It's rising, NFT seems to be pulling?

Written by: Azuma, Odaily Planet Daily

The NFT track, which has long been cold, seems to have shown some signs of recovery after a long absence.

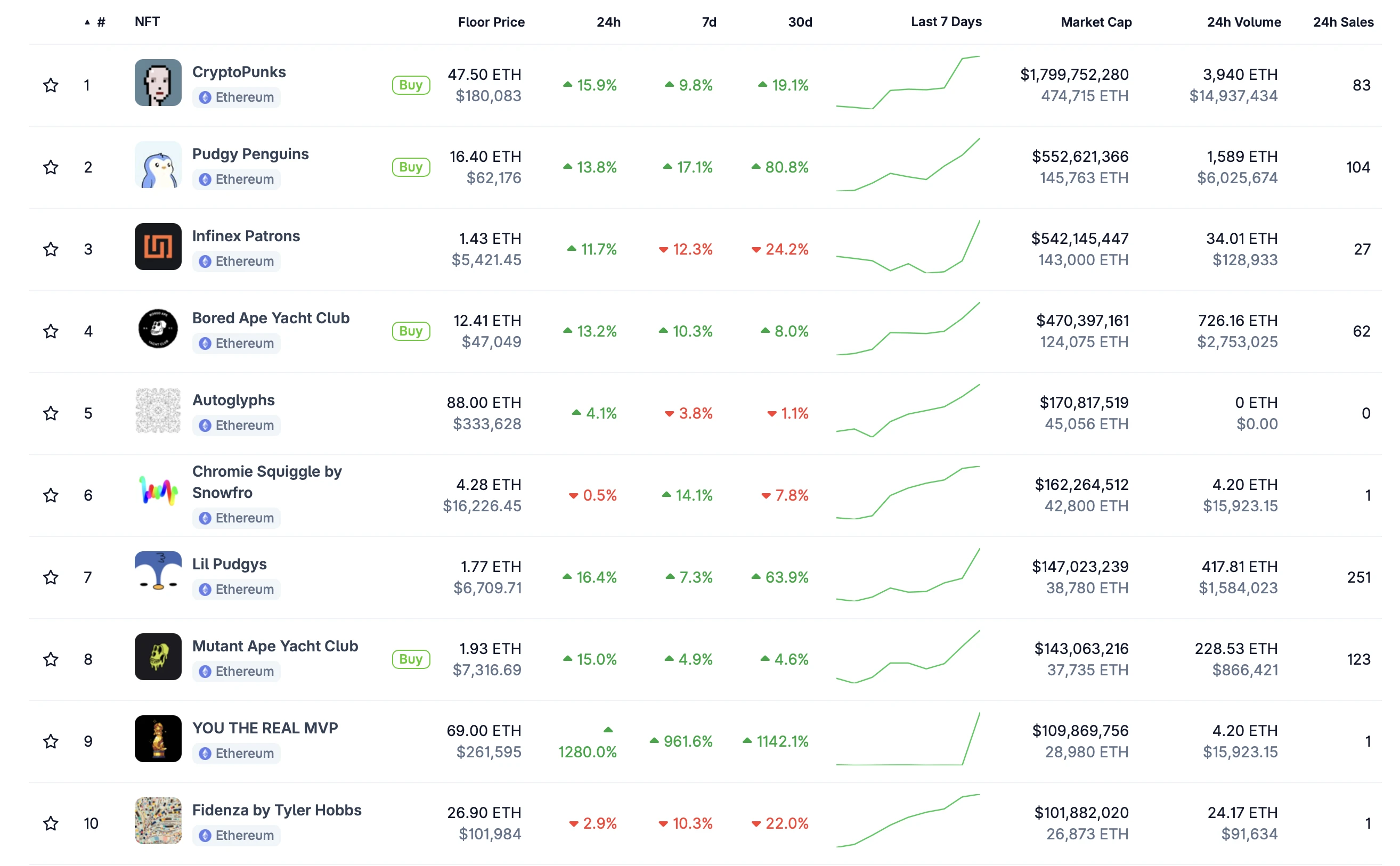

CoinGecko data shows that the total market value of the NFT sector has risen to above $6 billion and is now trading at $6.417 billion, up 23.2% in 24 hours; The growth in trading volume is even more exaggerated, with a total trading volume of about $40 million in the past 24 hours, an increase of about 318.3%.

