USDT issuance hegemony changes hands: why can TRON surpass Ethereum?

On May 22, the issuance of USDT on the TRON chain exceeded $77.7 billion, surpassing Ethereum in terms of total supply and circulation, becoming the world's largest stablecoin issuance network.

Stablecoins are not only an important part of the crypto ecosystem, but also in the cross-border payment space, that is, in the traditional financial system. Being able to surpass Ethereum in the stablecoin space not only marks the maturity of TRON network technology, but also reveals its dominance in the field of decentralised finance (DeFi) and global payments.

Thetechnical strength behind double-kill Ethereum

, efficiency and cost are often the two aspects that on-chain traders are most concerned about, efficiency is more bluntly not congested, fast, and cost is low handling fees.

In terms of efficiency, the TRON transaction confirmation time only takes a few seconds, and it can process more than 2,000 transactions per second (TPS=2,000), which is the same as the processing speed of the VISA payment system, while the Ethereum mainnet processes only double-digit transactions per second (TPS=30), which will be congested once the transaction popularity increases.

In terms of cost, the average cost of TRON has been kept below 1u for a long time, and there are ways to reduce the cost to 0.2u, or even free of charge. The cost is made up of bandwidth and energy, bandwidth will be given away for free every day, energy can be purchased or rented, renting will be 80% cheaper than buying. If it is a frequent transfer, after renting energy, the fee for each transfer can be controlled at about 0.5U, which is much lower than that of other public chains. Ethereum's gas fees of hundreds at every turn mean that it takes 10-20u to complete a transfer, which is almost 100 times the cost of TRON.

Although Ethereum is also solving congestion and cost problems through upgrades, it is one step slower after all, and can only watch its market share be overtaken by its stronger competitor TRON.

In addition to the long-term low transfer fees, TRON also launched the GasFree function in April 2025, breaking the original concept of on-chain transaction Gas. Transfers no longer need to use TRX, but are paid in USDT when transferring stablecoins, which further lowers the threshold for users to transact on the chain and further consolidates its position as the supremacy of the stablecoin issuance network.

Low cost, high efficiency, and GasFree are all favourable conditions for the development of stablecoins, and achieving such an effect is the result of the continuous iteration of the TRON network.

In the past, TRON was mainly based on operational-level publicity, resulting in many people not having much awareness of the iteration and upgrading of its technology. When we look back at the results, we can see that the technical architecture of TRON is the core engine of its success, and it has been quietly iterating.

In 2018, Justin Sun, the founder of TRON, proposed a long-term vision for four phases: Exodus, Odyssey, GreatVoyage and StarTrek. In 2021, TRON entered the Grand Voyage phase, and the latest version is GreatVoyage-v4.8.0 (Kant), which will be released in May 2025.

Judging from the latest upgrade of Kant, its technological innovation is reflected in three levels, including efficiency improvement and cost reduction.

Storage efficiency improvement: EIP-1153 introduces a temporary storage function, which reduces the execution cost of smart contracts by 35%.

Cross-chain compatibility: Prototype sharding (EIP-4844) supports asset interoperability between TRON and Ethereum Rollups, and the processing speed of cross-chain transactions is increased to 1,500 transactions per second.

Developer-friendliness: EIP-5656 optimises memory replication efficiency and shortens DApp deployment time by 50%.

(The iteration speed of TRON is significantly accelerated after entering the Great Voyage, source: TRON Developer Hub)

Excellent network performance is like the internal strength of TRON. On this basis, all kinds of fists (ecology) can give full play to the greatest value.

