Stablecoins enter the "interest-bearing era": a panoramic interpretation of yield-bearing stablecoins

Written by: imToken

Have you seen USDC's 12% annualized current yield on some platforms recently?

In the past, stablecoin holders were often "interest-free depositors" with zero interest, while issuers invested their deposited funds in safe assets such as U.S. Treasury bonds and bills to earn huge returns, such as USDT/Tether and USDC/Circle.

Now, the exclusive dividends that used to belong to the issuer are being redistributed - in addition to the USDC interest subsidy war, more and more new generation of yield-bearing stablecoin projects are breaking this "yield wall" and allowing coin holders to directly share the interest income of the underlying assets, which not only changes the value logic of stablecoins, but may also become a new growth engine for RWA and Web3 tracks.

1. What is an income stablecoin?

By definition, yield-bearing stablecoins refer to stablecoins that generate income from the underlying asset and distribute this income (usually from US Treasuries, RWA, or on-chain income) directly to the holder, which is significantly different from traditional stablecoins (such as USDT/USDC) because their income goes to the issuer, and the holder only enjoys the advantage of pegging the US dollar, but there is no interest income.

The reason for this is that the interest income from Tether/USDT bonds is distributed to the majority of stablecoin holders,

as may be more intuitive to give an exampleFor example, the process of Tether printing and distributing USDT is essentially the process of crypto users using US dollars to "buy" USDT - Tether issues $10 billion in USDT, which means that crypto users deposit $10 billion into Tether to obtain the $10 billion USDT.

After Tether gets the $10 billion, it does not need to pay interest to the corresponding users, which is equivalent to obtaining real US dollar funds from crypto users in the form of zero cost.

