More than BTC: the battle for the crypto treasury has begun, combing through the reserves of 28 listed companies

Source: Galaxy Research

Compilation: BitpushNews

Crypto Treasury Trends

The trend of listed companies setting up crypto treasury is expanding from Bitcoin to more crypto tokens, and the size of the allocation continues to expand.

In the past week alone, two publicly traded companies have announced that they will buy XRP as their treasury holdings, and one company has said it is buying ETH as a reserve.

Bitcoin Treasury companies have been in the headlines for most of the year, with Strategy (formerly Microstrategy) leading the way. VivoPower and Nasdaq-listed Webus announced their intention to launch $100 million and $300 million in XRP treasury, respectively, while SharpLink announced the creation of a $425 million ETH treasury.

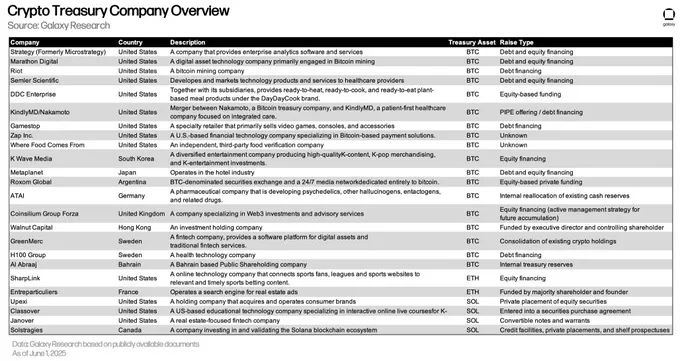

Including these companies, Galaxy Research has sorted out 28 crypto treasury companies:

20 focused on BTC, 4 focused on SOL, 2 focused on ETH, and 2 focused on XRP.

– >

– >

Overview of Crypto Treasury Companies

Our Take: Given

themomentum of existing companies, and the market seems to be strongly interested in funding these companies at a sizeable size and across multiple assets, the trend towards crypto treasury is expected to continue.

However, scepticism continues to heat up as more crypto treasury companies come online.

The main concern lies in the source of financing part of the purchase: debt.

Some companies rely on borrowed funds, mainly zero- and low-interest convertible notes, to purchase treasury assets.

At maturity, these notes can be converted into equity in the company by the investor themselves, provided that the notes are "in the money" (i.e., when the company's share price exceeds the conversion price, making it economically advantageous to convert equity). However, if the maturity date arrives and the notes are "out of the money", additional funds will be needed to cover the liabilities – and this is the source of the treasury firm's strategic concerns.

In addition, although less mentioned, there is also a risk that these companies may lack sufficient cash to cover the interest on their debts.

Whatever happens, there are four main options for treasury companies. They can:

-

Sell their cryptocurrency reserves to replenish cash, which can hurt asset prices, a move that could affect other treasury companies that hold the same assets.

-

Issuing new debt to cover old liabilities and effectively refinancing debt.

The -

issuance of new shares to cover liabilities is similar in nature to the way they currently fund treasury asset purchases through equity financing.

If the value of its cryptocurrency reserves does not fully cover its liabilities, it enters into default.

In the worst-case scenario, the path each company will take will depend on the specific circumstances and market conditions at the time; For example, treasury companies can only refinance when market conditions allow.

The opposite of the treasury source of funds is equity sales, where the treasury company issues shares to fund asset purchases. Equity sales to supplement asset purchases are less of a concern in the big picture, as under this approach, the company has no default obligations and no liabilities are incurred for asset purchases.

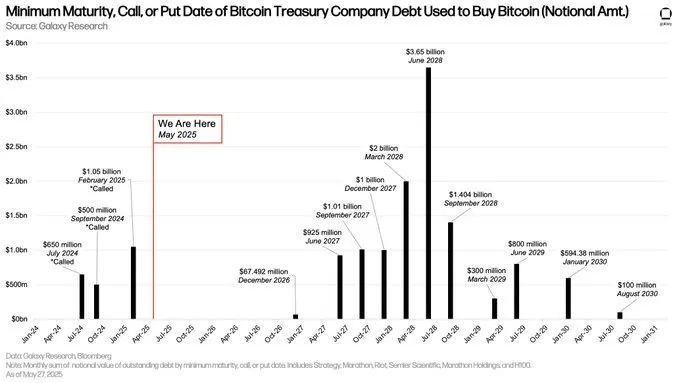

In a recent report on the crypto leverage landscape, we looked at the size and maturity timelines of debt issued by a number of Bitcoin treasury companies.

Based on our findings, we believe that there is not an imminent threat at this time, as the majority of debt is due between June 2027 and September 2028 (as shown in the chart below).

The chart above counts the debts issued by the Bitcoin Treasury Company to purchase Bitcoin, and lists the earliest date on which these debts may be claimed (maturity/redemption/exercise date), as well as the corresponding notional amount of debt.

Given the industry's past leverage-related history, concerns about treasury companies' debt-driven strategies are not unreasonable, but at the moment, we don't see significant risks to this approach.

However, this may not remain the same as debt matures and more companies adopt the strategy, potentially taking a riskier approach and issuing debt with shorter maturities.

Even in the worst-case scenario, these companies will have a range of traditional financial options to get out of trouble, and this may not end in the sale of treasury assets.

– Galaxy On-Chain Analyst @ZackPokorny_