆借币一致。

场景2,用户有足够尊享借币额度来承托负债:在满足保证金条件下,负债将占用尊享借币额度,利息在尊享借币订单匹配成功时即被收取,负债占用尊享借币额度不会再单独计息。

场景3,用户有尊享借币额度,但不足以承托负债:此时尊享借币额度不足以承托的负债部分将占用余币宝杠杆借币资金池。

单币种账户模式下,尊享借币锁定额度按开仓先后顺序抵扣仓位负债 (不再区分是全仓还是逐仓);跨币种账户模式下,尊享借币锁定额度先抵扣逐仓里的负债(先开仓的先抵扣),再抵扣全仓里的负债。

在调整账户仓位减少借贷的情况下,释放的额度顺序与使用借币顺序相反:先释放余币宝杠杆借币资金池借币占用,再释放尊享借币资金池占用。

例:用户A的一个账户负债为5,000 USDT,其中尊享借币占用4,000 USDT,余币宝杠杆借币占用1,000 USDT。当负债减少后尊享借币和余币宝杠杆借币的占用情况:

负债(借贷总额) | 尊享借币资金池占用 | 余币宝杠杆借币资金池占用 |

5,000 USDT | 4,000 USDT | 1,000 USDT |

4,500 USDT | 4,000 USDT | 500 USDT |

3,500 USDT | 3,500 USDT | 0 |

4、利息

4.1 尊享借币扣息

尊享借币采取“出借方挂单,借款方吃单”的模式,借款订单将和与市场上的出借订单匹配,借款订单在出借订单簿匹配到的加权平均利率即为该笔借款订单的利率。

利息将在订单匹配成功后计算,并在借款订单匹配成功时立刻从用户的交易账户余额中扣除。在尝试匹配借款订单时,用户可以在下单页面查看预估利息并检查您的交易账户余额,以避免订单失败。

借贷计息期限将在订单匹配成功后开始。30天总利息计算公式如下:总利息 = 借币数量 × 最终匹配的年利率 × 30天 / 365天。

例:

借币数量:100,000 USDT

最终匹配的年利率:6%

借贷期限:30天

则总利息计算如下:

100,000 USDT × 6% × 30 / 365 = 493.15 USDT

4.2 尊享借币罚息

如果在到期前6小时前进行还币或续借,用户将被收取剩余利息的30%作为罚息。这部分罚息将作为对出借方被提前终结订单的补偿,平台不会从中收取任何费用。

4.3 尊享借币逾期利息

尊享借币订单到期时系统将自动尝试还币。但如果系统校验判断额度释放后用户的负债超过了剩余借贷总额度,该笔订单将自动还币失败并逾期。

例:

尊享借币订单1额度:20,000 USDT

尊享借币订单2额度:70,000 USDT

仓位负债:60,000 USDT

在这种情况下,尊享借币总借贷额度为90,000 USDT,整体可以承托仓位负债60,000 USDT,此时用户可以还币的额度为30,000 USDT。假设订单2即将到期,系统在到期时尝试对订单2进行还币操作,校验还币后剩余借贷总额为20,000 USDT,不可以承托仓位负债,所以订单2还币失败,这笔订单会逾期并产生逾期利息。