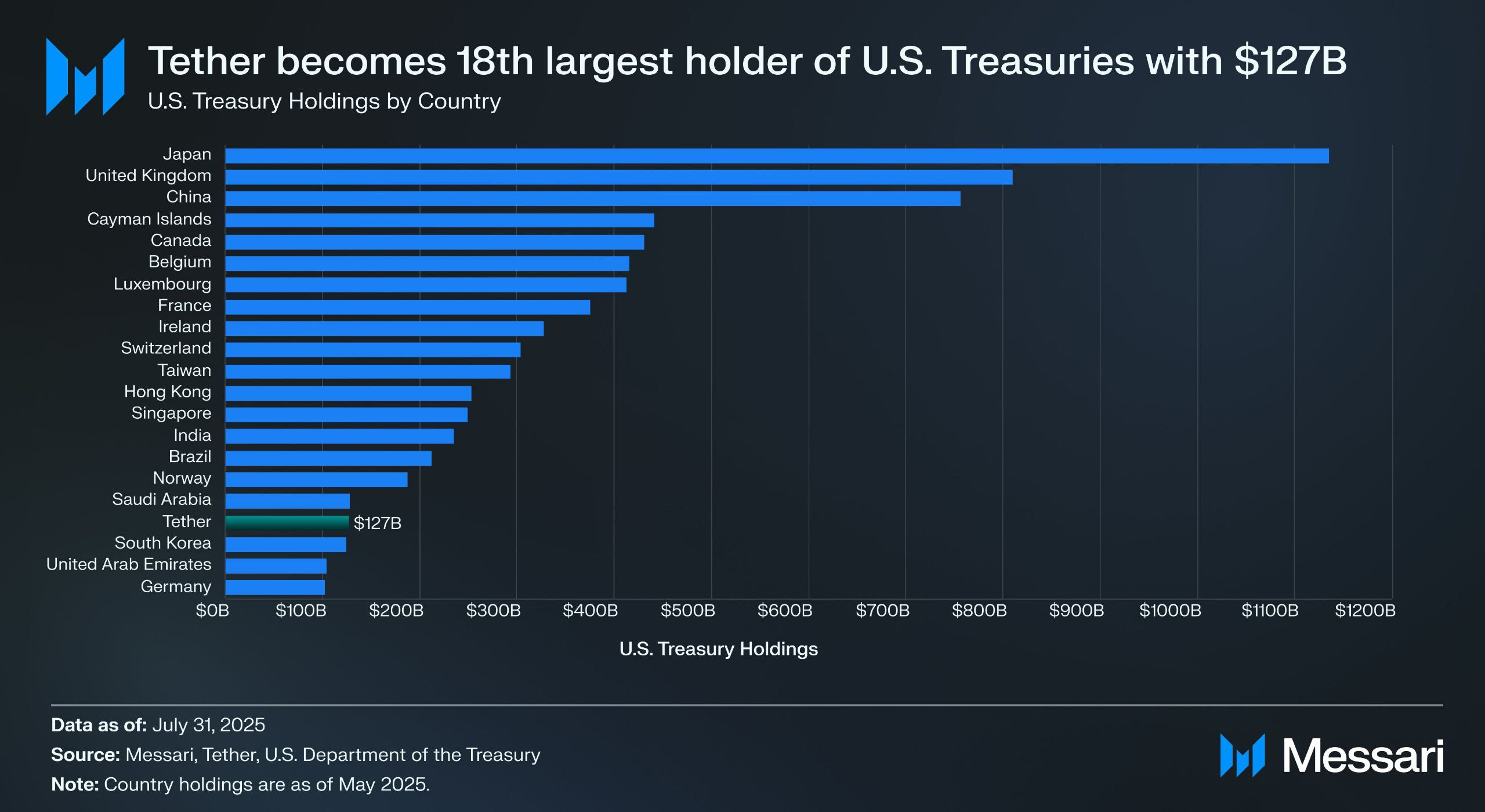

Source: Messari

According to Tether's second-quarter assurance report, it directly holds more than $157 billion in U.S. government bonds (including $105.5 billion in direct holdings and $21.3 billion in indirect holdings), making it one of the world's largest holders of U.S. Treasury bonds - according to Messari data, as of July 31, 2025, Tether surpassed South Korea to become the 18th largest holder of U.S. Treasury bonds.

This means that even at a Treasury yield of around 4%, Tether can earn about $6 billion a year (about $700 million in the first quarter), and Tether's operating profit of $4.9 billion in the second quarter also confirms the huge profit of this model.

Based on the market practice that "stablecoins are no longer a tool that can be summarized in a unified narrative, and their use varies from person to person and from person to person", imToken also divides stablecoins into multiple explorable subsets (further reading "Stablecoin Worldview: How to Build a Stablecoin Classification Framework from a User's Perspective?"). 》)。

According to imToken's stablecoin classification method, yield-bearing stablecoins are separately classified as a special subcategory that can bring continuous income to holders, mainly including two categories:

-

Native interest-bearing stablecoins: Users only need to hold this type of stablecoin to automatically obtain income, similar to bank demand deposits. The token itself is an interest-bearing asset, similar to USDe, USDS, etc.;

-

Stablecoins that provide an official income mechanism: These stablecoins do not necessarily automatically generate interest, but their issuers or management protocols provide official income channels, and users need to perform specific actions, such as depositing them into designated savings protocols (such as DAI's deposit interest rate mechanism DSR), staking or exchanging them for specific income certificates, to start earning interest, such as DAI.

If 2020-2024 is the "expansion period of stablecoins", then 2025 will be the "dividend period of stablecoins", and under the balance of compliance, income and liquidity, yield-bearing stablecoins may become the next trillion-dollar stablecoin sub-track.

Source: imToken Web (web.token.im)'s yield-bearing stablecoin

2. Inventory of the head projects of income-generating stablecoins

From the perspective of specific landing paths, most yield-bearing stablecoins are closely related to the tokenization of U.S. Treasury bonds - the on-chain tokens held by users are essentially anchored to U.S. Treasury assets custodian custodians, which not only retain the low-risk attributes and yield capabilities of Treasury bonds, but also have high liquidity of on-chain assets, and can also be combined with DeFi components to derive financial gameplay such as leverage and lending.

In the current market, in addition to established protocols such as MakerDAO and Frax Finance continuing to increase their weight, the development of new players such as Ethena (USDe) and Ondo Finance is also rapidly accelerating, forming a diversified pattern from protocol-based to CeDeFi hybrid.

Ethena's USDe

,as the traffic responsible for this round of yield-bearing stablecoin craze, is naturally Ethena's stablecoin USDe, which recently exceeded the 10 billion mark for the first time.

According to data from the official website of Ethena Labs, as of the time of publication, the annualized rate of return of USDe is still as high as 9.31%, and it was once maintained at more than 30%, and there are two main sources of high returns:

-

ETH's LSD staking income;

-

Delta funding rate income for hedging positions (i.e., short positions in perpetual futures);

The former is relatively stable and currently fluctuates around 4%, while the latter is entirely dependent on market sentiment, so USDe's annualized return is also directly dependent on the network-wide funding rate (market sentiment) to some extent.

<img src="https://upload.techflowpost.com/upload/images/20250818/2025081823310373335448.png"

> Source: Ethena

Ondo Finance USDY

As a star project in the RWA track, Ondo Finance has been focusing on bringing traditional fixed income products to the on-chain market.

