Stablecoin Volumes Hit $2.5T as Supply Peaks – But Fragmentation Persists: Chainalysis Report

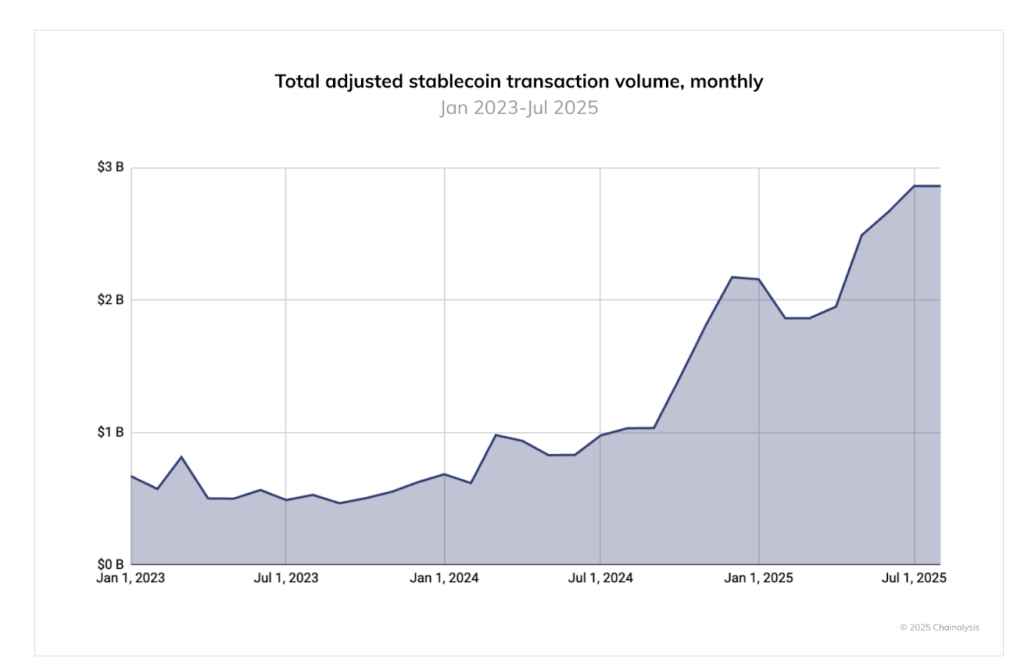

The stablecoin market has evolved over the past 12 months. Recent findings from payment platform Bridge show that stablecoin transaction volume has reached record highs, surpassing $2.5 trillion.

Data from Bridge also shows that the total stablecoin supply has reached an all-time high in the past few months, driven primarily by the growth of Tether’s USDT.

Additional findings from Chainalysis’s 2025 Global Adoption Index report note that between June 2024 and June 2025, USDT processed over $1 trillion per month, peaking at $1.14 trillion in January 2025. Meanwhile, Circle’s USDC ranged from $1.24 to $3.29 trillion monthly, with particularly high activity in October last year.

— Chainalysis (@chainalysis) September 3, 2025

The Chainalysis 2025 Global Cryptocurrency Adoption Index is L I V E!

Here’s a snapshot of what we found:APAC is emerging as the fastest-growing region

Eastern Europe countries dominate the index, when adjusted for population

Stablecoins are surging globally for a… pic.twitter.com/XGdbscCq48

Stablecoin Market Fragmented, But Growth Remains Strong

According to Chainalysis, these volumes show the continued centrality of Tether and USDC in crypto market infrastructure. Yet hundreds of other stablecoins are also being leveraged daily. This suggests that while today’s stablecoin ecosystem is expanding, fragmentation remains across the sector.

Chainalysis chief economist Kim Grauer told Cryptonews that this divergence may also indicate a shift in how stablecoins are being used.

“USDC’s growth appears closely linked to U.S.-based institutional rails and regulated corridors, while EURC’s rise suggests growing interest in euro-denominated digital assets, possibly driven by MiCA-compliant platforms and European fintech adoption,” Grauer said.

Expanding on this, Reeve Collins, chairman of stablecoin protocol STBL.com, told Cryptonews that USDT appears to be dominant in emerging markets where it acts as digital cash to provide access to U.S. Dollars.