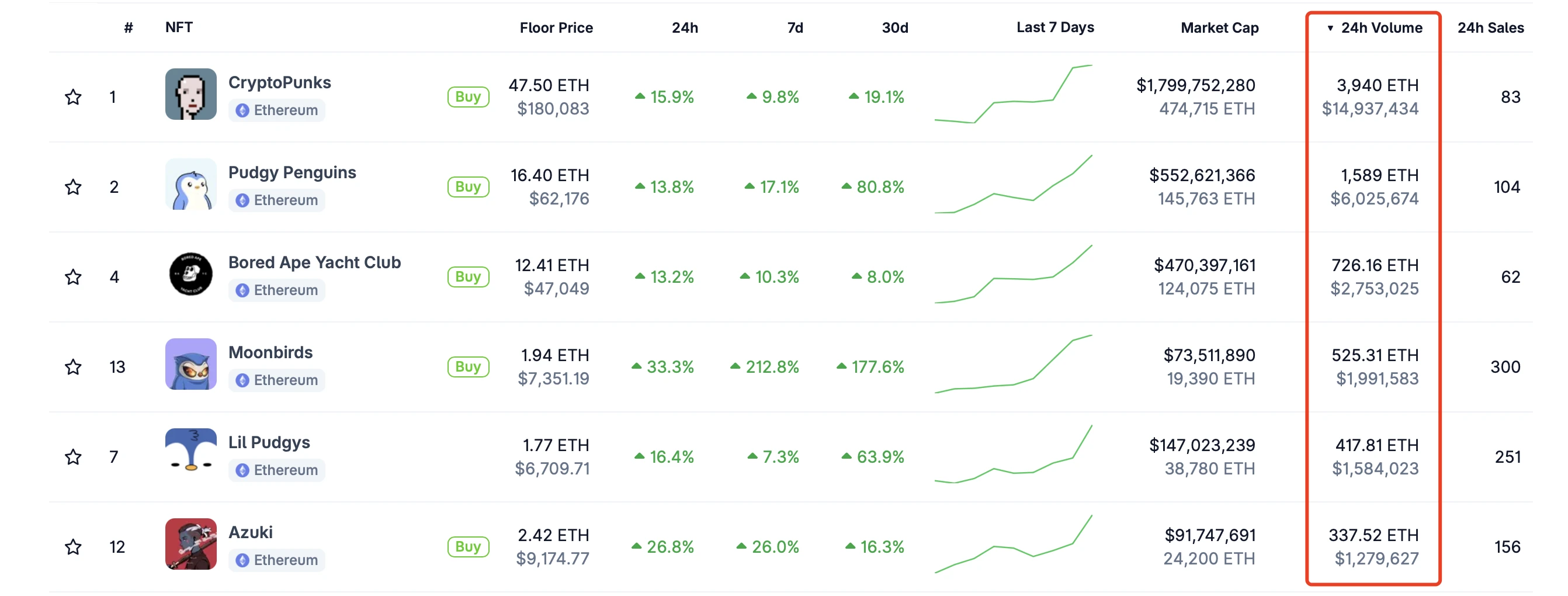

Among the mainstream NFT projects, CryptoPunks, Moonbirds, Pudgy Penguins, etc. stand out.

-

CryptoPunks are because a whale spent millions of dollars to sweep 45 Squiggles last night (the whale also swept multiple Chromie Squiggles), NFT artist Jediwolf said that in just 5 hours from last night to this morning, a total of 76 CryptoPunks changed hands, making it the largest sweep operation in the series since 2021. As of publication, the floor price of CryptoPunks is temporarily reported at 47.5 ETH, with a 24-hour increase of 15.9%.

-

Moonbirds is because OpenSea briefly changed its official X avatar to a Moonbirds series of images last night, which increased the popularity. As of publication, the floor price of Moonbirds is temporarily reported at 1.94 ETH, with a 24-hour increase of 33.3%.

-

Pudgy Penguins, who can be called the "light of the industry" in the NFT winter, recently appeared in the footage of the second season of the American TV series "Poker Face", capturing a certain amount of out-of-the-circle traffic. As of publication, the floor price of Pudgy Penguins is temporarily reported at 16.4 ETH, with a 24-hour increase of 13.8%.

In addition to the above-mentioned outstanding projects, the vast majority of NFT projects have seen good gains, with BAYC up 13.2% in 24 hours and Azuki up 26.8% in 24 hours. The Bitcoin ecosystem is no exception, with Taproot Wizards experiencing a 24-hour increase of 30.3%.

In addition, NFT concept coins have also ushered in a sharp rise. OKX market, as of the publication of BLUR, it is temporarily trading at 0.1176 USDT, with a 24-hour increase of 27.4%, and currently ranks third on the OKX gainer list.

Regarding the recovery of the NFT market, although there was not no one in the market earlier, but in the past few years, the various "milk methods" surrounding NFTs have appeared too many times, in exchange for the track getting colder day by day, and retail investors have long been numb to similar "shouting" words.

On July 16, BitMEX co-founder Arthur Hayes predicted on the X platform that "ETH season has arrived, and the DeFi and NFT markets will benefit and make a comeback", but at that time, under its dynamics, the vast majority of replies were mostly ridiculous.

However, as the "copycat season", which has been eagerly awaited by the market, has finally shown signs of belatedness, there are gradually more discussions about whether the NFT market can recover.

FreeLunchCapital, founder of BitmapPunks and a well-known NFT collector, said today that institutions have contacted it in advance to try to receive goods and ambush - "Since two weeks ago, some institutions have contacted me with some interesting offers. Everyone knows I don't sell NFTs, but that's not the case. If the other party has the resources to attract more attention to NFTs and help the industry reach a higher level, I will consider OTC trading."

Veteran players who were active in the last NFT cycle, such as Abstract contributor 0xCygaar, are even shouting that "NFT Season is finally back."

Regarding the sudden recovery of NFTs, it is not too difficult to understand logically.

On the one hand, as ETH rebounds strongly and quickly rises to a high level, the funds that follow up will also consider related investment targets while focusing on ETH. Since NFTs are popular in the Ethereum ecosystem, and most of the current leading projects are still concentrated in the Ethereum ecosystem, the NFT sector can also be regarded as an alternative to ETH to a certain extent. In terms of trading volume, the NFT with the largest trading volume is still the leading project with relatively sufficient liquidity on the Ethereum chain, which shows that the funds for this round of small recovery mainly come from within the Ethereum ecosystem.

On the other hand, after a long trough, the entire NFT market has undergone a full wash - weak hands have stepped down, and bookmakers who intend to control the market may have already completed the target selection and chip layout. Considering the non-standard liquidity characteristics of NFTs themselves, NFTs may be an easier choice to operate compared to altcoins.

But the current problem is that because the NFT market was too cold before, the track consensus has almost collapsed, and even if the short-term popularity has risen, it is still unknown whether more retail investors and funds can follow up in the future.

In other words, the current situation is - if you say that the altcoin season is coming, there may be many retail investors willing to pay, but if NFT is about to skyrocket, it seems that it is better to believe that I am Qin Shi Huang......