Its launch of USD Yield (USDY) is a tokenized note guaranteed by short-term U.S. Treasury bonds and bank demand deposits, which is essentially a bearer certificate, that is, the holder can directly hold and enjoy the income without real-name verification.

USDY essentially provides on-chain funds with near-Treasury-level risk exposure, while giving tokens composability, which can be combined with DeFi lending, staking, and other modules to achieve re-amplification of returns. This design makes USDY an important representative of current on-chain money market funds.

PayPal's PYUSD

When PayPal's PYUSD came out in 2023, it was primarily positioned as a compliant payment stablecoin, with Paxos as the custodian, pegging US dollar deposits and short-term Treasury bonds 1:1.

After entering 2025, PayPal began to try to superimpose a revenue distribution mechanism on PYUSD, especially in the cooperation model with some custodian banks and Treasury bond investment accounts, returning part of the underlying interest income (from U.S. bonds and cash equivalents) to coin holders, trying to open up the dual attributes of payment and income.

MakerDAO's EDSR/USDS

MakerDAO's dominance in the decentralized stablecoin track needs no further details, and its launch of USDS (an upgraded version of the original DAI deposit interest rate mechanism) allows users to deposit tokens directly into the protocol and automatically earn interest linked to U.S. Treasury yields without incurring additional operating costs.

With a current savings rate (SSR) of 4.75% and a deposit size of nearly 2 billion, objectively speaking, behind the name change is also MakerDAO's repositioning of its own brand and business form - evolving from a DeFi native stablecoin to an RWA yield distribution platform.

<img src="https://upload.techflowpost.com/upload/images/20250818/2025081823310398885473.png"

> Source: sFRAX by makerburn

Frax Finance

Frax Finance has been the most active in moving closer to the Fed among DeFi projects, including applying for a Fed master account (which allows holding US dollars and trading directly with the Fed), its launch of sFRAX, a pledge vault that leverages the proceeds of U.S. Treasury bonds, tracks Fed interest rates to stay relevant by opening a brokerage account with Lead Bank in Kansas City to buy U.S. Treasuries.

As of the time of publication, the total amount of sFRAX staked has exceeded 60 million, and the current annualized interest rate is about 4.8%.

Source: Frax Finance

In addition, it is worth noting that not all yield-bearing stablecoins can operate stably, such as the USDM project has been announced for liquidation, and the minting function has been permanently disabled, leaving only a limited time for primary market redemptions.

In general, most of the current underlying allocations of yield-bearing stablecoins are concentrated in short-term Treasury bonds and treasury bond reverse repurchases, and the interest rates provided to the outside world are mostly in the range of 4%-5%, which is in line with the current level of U.S. Treasury yields.

3. How do you view the yield markup of stablecoins?

As mentioned above, the core of the reason why yield-bearing stablecoins can provide sustainable interest returns lies in the stable allocation of the underlying assets. After all, the vast majority of such stablecoins come from RWA assets such as U.S. Treasury bonds with extremely low risk and stable returns.

From the perspective of risk structure, holding U.S. Treasuries is almost the same risk as holding U.S. dollars, but U.S. bonds will generate additional annualized interest of 4% or even higher, so in the high-interest cycle of U.S. bonds, these agreements obtain income by investing in these assets, and then deduct operating costs to distribute part of the interest to coin holders, forming a perfect closed loop of "U.S. Treasury interest - stablecoin promotion":

holders only need to hold stablecoins as certificates to obtain "interest income" on U.S. bonds as the underlying financial asset At present, the yields of short- and medium-term U.S. Treasury bonds are close to or exceed 4%, so the interest rates of most fixed-income projects backed by U.S. bonds are also mostly in the range of 4%-5%.

Objectively speaking, this "hold and earn interest" model is naturally attractive, ordinary users can automatically generate interest on idle funds, DeFi protocols can also use it as high-quality collateral to further derive financial products such as lending, leverage, and perpetuality, and institutional funds can enter the chain under a compliant and transparent structure, reducing operational and compliance costs.

Therefore, yield-based stablecoins are expected to become one of the most understandable and easy-to-implement application forms in the RWA track, and because of this, RWA fixed income products and stablecoins based on U.S. bonds are rapidly emerging in the current crypto market.

No matter how U.S. Treasury interest rates change in the future, this wave of income-yielding stablecoins spawned by the high interest rate cycle has moved the value logic of stablecoins from "anchoring" to "dividends".

In the future, perhaps when we look back on this time node, we will find that it is not only a watershed in the stablecoin narrative, but also another historical turning point in the integration of crypto and traditional finance.