He added that PYUSD uses PayPal’s reach to normalize stablecoins in everyday payments, though adoption remains small. At the time of writing, CoinMarketCap shows that the market capitalization of PYUSD is $1.18 billion.

“In this space, liquidity and utility outweigh brand recognition, which is why USDT and USDC continue to lead for now,” Collins said.

Interestingly, findings from Chainalysis show that smaller stablecoins like EURC, PYUSD, and MakerDAO’s DAI have experienced rapid growth. The index report shows how EURC grew nearly 89% month-over-month on average, with monthly volume rising from approximately $47 million in June 2024 to over $7.5 billion by June 2025.

Findings also show that PYUSD sustained acceleration, rising from around $783 million to $3.95 billion in the same period.

Stablecoins For Institutions

While rapid growth has become apparent across popular stablecoins, additional use cases are further driving adoption.

For example, a Ripple spokesperson told Cryptonews that Ripple USD (RLUSD) is an enterprise-grade stablecoin, designed with regulatory compliance, utility, and transparency.

“Unlike stablecoins geared primarily toward retail users, RLUSD has been purpose-built for enterprise utility,” they said.

According to Ripple, common use cases for RLUSD include facilitating the instant settlement of cross-border payments, providing liquidity for remittance and treasury operations, seamlessly integrating with decentralized finance (DeFi) protocols, and bridging between traditional fiat currencies and the crypto ecosystem to ensure an efficient transition when on-ramping/off-ramping in crypto.

These use cases are important, especially as stablecoins move beyond crypto-native trading tools to mainstream financial infrastructure. This already appears to be the case, as there has been a rise in institutional activity around stablecoins recently.

Chainalysis’s index report notes that Stripe, Mastercard, and Visa have all launched products allowing users to spend stablecoins via traditional rails. Platforms like MetaMask, Kraken, and Crypto.com have recently introduced card-linked stablecoin payments.

At the same time, traditional financial institutions such as Citi and Bank of America are expanding their offerings and may even launch their own stablecoins soon.

Stablecoins For Payments

Another interesting use case for stablecoins centers around retail and merchant payments.

According to Chainalysis, PYUSD’s recent growth could point to a broader appetite for alternative, highly regulated stablecoins in retail and payment contexts. Also on the merchant side, partnerships between Circle, Paxos, and companies like Nuvei plan to streamline settlement in stablecoins.

This isn’t only impacting the U.S. Dr. Sangmin Seo, chairman of Kaia DLT Foundation, told Cryptonews that in regions like Korea, stablecoins for retail payments are quickly gaining traction.

“Stablecoin users can purchase merchandise by using tap-to-pay or online stablecoin-enabled payment solutions in Korea,” Dr. Seo said.

He further explained that Kaia’s USDT stablecoin has become the main digital currency for the mini decentralized application (dApp) ecosystem within LINE Messenger, a popular messaging app in Asia.

“When users enjoy Dapps on their every day messaging app which dominates markets in Japan, Taiwan, and Thailand, they can use Kaia USDT for payments. Kaia USDT is now also available in Visa-enabled tap-to-pay, Oobit, in South Korea, Thailand, and the Philippines. You can travel with the Oobit app to enjoy shopping in these Asian countries.”

Although stablecoin growth is accelerating in different areas, a number of challenges may slow adoption.

For instance, Grauer explained that stablecoin usage remains partly discouraged by traditional financial players and regulators who are still more cautious about digital assets more broadly.

From a user’s perspective, Grauer thinks that the technology remains partly complex and potentially too intimidating at this point for mainstream adoption.

However, as regulatory frameworks mature globally, Grauer is confident that stablecoins will move from a niche financial tool to mainstream financial infrastructure with real-world utility.

“The potential is immense, and unlocking this next phase of digital financial innovation can be best achieved with increased regulatory clarity, enhanced user experience, and industry collaboration,” she commented.

As for the future of stablecoins, Collins noted that growth is just one piece of the puzzle.

“We’re entering Stablecoins 2.0—The first wave digitized dollars, the next wave financializes them. Stablecoins won’t just be passive payment tokens; they’ll unlock yield, governance, and programmability,” Collins said.

In order to achieve this, Collins said that a key shift will be to separate principal from yield, so that stablecoin users can spend the dollar while still capturing an income stream.

“The challenge, and the opportunity, is to build this in full alignment with emerging stablecoin regulations,” he said.