The market value of the three-no product soared by 20 million, what did $B do?

Written by Oliver, Mars Finance

In the midst of the turmoil of the crypto market, few projects have been able to push their market capitalisation to $20 million in a matter of hours with the "three nos" of $B token – no white paper, no audit, no clear team. This new star on BNB Chain, backed by the BUILDonBsc_AI project, with the blessing of the $USD 1 liquidity pool and the blessing of the AI narrative, has gone from "disappearing" a month ago to the focus of speculation today, which is a miracle. You're missing out on this spree while driving, but the rise of $B is far from accidental. Below, we will peel back the surface, explore the essence of the project and the operation strategy, and reveal the driving force behind this market value carnival.

The essence of the "three nos": the vague blueprint of AI and DeFi

BUILDonBsc_AI's public information is a fog that is typical of early projects: vague but seductive. Its core positioning seems to lock in the intersection of AI and DeFi, and may aim to take advantage of the low cost and high throughput of BNB Chain to build an intelligent financial protocol. Speculating on its functionality, perhaps an AI-powered liquidity optimiser that dynamically adjusts pool weights through machine learning to maximise returns; Or it is a decentralised computing marketplace that provides on-chain support for AI model training. This vision is not a pipe dream – BNB Chain's recent push for AI applications (such as Tutorial Agent navigating the ecosystem through AI) provides an ecological soil for similar projects.

However, $B's "three nos" label is alarming. Without a white paper, the technical details cannot be verified; Without an audit report, the security of the smart contract is in doubt; The background of the team is even more blank, and the anonymity makes people think about it. This information vacuum is both a paradise for speculators and a hotbed of risk. BUILDonBsc_AI's X Feed claims that "$USD 1 has taken BNB Chain by storm and $B is poised to be built", implying that its integration with $USD 1 is a core selling point, but is this just narrative wrapping? The essence of $B could be an unformed AI-DeFi experiment or a well-woven speculative story.

Operation Decoding: Leveraging $USD 1 and Precision Marketing

$B's market value of "20 million" is inseparable from BUILDonBsc_AI's operation strategy, and its core lies in the synergy of leverage, marketing and incentives.

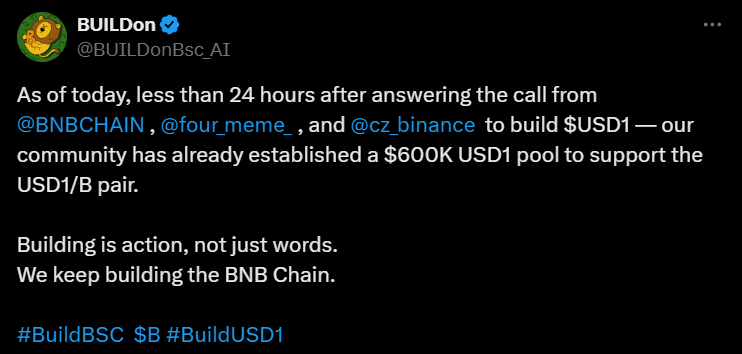

First of all, the $USD 1 liquidity pool is the tipping point for the skyrocket. As a stablecoin launched by World Liberty Financial, $USD 1 reached a market capitalisation of $92.6 billion in May 2025, surging 30% in the past week, becoming the traffic engine of BNB Chain. Its low slippage and high depth provide an ideal trading environment for $B. After the pool opened, the $B/$USD 1 pair could have attracted millions of dollars in TVL on PancakeSwap, with triple-digit APYs further igniting the liquidity mining craze. This liquidity injection not only reduces trading friction, but also attracts institutional and retail funds through the aura of stablecoins.

Second, BUILDonBsc_AI's marketing strategy is on the pulse of the market. The AI narrative will remain the golden sign of the crypto market in 2025, and $B combine it with the hotspots of $USD 1 to weave a story of "the future of finance". The tweets on platform X are full of hints, and the language is both mysterious and inflammatory, such as "bridge complete, tried-and-tested", which stimulates FOMO sentiment. You mentioned that you thought the project was "hanging" a month ago, which may reflect its deliberately low-key warm-up phase, which was then quickly exploded through the launch of the $USD 1 pool and social media hype.

