Notice: The trading of this cryptocurrency is currently not supported on OKX. Continue trading with cryptocurrencies listed on OKX.

TAO

Bittensor price

This data isn’t available yet

You’re a little early to the party. Check out other crypto for now.

Bittensor Feed

The following content is sourced from .

AI + Crypto marriage is the biggest wealth creator you're not paying attention to

$25B market cap already and it's just getting started

AI agents running on blockchain = unstoppable

Wall Street + crypto convergence is happening RIGHT NOW

Virtuals, Bittensor, Fetch - load up or stay poor

btw this isn't even close to the top

@Infinit_Labs and @Surf_Copilot are the most powerful tools I'm using

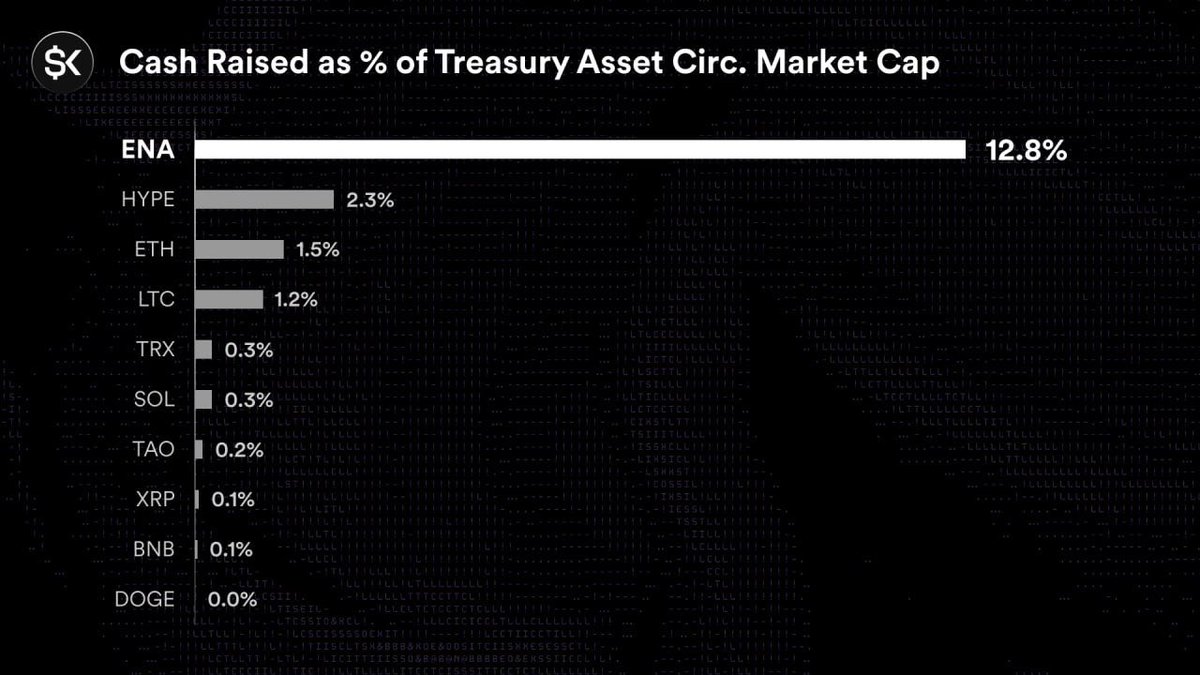

$895M raised to buy $ENA is the equivalent of Saylor raising ~$300b to buy BTC or Tom Lee raising ~$75b to buy ETH (h/t @gdog97_).

Think it’s best bears get out the way.

Ethena Labs

StablecoinX Inc. @stablecoin_x has announced an additional $530 million capital raise as part of its $ENA accumulation strategy.

To date, StablecoinX has raised a total of approximately $895M in PIPE financing, which is expected to result in a vehicle with over 3 billion ENA tokens on its balance sheet at closing.

This enhanced scale enables greater access to additional institutional channels, broader investor and third-party coverage, and the capacity to hire top tier leadership.

As with the initial PIPE raise, the cash raised via the PIPE will be used by StablecoinX to acquire tokens from a subsidiary of the Ethena Foundation.

The Ethena Foundation subsidiary will initiate an approximately $310 million buyback program over the next 6-8 weeks via third party market makers, reinforcing the alignment between the Foundation and StablecoinX shareholders.

The expected deployment rate of purchases is outlined in the section below this tweet, and is incremental to the buyback program from the initial PIPE financing transaction which has now been completed.

At current prices, the planned buyback program of this second PIPE transaction combined with the liquid ENA contributed to the PIPE by third party investors represents roughly 13% of circulating supply.

This is in addition to the initial PIPE financing which resulted in the acquisition of approximately 7.3% of circulating token supply over the last 6 weeks.

Importantly, as with the initial PIPE raise, the Ethena Foundation has the right to veto any sales of $ENA by StableCoinX at its sole discretion.

Once again, to the extent StablecoinX subsequently raises capital with the intent of purchasing additional locked ENA from the Ethena Foundation or its affiliates, cash proceeds from those token sales are planned to be used to purchase spot $ENA.

StablecoinX's treasury strategy is a deliberate, multi‑year capital allocation strategy that will enables StablecoinX to capture the enormous value of the secular surge in demand for digital dollars while compounding ENA per share to the benefit of shareholders.

About Bittensor (TAO)

Learn more about Bittensor (TAO)

Bittensor TAO Price: Key Insights, Tokenomics, and Future Potential

What is Bittensor and Why is It Unique? Bittensor is a decentralized AI network that seamlessly integrates blockchain technology with machine learning, creating a revolutionary marketplace for AI mode

11 Aug 2025|OKX

xTAO Bridges Traditional Finance and Decentralized AI: A New Era for Bittensor Network

Introduction to xTAO and the Bittensor Network The convergence of artificial intelligence (AI) and blockchain technology is reshaping industries, and xTAO is leading this transformation. As the first

31 Jul 2025|OKX

Bittensor's Subnet Market Nears $1 Billion: Decentralized AI Infrastructure Gains Momentum

Bittensor Blockchain Validator: A Comprehensive Guide to Its Ecosystem and Growth Bittensor's Subnet Market: A Billion-Dollar Milestone Bittensor's subnet market is rapidly approaching a $1 billion va

28 Jul 2025|OKX

What is Bittensor (TAO)? A guide to the decentralized artificial intelligence platform

Bittensor is a disruptive platform that bridges the distinct powers of artificial intelligence (AI) and blockchain. AI is quickly weaving its way deeper into more industries to help revolutionize myri

25 Jul 2025|OKX

Bittensor FAQ

What is cryptocurrency?

Cryptocurrencies, such as TAO, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as TAO have been created as well.

Can I buy TAO on OKX?

No, currently TAO is unavailable on OKX. To stay updated on when TAO becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of TAO fluctuate?

The price of TAO fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials