The public offering of Plasma, a public chain of stablecoins, opens tonight, will the valuation of $500 million still participate?

Original | Odaily (@OdailyChina)

Author|Azuma(@azuma_eth)

At the end of the deposit phase (the exact duration is yet to be determined), participating users will receive a corresponding public offering share based on the time-weighted deposit proportion, and then participate in the public offering at a full circulation valuation (FDV) of $500 million.

Plasma: A public chain of stablecoins endorsed by Bitfinex, Tether, Peter Thiel, etc

Plasma is positioned as a high-performance blockchain built for stablecoins, with core features including: the ability to support thousands of transactions per second; Support zero-fee USDT transfer; Rely on the Bitcoin network for settlement (which can be understood as a Bitcoin sidechain); 100% EVM compatible; Customizable gas tokens (e.g. USDT, BTC); Support private transactions without compromising compliance.

From a market perspective, the key reason why Plasma has gained such popularity is its extremely fast financing progress and luxurious investor endorsement.

-

In October 2024, Plasma announced the closing of a $3.5 million funding round when it debuted, led by Bitfinex, with participation from Christian Angermayer and venture capital firms Split Capital, Anthos Capital, Karatage, and Manifold Trading, and backing the project by Bitfinex CTO and Tether CEO Paolo Ardoino.

-

In February 2025, Plasma again announced the completion of a $24 million funding round ($20 million Series A and $4 million seed round), led by Framework Ventures, with Bitfinex and Paolo Ardoino again participating, and the name of Peter Thiel, a Silicon Valley venture capital guru and PayPal co-founder, also appeared on the investment list.

-

In May 2025, Plasma again announced a strategic investment from Peter Thiel's Founders Fund, which was not disclosed, but emphasised that the investment will help Plasma expand its team and ecosystem and accelerate adoption in Latin America, the Middle East, and beyond.

Details of the public offering

On May 27, Echo, an angel investment platform owned by well-known KOL Cobie, announced that it will launch a new public offering platform, Sonar, and Plasma will become the platform's first public offering project.

In this public sale, Plasma plans to sell a total of 10% of its tokens XPL at a full float valuation (FDV) of $500 million, with the goal of raising $50 million. While some followers questioned the $500 million overvaluation, Plasma said it was in line with the recent round of equity funding led by Founders Fund.