逾期利息将按小时计算,并从用户的交易账户余额中扣除,直到逾期贷款订单还清为止。

逾期利息将作为对出借方延迟赎回出借订单的补偿,平台不会从中收取任何费用。

订单逾期超过30天将触发强制平仓,如果订单逾期用户应尽快还清订单。

5、借币方法

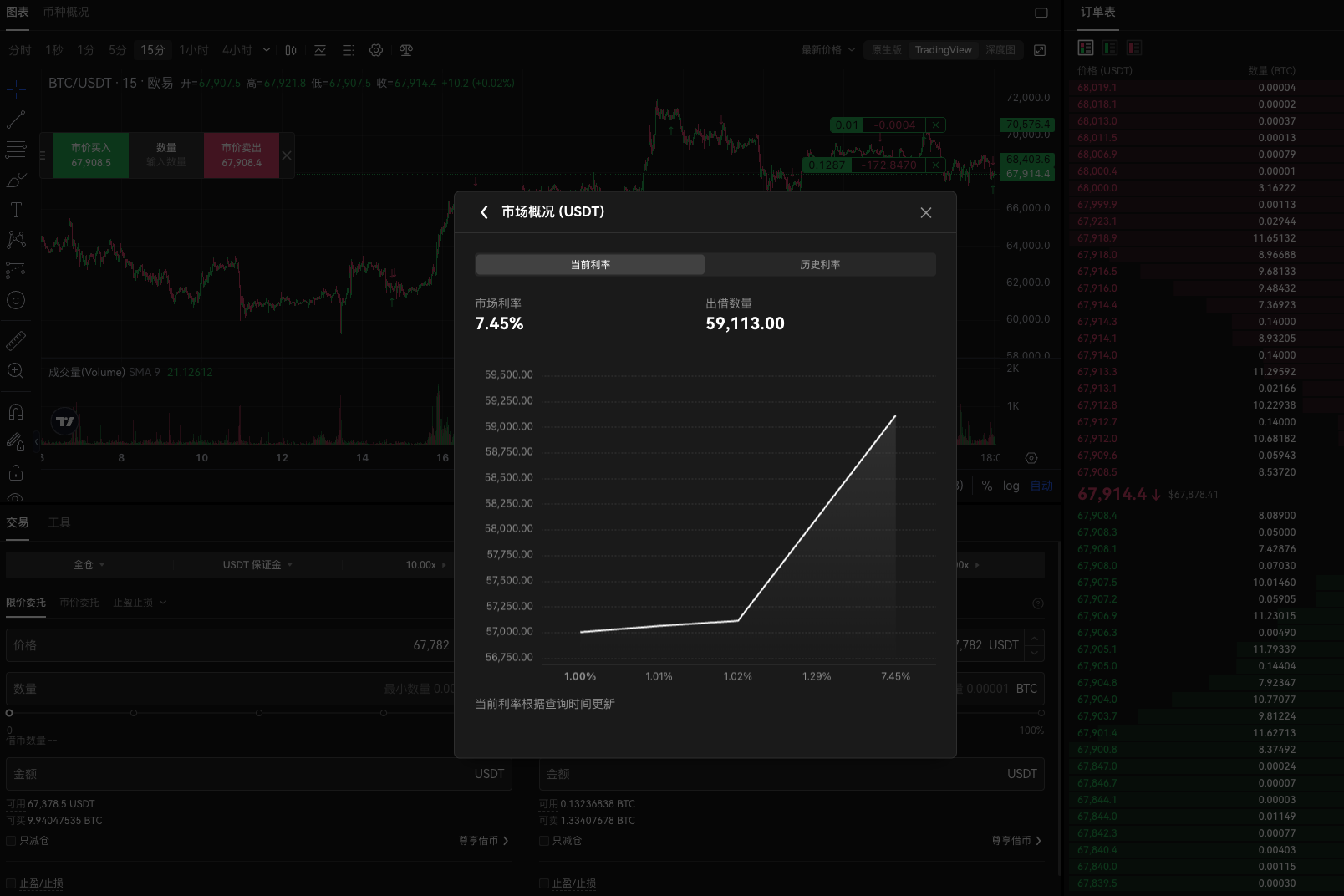

用户可以在尊享借币下单页输入预期的借币年利率。点击"市场概况"查看当前市场上利率和金额的匹配情况。

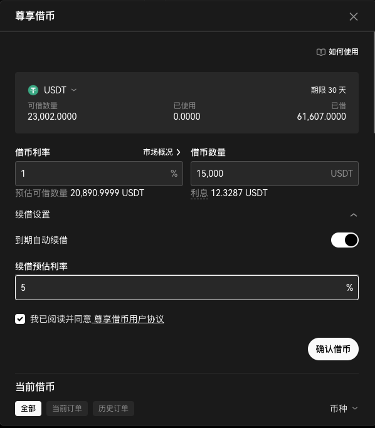

输入预期年利率后,用户将看到该利率在当前出借市场上对应的预估可借数量。预估可借数量仅供参考,而并不是最终的借款额度。

用户可以调整借币额度。在输入借币利率和借币数量后,用户应检查交易账户的余额是否足够支付利息,以避免订单失败。

最后,用户可以选择设置自动续借功能并设置预期续借年利率。

6、还币

6.1 到期系统自动还币

尊享借币订单到期时系统将自动尝试还币。但如果系统校验判断额度释放后用户的负债超过了剩余借贷总额度,该笔订单将自动还币失败并逾期。

如果您的借款订单已逾期,您可以通过以下方式还币:

降低负债;

匹配一个新的尊享借币订单,其额度应与逾期订单额度相同,或至少能够覆盖负债。

6.2 到期前还币

用户可以在到期前还币,但可能会被收取罚息:

如果用户在到期前6小时内还币,则不会被收取任何罚息。

如果用户在到期前超过6小时还币,将被收取一定的罚息。罚息计算公式为剩余利息的30%。

在还币之前,用户可以先在确认页面上查看罚息金额。

7、续借

7.1 到期自动续借

自动续借功能可以根据用户先前订单产生的负债数量自动续借一笔新的订单,以确保仓位负债可以被新的额度覆盖。但若当前借贷市场没有和用户的需求相匹配的订单,或用户未能满足保证金或利息收取要求,自动续借订单可能会匹配失败。

用户可以在下单时在"续借设置"开启自动续借功能并设置预期续借利率,一旦自动续借功能开启,系统将在当前订单到期时自动匹配新的订单。

7.2 到期前续借

1. 用户可以在到期前续借订单,这意味着当前订单会被终止:

如果用户在当前订单到期前6小时内续借,将不会被收取任何罚息。

如果用户在当前订单到期前超过6小时续借,将被收取一定的罚息。罚息计算公式为剩余利息的30%。

2. 如用户选择到期前续借,系统将匹配一笔以与当前订单额度相同的新订单。

3. 为避免当前订单逾期,用户可以在当前订单到期前6小时内续借。

8、风控规则

尊享借币不将用户在本产品下的借币纳入保证金计算,在当前统一账户的风控规则下,除借币后的扣息外,尊享借币不增加其他新的风险场景。

尊享借币的利息会从交易账户余额中扣除。交易账户余额按照统一账户的风控规则进行风险控制。

杠杆交易发生真实借币时,根据账户和仓位模式,系统也按照统一账户的风控规则进行风险控制。详情可参考统一账户风控规则。

9、尊享借币字段说明

字段 | 代表 |

可借数量 | 账户在相应币种下最多能借到的额度,由VIP等级确定,可借额度母子账户共用 |

已借 | 当前账户已经借到的额度,产生的负债可以占用这部分额度 |

已使用 | 负债已占用的额度 |

剩余可借 | 当前账户还能借到多少额度,数量上等于可借数量减去已借数量 |

可还数量 | 当前账户能够还币的额度,数量上等于已借减去已使用 |

10、查看当前借币情况

web端和app端:

可在“尊享借币”下单页查看,或

通过“资产管理”-“订单中心”—“借币数据”—“尊享借币”查询。

API用户:

可通过“API接口”—“获取固定借币订单信息”查询。