🛡️: The stablecoin vehicle of the TRON ecosystem is heading towards becoming a global trading hub.

In the entire circulation system of USDT, one out of every two is issued from TRON.

Behind this is a transformation of the TRON ecosystem: evolving from an asset circulation network to a global financial infrastructure anchored by stablecoins. And this is the key engine driving this upgrade.

01|

Many people refer to it as a “scheduling hub for stablecoin circulation,” emphasizing the flow of traffic and value accumulation.

It is essentially the central control system for the TRON ecosystem's stablecoins, focusing on "absorption - circulation - distribution," divided into three core engines:

🔷SunSwap: Supports free exchange between mainstream assets and stablecoins, adapts to various fee levels, and supports V3 mode, serving as the basic trading channel;

🔷SunCurve & PSM: The former focuses on low-slippage stablecoin exchanges, while the latter provides 1:1 exchange scenarios for USDD with USDT/USDC/TUSD, making it an ideal choice for institutions and large holders to adjust their stablecoin positions;

🔷SunPump: An emerging meme asset issuer that accepts long-tail flow assets with a very low threshold, activating community trading vitality.

These three engines combine to form a closed-loop ecosystem from "asset issuance" to "fund circulation" to "value extraction."

02|Why do we say it has the opportunity to become a "stablecoin trading hub"?

1) Dominance of USDT issuance chain

TRON is the largest issuance chain for USDT, accounting for over 50%, surpassing Ethereum.

This represents a natural trading demand and accumulation advantage, meaning that every transaction is processing "the most essential on-chain asset."

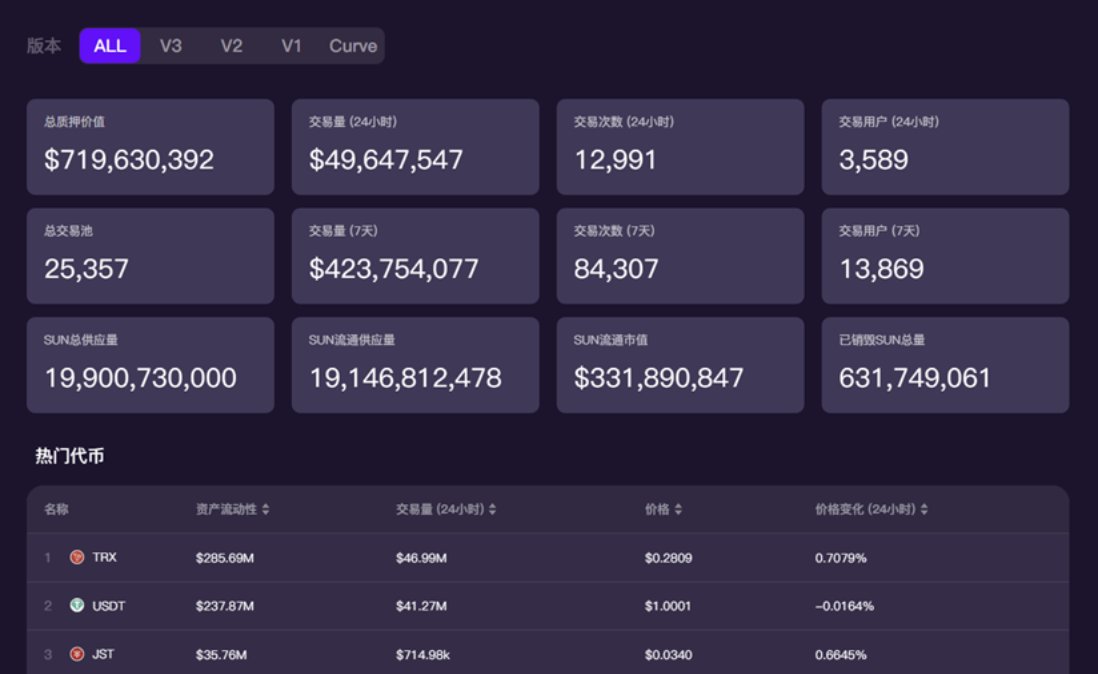

2) Real TVL, sufficient depth

TVL has consistently maintained above $970 million, stable within the top five global DEXs.

3) Trading tools specifically designed for stablecoins

SunCurve and PSM have extremely low slippage and stable ratio exchange capabilities, highly suitable for large and frequent trading needs.

In contrast, other DEXs still support stablecoins with a "general pool" approach, unable to meet the standardized needs of professional financial scenarios.

4) Platform deflationary mechanism + asset interconnectivity incentives

SUN, as the platform governance token, has cumulatively destroyed over 600 million tokens, with the buyback and destruction mechanism coming from trading fees and SunPump income, forming a closed funding loop.

At the same time, USDT can be combined with RWA products (like stUSDT), lending platforms (JustLend), LP mining, etc., creating an integrated path of "trading - mining - lending - cross-pool arbitrage."

03|Why is it worth paying attention to? What will the future look like?

From

👉 It is not only the DEX of the TRON ecosystem but also an on-chain platform that combines "stablecoins + real use + multi-asset interaction," moving towards the global financial center.

As TRX enters the Nasdaq SRM listed company reserve system and TRX ETF approaches,

along with the long-tail trading vitality brought by SunPump,

💬Summary:

If Curve is the stablecoin scheduling platform of Ethereum, then this is the core engine for TRON to move towards becoming a global financial hub.

@justinsuntron #TRONEcoStar

Show original

33.56K

114

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.