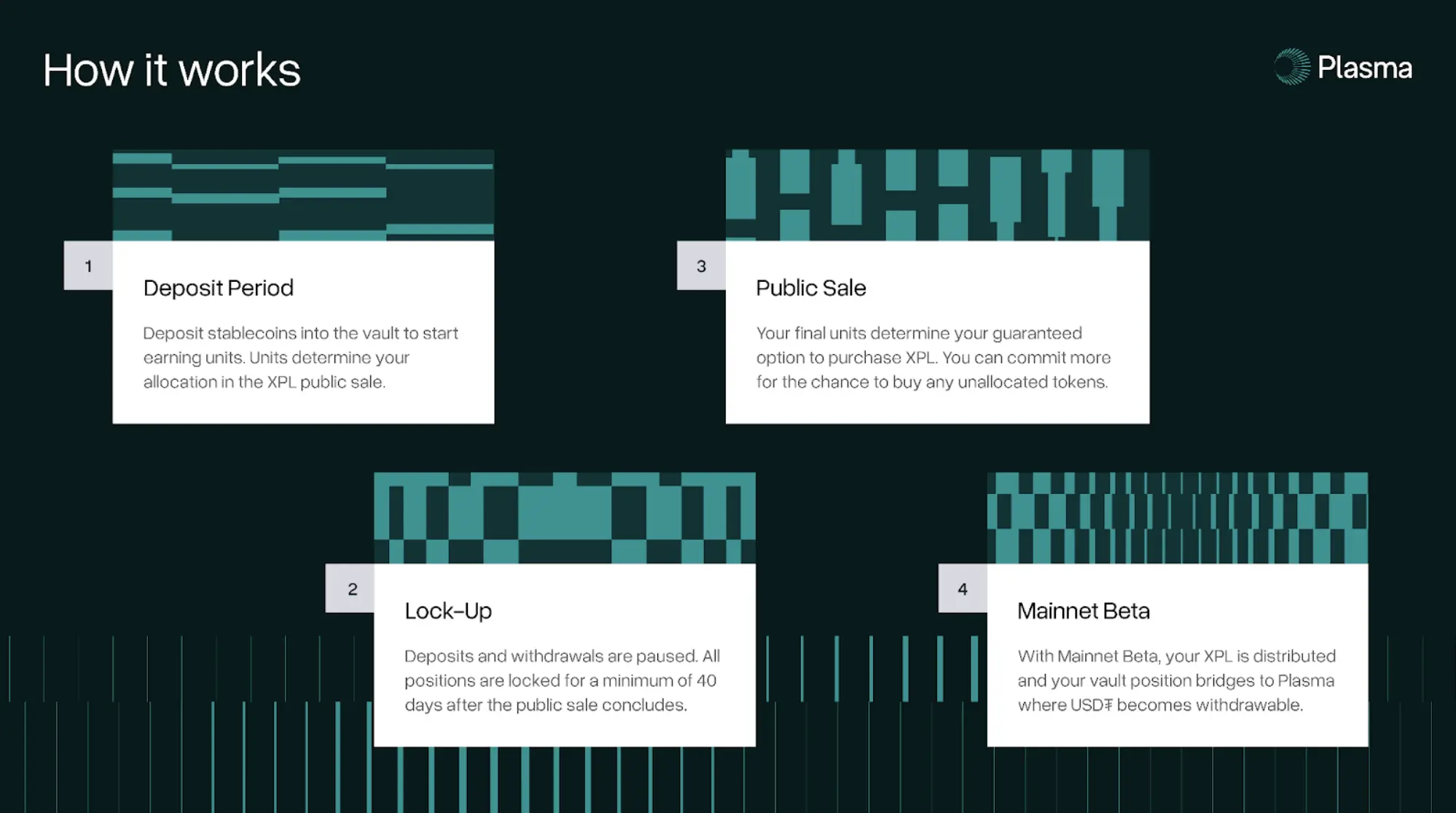

According to Plasma's disclosure, the public offering will be divided into four phases.

Deposit stage

The first phase is the deposit phase, where participants can deposit USDT, USDC, USDS, or DAI into the Plasma vault on the Ethereum mainnet, and the funds will be deployed to the Aave and Maker protocols through Veda's audited escrow contract (users can claim rewards when withdrawing from the beta version of the Plasma mainnet). After depositing, the user starts to accumulate units, which reflect the time-weighted percentage of the user's total deposit in the vault, which will ultimately determine the user's guaranteed quota in the XPL public offering.

During the deposit phase, users can withdraw their deposits at any time, but the points will be reduced accordingly after withdrawal.

The deposit phase is expected to last several weeks, with an initial deposit limit of $250 million, which will be gradually increased over time, with a maximum deposit limit of $50 million for a single user – presumably $50 million for everyone......

Lockdown phase

Once the deposit channel is closed, the vault will be locked and no new deposits or withdrawals will be allowed.

This lock-up period will last for at least 40 days (calculated from the end of the public sale), during which all stablecoin deposits will be converted to USDT in preparation for cross-chain access to the Plasma mainnet beta.

Sale stage

After that, it will enter the sale stage, and users can use their deposit address to participate in the sale on the Plasma website. Sonar will handle the KYC identity verification, jurisdictional screening and other review processes on behalf of Plasma – the UK, China, Cuba, Iran, Russia, Syria, North Korea and Ukraine are prohibited from participating; U.S. participants are required to verify their status as accredited investors and are required to hold their positions for 12 months after the end of the public offering.

The user's points determine their guaranteed quota in the XPL offering, and the subscription supports the use of stablecoins such as USDT, USDC, USDS, DAI, etc. If other depositors are undersubscribed, the remaining XPL shares will be distributed to oversubscribers on a pro-rata basis.

Mainnet phase

After the public sale is completed, Plasma will launch the mainnet beta.

At the same time as the network goes live, the XPL tokens subscribed by users will be distributed, and the vault assets will be cross-chain to the Plasma network, where users can choose to withdraw USDT directly on the Plasma chain.

Mixed reviews

As the public offering approaches, there is more and more discussion about Plasma in the market, and there are two distinct schools of thought.

The proponents believe that at a time when stablecoins have made a breakthrough at the legislative level, coupled with the market heat of Circle's recent IPO, the development prospects of Plasma, which is endorsed by Tether, the "king of stablecoins", are quite promising. Judging by this perspective, the $500 million valuation is not expensive, so it is expected that the $250 million hard cap will be filled soon after the doors open tonight.