From stablecoin hegemony to full-scenario financial infrastructure

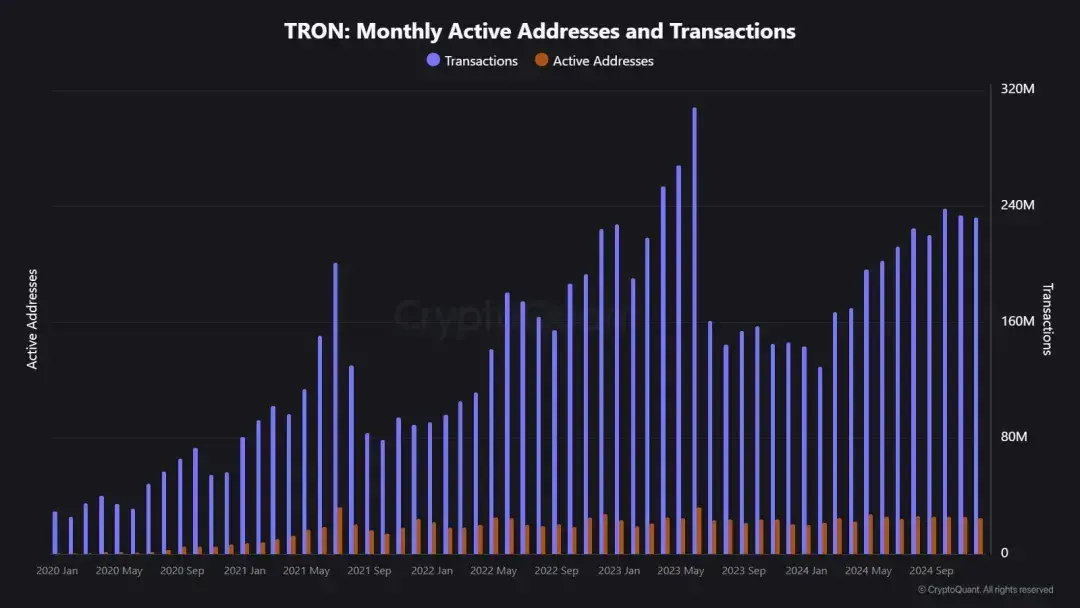

, in addition to continuous iteration in network technology, TRON's ecosystem is also expanding dramatically. According to the 2024 TRON Annual Report released by blockchain data analysis platform CryptoQuant, the total number of TRON transactions in 2024 increased from 129.8 million in February 2024 to 239.6 million in October, an increase of 84%, in addition, the total number of transactions in 2024 reached 2.38 billion.

– >

– >

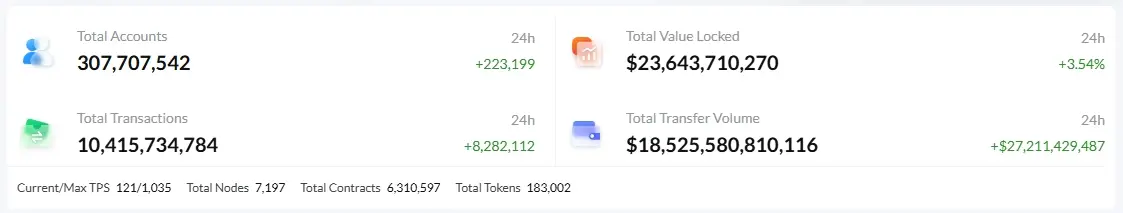

of May 20, 2025, there are more than 307 million accounts on the TRON network, a 40% increase from a year ago, with a total value of more than $23.6 billion in locked assets.

(TRON Mainnet Data)

