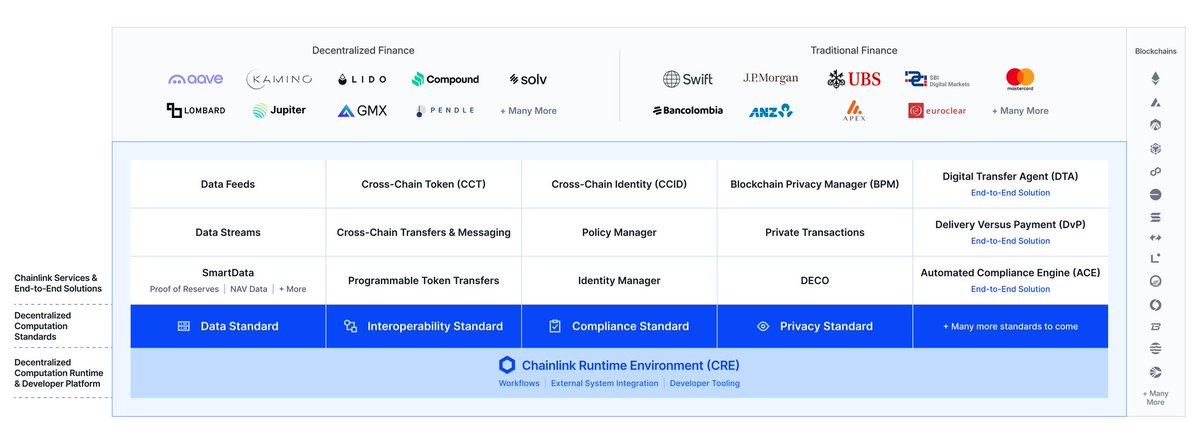

On this note, read the SWIFT CIO's post. He's describing a coordination layer that's "compliant, synchronized, secure, and auditable."

He says, "A financial system where:

Liquidity moves freely, not trapped in domestic or network silos.

Finality is consistent, no matter the jurisdiction.

Compliance is embedded in the flow, not bolted on afterward.

Public and private infrastructure work seamlessly together with interoperability as the default, not the exception."

What do you think he could be talking about? Answer is the image.

Tokenization Is Only Half the Story — The Future Belongs to Orchestration.

Circle launches its own chain: Another EVM L1, using USDC as the native gas.

Stripe is launching an EVM L1 with no ETH/Ethereum.

DTCC's permissioned chain is an EVM Hyperledger Besu client.

JP Morgan's permissioned chain, Kinexys, is an EVM chain.

Looks like the network effect is the EVM; not Ethereum or ETH.

5.65K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.