Covalent price

in BRLCheck your spelling or try another.

About Covalent

Disclosures

Covalent risk

This material is for informational purposes only and is not exhaustive of all risks associated with trading Covalent. All crypto assets are risky, there are general risks in investing in Covalent. These include volatility risk, liquidity risk, demand risk, forking risk, cryptography risk, regulatory risk, concentration risk & cyber security risk. This is not intended to provide (i) investment advice or an investment recommendation; (ii) an offer or solicitation to buy, sell, or hold crypto assets; or (iii) financial, accounting, legal or tax advice. Profits may be subject to capital gains tax. You should carefully consider whether trading or holding crypto assets is suitable for you in light of your financial situation. Please review the Risk Summary for additional information.

Investment Risk

The performance of most crypto assets can be highly volatile, with their value dropping as quickly as it can rise. You should be prepared to lose all the money you invest in crypto assets.

Lack of Protections

Crypto assets are largely unregulated and neither the Financial Services Compensation Scheme (FSCS) nor the Financial Ombudsman Service (FOS) will protect you in the event something goes wrong with your crypto asset investments.

Liquidity Risk

There is no guarantee that investments in crypto assets can be easily sold at any given time.

Complexity

Investments in crypto assets can be complex, making it difficult to understand the risks associated with the investment. You should do your own research before investing. If something sounds too good to be true, it probably is.

Concentration Risk

Don't put all your eggs in one basket. Putting all your money into a single type of investment is risky. Spreading your money across different investments makes you less dependent on anyone to do well. A good rule of thumb is not to invest more than 10% of your money in high-risk investments.

Five questions to ask yourself

- Am I comfortable with the level of risk? Can I afford to lose my money?

- Do I understand the investment and could I get my money out easily?

- Are my investments regulated?

- Am I protected if the investment provider or my adviser goes out of business?

- Should I get financial advice?

Covalent’s price performance

Covalent on socials

Guides

Covalent FAQ

Dive deeper into Covalent

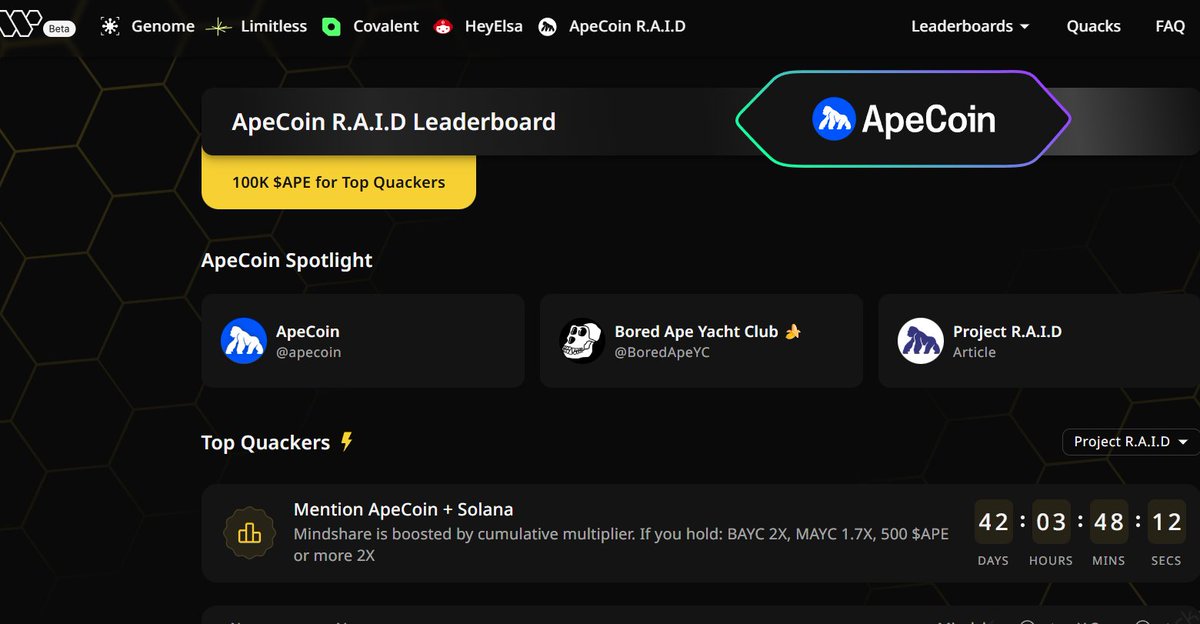

Covalent (CQT) is a protocol that excels in aggregating data from leading blockchain networks. By comprehensively indexing entire blockchains and utilizing a unified application programming interface (API), the platform gains access to valuable data. Covalent's primary objective is to extract granular information from smart contracts and provide a reliable source for blockchain data.

What is Covalent?

Covalent is a project that provides developers easy access to accurate and up-to-date data from the entire blockchain industry. The platform envisions a future where all blockchain data is indexed, enabling the integration of private enterprise data. Covalent's software focuses on achieving cross-chain interoperability, allowing users to develop, validate, index, store, and access information from various blockchains. Users can also earn rewards for their contributions to the platform.

The Covalent team

Covalent was founded in 2017 by Ganesh Swami and Levi Aul. Since its inception, the team has raised over $5 million through two funding rounds, attracting investments from top firms such as Alameda Research, CoinGecko, and Hashed Ventures.

How does Covalent work?

Covalent's software plays a crucial role in indexing the complete history of all blockchain networks. It gathers and organizes extensive data from the blockchain industry, including details from smart contracts, wallet addresses, transactions, and more.

To ensure uniformity, the indexed data is normalized into a standardized format known as "block-specimens." This normalization enables users to query data from different blockchains effortlessly using a unified API.

CQT: Covalent’s native token

CQT is the native token of the Covalent network, offering multiple use cases. Holders can utilize the token for protocol governance, allowing them to participate in voting decisions on proposals that impact the protocol's parameters. Additionally, CQT can be staked to earn attractive rewards within the network.

CQT tokenomics

The total supply of CQT tokens is capped at 1 billion, with all tokens issued in the genesis block. As of now, the circulating supply of CQT stands at 607,920,038 tokens.

CQT use cases

CQT is a utility token for facilitating transactions and interactions on the Covalent platform. Additionally, it holds value as the primary governance token, enabling CQT holders to participate in decision-making processes regarding the protocol. Furthermore, users can stake their CQT tokens to earn additional rewards within the network.

CQT distribution

CQT has a total supply of 1 billion tokens, with 607,920,038 CQT tokens currently in circulation. These tokens are crucial in various use cases within the Covalent ecosystem.

Covalent’s unique role in shaping blockchain’s future

Covalent is at the forefront of consolidating millions of data points from over 100 organizations. The network becomes a one-stop shop streamlining processes and enhancing efficiency by providing a comprehensive and high-quality multi-chain data hub. In the vast landscape of the blockchain industry, Covalent's software plays a pivotal role in making valuable information readily accessible and easily manageable.

Disclaimer

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.