Finally, community incentives are a key enabler of $B's rise. BUILOnBsc_AI may have attracted early participants through airdrops or mining rewards, but the distribution mechanism is not transparent. You mentioned that the assistant was conservative and missed gains, suggesting that the reward may be skewed towards high-risk speculators rather than long-term supporters. Assuming that the total supply of $B is 1 billion, if the circulation is too high, there may be a hidden danger of selling pressure. If the team's coin holdings are concentrated, it may raise the question of "cutting leeks". There is no public tokenomics, and investors can only fumble in the dark pool.

The driving force behind the market carnival: BNB Chain

The skyrocketing price of $B is inseparable from the ecological blessing of BNB Chain. As one of the world's leading blockchains, BNB Chain has attracted countless DeFi and AI projects with low gas fees and EVM compatibility. In the fourth quarter of 2023, its market size surged by 48%, with an average daily transaction volume of 4.6 million, showing strong network activity. The rise of $USD 1 has further cemented its position in the stablecoin market, providing a traffic on-ramp for $B. BUILDonBsc_AI choosing BNB Chain is not only a cost consideration, but also an accurate bet on ecological dividends.

However, there are also speculative traps in this hot land. Projects that are quickly launched on BNB Chain often lack in-depth verification, and community sentiment is easily manipulated by marketing. The skyrocketing of $B is the chemical reaction between the hot narrative (AI+$USD 1) and the influx of liquidity. But similar AI projects aren't invulnerable — on April 1, the Act I The AI Prophecy token plummeted 58% in a matter of minutes, wiping $96 million off its market cap, exposing the volatility risk of low-cap tokens. $B Without substantial technical support, the mistakes of the past may be repeated.

Opportunities and Reefs: The Potential and Concerns of $B

$B's short-term performance is impressive, but its long-term value needs to be scrutinised.

In terms of potential, if BUILOnBsc_AI can deliver on the promise of AI-DeFi, such as launching a smart yield optimisation protocol or a hash marketplace, it could take a place in BNB Chain's $10 billion DeFi market. $USD 1's continued expansion provides it with a stable trading pair, while BNB Chain's ecological support, such as the integration with PancakeSwap, paves the way for its growth. If the white paper is released or audited in the future, $B may usher in a new round of catalysis.

But the worries are everywhere. Opaque information is the biggest risk: no white papers, no audits, and no team backgrounds call into question the legitimacy of $B, and there are many cases of "rug pull" of AI-themed projects. On the market front, the $B surge is dependent on the hot spot of $USD 1, and if the pool funds are withdrawn, the price may quickly retrace. Technical indicators (based on DexTools assumptions) show that the RSI for $B may be overbought, signalling short-term corrective pressure. In addition, $USD 1 may face regulatory uncertainty due to the political context, and the liquidity of $B will be hit hard in the event of sanctions.

Investors' game-breaking strategies

You missed the first wave of $B rallies while driving, but the market is never short of opportunities. Here are some suggestions for next steps to help you capture your potential and mitigate your risks:

Dive into BUILOnBsc_AI's X, Telegram, or Discord to track technical updates and request whitepapers or contract audits. Projects that do not have transparency should be treated with caution. PancakeSwap monitors the TVL and APY of the $B/$USD 1 pool, and if the pool size shrinks or the income declines, it may be a sign of withdrawal. Observing the volume of $B with RSI via BscScan or DexTools, overbought signals or bearish divergences signalling a pullback, an entry point can be found at the Fibonacci retracement level (e.g. 38.2%). Pay attention to the regulatory dynamics of $USD 1, any negative news may affect $B, and you need to set a stop loss to protect your funds.

Epilogue: The Cold Thinking Behind the Hurricane

The soaring market capitalisation of $B tokens and BUILOnBsc_AI is a microcosm of the crypto market in 2025: the dazzling narrative of AI, the wave of liquidity in $USD 1, and the ecological hotspot of BNB Chain have all spawned a speculative feast. Beneath the surface of its "three nos", there may be a grand experiment in AI-DeFi; But it could also be just a bubble in the craze. What you're missing out on is not only the spike in prices, but also the ever-changing pulsation of the crypto market.

The future of $B is a big gamble. If the narrative can be fulfilled with technology, it could become the star of tomorrow for BNB Chain; If it is only a phantom of speculation, it will eventually be lost in the hustle and bustle of the market. For investors, the key to chasing $B is not to blindly follow the craze, but to peel back the coat of the "three nos" and gain insight into its essence and risks. In the hot land of BNB Chain, every hurricane is a dance of opportunity and pitfall, and victory or defeat depends on whether you can stay awake in the frenzy.