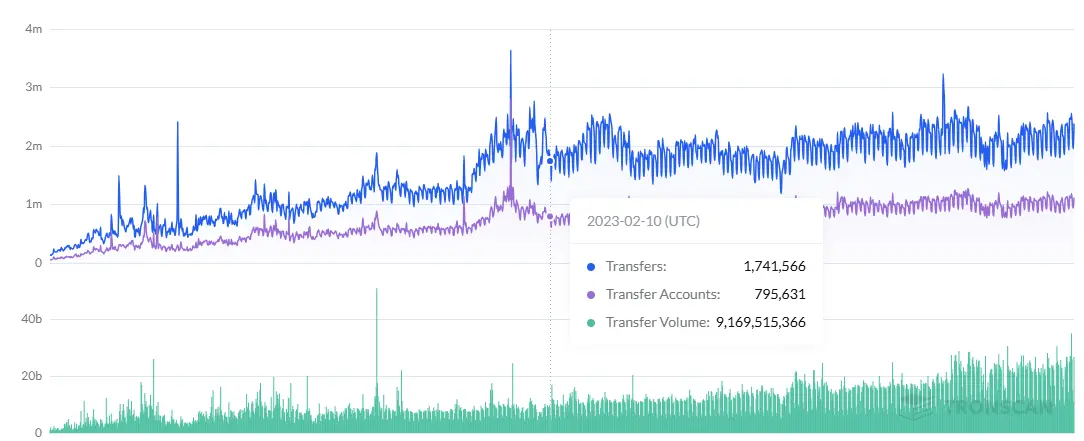

shows avery clear growth trend in the on-chain TRC20-USDT trading volume, which is driven by emerging markets and remittance demand, with a daily processing volume of up to $19 billion.

(TRC20-USDT trading data)

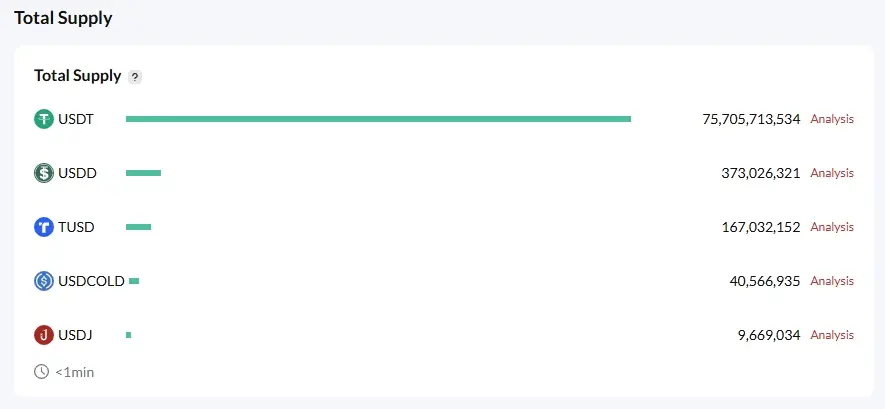

The dominance of TRON USDT (98.5% of its network's stablecoins) has also increased liquidity for DeFi protocols, and TVL will also grow in tandem with each additional Tether issue.

(TRON stablecoin amount).

In Q1 2025, after the election of US President Trump, TRON began to fully enter the US political stage, with the blockbuster Trump family project World Liberty Financial (WLF) buying TRX, the USD1 stablecoin issued by the Trump family's support organisation on Huobi HTX, and TRON founder Justin Sun will also attend a dinner hosted by US President Trump. These not only enhance the global influence of TRON, but also provide a strong brand endorsement for USDT's continued growth.

In addition, in terms of compliance, TRX has submitted a spot ETF application to the SEC in the United States, which, if approved, will be the first crypto ETF to support the staking function. TRON is also actively working with the Dominican government and Tether's T3 Financial Crime Unit to build an on-chain monitoring system that complies with FATF travel rules, and continues to exert its influence in the financial sector.

In its annual report, Crypto Thesis 2024, Messari mentions that TRON has a well-established infrastructure and is committed to democratising cryptocurrencies, so it plays an important role in driving the transformation of global payment models.

The

success of TRON is not accidental, but the result of the co-evolution of both internal and external technology and ecology. With stablecoins as the fulcrum, it leverages the huge market for DeFi, cross-border payments and compliant finance, and explores the next generation of financial infrastructure with the help of AI and cross-chain technology. As Sun said, "TRON's goal is to become the core settlement layer of global financial transactions, providing efficient and low-cost financial services to various institutions and individuals. "

In the future, with the improvement of the regulatory framework and the breakthrough of technological boundaries, TRON may become the core hub connecting traditional finance and the Web3 world. The realisation of this vision will not only redefine the rules of value circulation, but also accelerate the evolution of human society towards an efficient, transparent and inclusive financial system.