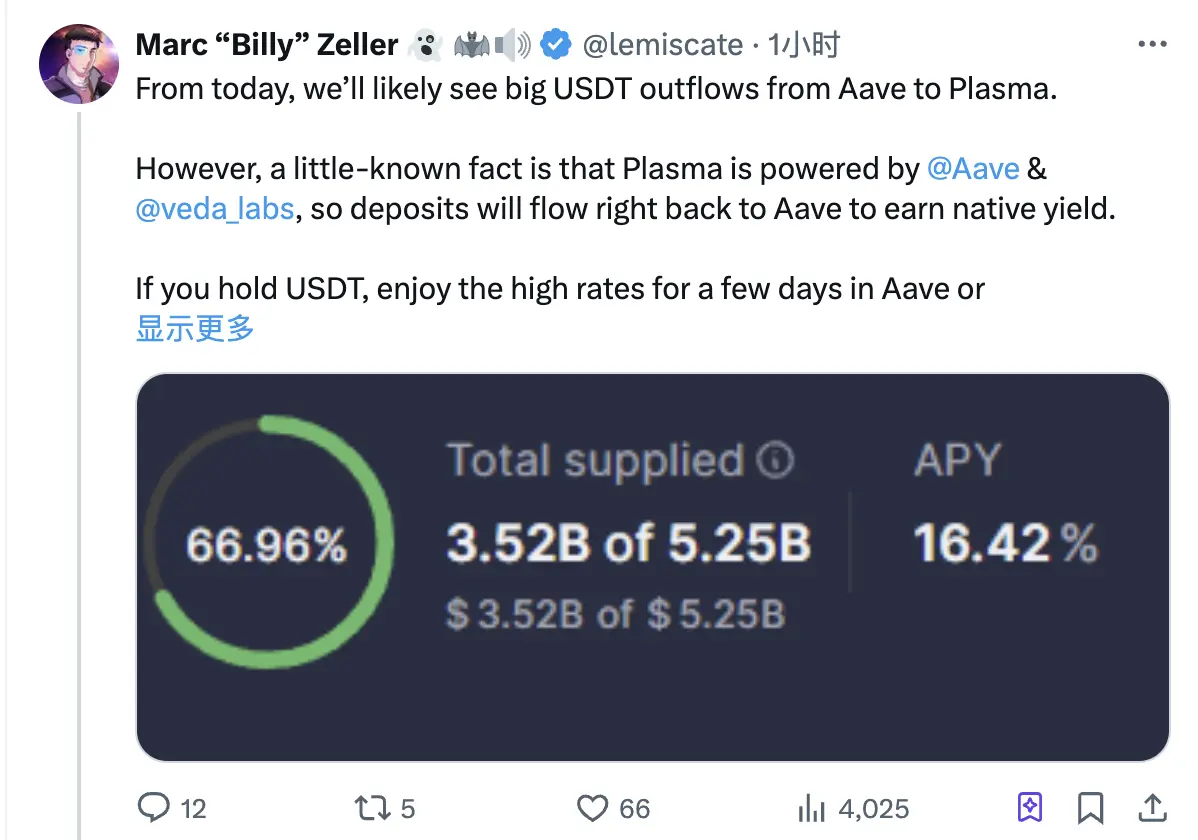

Marc Zeller, a core member of Aave, also commented on the flow of funds from the protocol: "Starting today, we may see a large amount of USDT flowing out of Aave to Plasma. After the user completes the deposit, it is returned to Aave via Veda. "

The opposing side argues that Plasma's $500 million is not cost-effective in the context of the general low opening of new projects in this cycle...... There are even those who have bluntly said that Plasma and another hot project that is about to be publicly offered pump.fun may "harvest" the last liquidity ...... of this cycle

As far as I am concerned, although I still have a wait-and-see attitude towards whether to participate in the Plasma public offering for the time being, given that Plasma has mentioned that it will deposit the funds received during the public offering into Aave and Maker to earn interest, I will tend to take advantage of the pit first for qualification considerations, first, even if I finally give up participating, I will get a certain interest rate return, and second, if Plasma and its ecological projects are intended to be airdropped in the future, early depositors will most likely be given priority, so I will personally tend to deposit after the door opens tonight.