Nakamoto joins the corporate BTC reserve war

Contributed by Token Dispatch, Thejaswini M A, Nameet Potnis, Prathik Desai

Compilation: Block unicorn

preface

That's the text on Nakamoto's (no, not Satoshi Nakamoto) typewriter-style website about cryptocurrency's newest corporate challenger, Bitcoin Reserves.

Just two weeks ago, after another company led by giants such as Tether, Cantor, and SoftBank launched a pure-play Bitcoin company to challenge Michael Saylor's Strategy, Nakamoto Holdings broke into the party with $710 million in capital reserves and a set of strategies that Satoshi Nakamoto would be proud of.

In today's Enterprise Bitcoin Reserve article, we'll tell you:

-

How the launch of Nakamoto has intensified the race for corporate BTC reserves

-

Bernstein's $330 billion prediction got everyone jumping on the bandwagon

-

Why corporate bitcoin reserves are suddenly the hottest topic in cryptocurrency

-

A hotel company now holds more bitcoin than the sixth-largest national bitcoin holder

Nakamoto's Bitcoin Strategy

Nakamoto Holdings, founded by Bitcoin Magazine CEO David Bailey, has announced a merger with healthcare provider KindlyMD, a deal that transforms a company that treats opioids into Bitcoin's newest corporate reserve contender.

Why is it named Nakamoto?

"The financial institutions that define the pages of history are named after their founders: Medici, Rothschild, Morgan, Goldman Sachs. Today, we're betting that legacy on Satoshi Nakamoto," Bailey said.

Mission? "Establishing the Bitcoin standard in the global capital markets."

This is the text on Nakamoto's gorgeous website.

The move comes two weeks after Jack Marles' Twenty One Capital launched its $4 billion Bitcoin corporate reserve program.

If you think Marles' pure Bitcoin corporate reserve is a groundbreaking bet, wait to hear Bailey's plan. He is building what he calls "the first publicly traded Bitcoin conglomerate."

Bailey's financial strategy consists of a fully committed $510 million private equity public placement (PIPE financing) and $200 million convertible bonds.

The PIPE funding attracted more than 200 investors from six continents, including Adam Back, Balaji Srinivasan, Eric Semler (CEO of Semler Scientific), and Simon Grovich (CEO of Metaplanet), among others, demonstrating the program's strong financial backing.

How is this different from Thaler's Strategy and Marles' Twenty One?

"Nakamoto's vision is to bring Bitcoin into the centre of the global capital market, packaging it into stocks, bonds, preferred shares, and a new hybrid structure that every investor can understand and own. Our mission is simple: to list these instruments on every major exchange in the world," Bailey explains the approach.

The race for corporate reserves intensifies

In parallel with Nakamoto's grand debut, Strategy (formerly known as MicroStrategy) had another ordinary Monday. 13,390 BTC worth $1.34 billion was purchased again.

Strategy's Bitcoin corporate reserves now stand at a staggering 568,840 BTC, which is about 2.8% of Bitcoin's total supply.

In 2025 alone, 122,440 BTC has been added, more than most companies' corporate reserve holdings.

Jack Marles' project is positioned as a purer way to play than Strategy, but now faces competition from Bailey's broader "Bitcoin Company Ecosystem" approach.

Even Coinbase revealed that it bought $153 million worth of crypto assets, mostly Bitcoin, in the last quarter.

"Over the last 12 years, there have definitely been moments where we've thought, wow, we should put 80% of our balance sheet into crypto — especially Bitcoin," Armstrong told Bloomberg. "We made smart choices about our risks."

Today, the race has evolved from a simple Bitcoin accumulation to a battle for corporate identity.

Who can most convincingly reposition themselves as a "Bitcoin company"? Strategy transitioned from a software house, Twenty One brought in traditional financial players, and now Nakamoto is merging with a healthcare provider. Common? is the insatiable thirst for Bitcoin.

This desire has also been echoed across the Pacific.

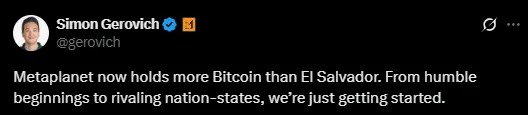

Metaplanet, a Japanese company that only started buying bitcoin last year, added 1,241 BTC to its balance sheet, totalling 6,796 bitcoins, worth about $700 million. That's more than El Salvador, the sixth-largest country holder, has more cryptocurrencies.

And Metaplanet isn't alone. Tokyo-based Beat Holdings last week approved an increase in its Bitcoin investment cap from $6.8 million to $34 million.

Cause? "When countries face deglobalization and escalating trade, they tend to enhance liquidity by implementing expansionary monetary and fiscal policies," the company said.

The company now holds 143,230 units of the Blackstone iShares Bitcoin Trust.

$330 billion problem

How far can this corporate bitcoin scavenger hunt go?

The latest estimates from Bernstein analysts suggest that we are just getting started.

The corporate bitcoin reserve strategy could inject a staggering $330 billion into the corporate bitcoin reserve by 2029.

"Small companies with low growth and high cash are better suited to MSTR's Bitcoin strategy, which sees no clear prospects in terms of value creation, and the success of the MSTR model provides them with a rare path to growth," the analyst wrote in a recent report.

To put it simply, at current prices, corporate reserves will absorb about 3.3 million bitcoins over the next four years. This means that over the next five years, more than 15% of the total Bitcoin supply will be locked in corporate coffers.

Still wondering why Bitcoin is in such high demand? Coinbase gives the answer in a short ad.

What happens when every company wants a piece of the 21 million bitcoin pie? As each new business joins, the Bitcoin corporate reserve strategy becomes more legitimate, potentially creating a feedback loop that accelerates adoption. The FOMO (fear of missing out) cycle for businesses has only just begun.

Our point of view

The battle for the Bitcoin reserve giant is no longer just a race for businesses to accumulate BTC. It is changing the way companies think about their balance sheets.

We couldn't agree more with Bailey's statement: "We believe that in the future, every balance sheet – whether public or private – will hold Bitcoin." We are witnessing the early stages of a new financial paradigm.

Several key dimensions have emerged from this corporate Bitcoin boom.

First of all, the speed is astounding. Think about it: Metaplanet surpassed the entire country's Bitcoin holdings in a single year. Strategy added 122,440 BTC in less than five months. Enterprise adoption is faster than even the most optimistic forecasts of previous cycles.

Second, the diversity of participants indicates that Bitcoin's appeal is expanding. From software companies to healthcare providers, from Japanese hotel groups to investment firms, Bitcoin is crossing industry boundaries. Gone are the days when some U.S. tech companies experimented with a mysterious currency that little else of the world has set foot in. Bitcoin is now a global phenomenon that crosses industry and continental boundaries.

Third, competitive dynamics are changing the structure of the market. The addition of each new business not only increases the buying pressure, but also creates a feedback loop of legalisation, making it easier for the next company to follow up. Strategy facilitated Twenty One Capital, and Twenty One facilitated Nakamoto, which will make the next Bitcoin Enterprise Reserve project a necessity.

As more and more bitcoins are locked up in corporate vaults, the supply available to retail investors decreases, potentially creating a supply shock that even the most conservative models fail to fully account for.

The race has begun. Not just to accumulate bitcoins, but also to occupy a place in the future financial order. The companies that take these actions today are no longer just betting on the price appreciation of Bitcoin; They are establishing themselves in a new financial system in which Bitcoin is the reserve asset of choice for businesses and countries.