A list of industry trends that may be missed during the Dragon Boat Festival

There is no rest button in the crypto market, only the ever-changing narrative rhythm and market tentatives. With the holiday season over, BlockBeats has compiled a list of events and signals worth paying attention to during the Dragon Boat Festival.

The "flash in the pan" of the LOUD token

SocialFi project Loudio (LOUD) completed its IAO on May 31 through HoloworldAI's HoloLaunch platform, with 45% of the total issuance of 1 billion tokens going through this crowdfunding round, raising approximately 400 SOLs. The project was initiated by @0x_ultra, a developer who has participated in the DeFi protocol Jones DAO, and the construction idea is highly dependent on Kaito AI's on-chain social scoring system.

The most notable initial FDV of $150,000, combined with the threshold of 0.2 SOL per person to participate in the IAO, sparked significant speculation in the Solana community.

LOUD evaluates the originality and dissemination of content posted on platform X through Kaito AI, and rewards 72% of the transaction fees to the top 25 posters according to the leaderboard every week, another 18% to KAITO stakers, and 10% to the creator fund. In order to compete for the position of the leaderboard, some users posted a large number of homogeneous content on the X platform, and even borrowed clickbait technology to attract interaction, which caused a certain amount of disgust in the community.

At the time of writing, LOUD's total market capitalisation was $6.57 million, down 80% from its market capitalisation high.

The Labubu craze sparks meme coin infringement controversy

In the past few days of the holiday, the market value of the Solana ecological meme coin, which is based on the Bubble Mart trendy play IP, exceeded $70 million $LABUBU, hitting a record high.

Looking back on the success of the Labubu token, the most intuitive reason is the out-of-the-circle effect of its IP foundation and social communication. Labubu is a popular toy IP under POP MART, which has been officially certified by the Tourism Authority of Thailand, and has been loved and promoted by celebrities many times, further enhancing Labubu's global popularity and sparking a global following. The official publicity and airdrop opportunities were also used in an ingenious way to ask participants to post a cute photo of LABUBU and tweet it, and get friends to like and retweet the tweet, which also accelerated Labubu's circle-breaking publicity.

Related Reading: A New Consensus for Young People: Labubu, CSGO and the Meme Coin

As a result, $LABUBU's rise has benefited from Labubu's strong cultural influence as a globally popular IP, however some in the community have expressed concerns about its infringement risks, which may limit its long-term growth, such as not being able to list on regulated trading platforms.

Backdoor entry into the "micro-strategy" game

Other headlines during the holiday season include SharpLink Gaming, a NASDAQ-listed company that will become Ethereum's version of "microstrategy." On May 27, SharpLink Gaming announced a $425 million financing agreement through a private equity investment (PIPE), led by Consensys Software Inc. as the lead investor, with participation from well-known crypto venture capital institutions such as ParaFi Capital, Electric Capital, Pantera Capital, Galaxy Digital, etc. It aims to drive its Ethereum financial strategy.

Related Reading: Ethereum's "Strategy Moment"? SharpLink Gaming's $425 Million Bet on ETH Reserves

Subsequently, SharpLink Gaming filed a Form S-3 ASR with the SEC and has entered into an ATM (mark-to-market) sale agreement with A.G.P., pursuant to which A.G.P. may issue and sell up to $1 billion of common stock in aggregate. The vast majority of the proceeds from the issuance will be used to purchase ETH, the native cryptocurrency of the Ethereum blockchain, and the proceeds from the offering are also planned to be used for working capital needs, general corporate purposes, operating expenses, etc.

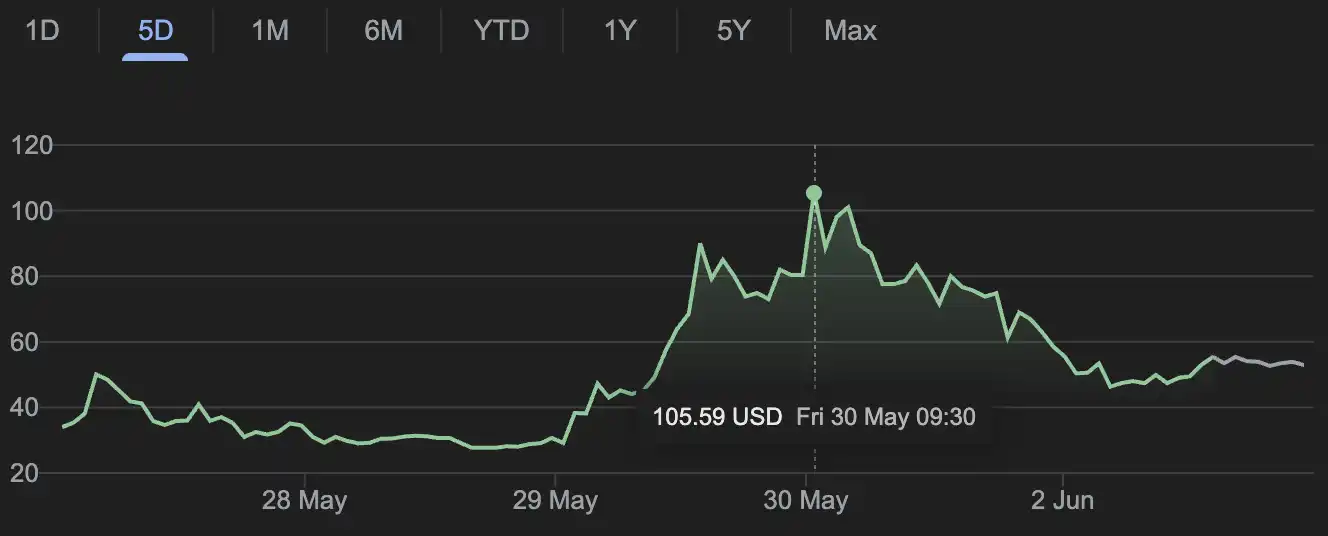

However, on June 2, Sharplink Gaming's stock price fell more than 20% pre-market, and has risen by 1,918.26% in the past 5 days.

Whale James Wynn also started "begging on the chain"

The day before the Dragon Boat Festival, James Wynn was liquidated for a highly leveraged BTC long position, and his $100 million worth of positions was liquidated at that time. According to Lookonchain data, its cumulative losses were as high as $9.36 million, with a total loss of $17.72 million. Subsequently, James Wynn closed all positions and transferred the last about 460,000 USDC out of his HyperLiquid account, completely emptying it.

Just one day after the short position, James Wynn redeemed the 126,116 HYPE (worth about $4.12 million) he had previously pledged, and sold it at an average price of $32.7 to make a profit of $1.05 million.

On June 2, James Wynn opened another 40x leveraged BTC long position, holding 944.93 BTC, with an opening price of $105,890.3 and a liquidation price of $104,580. As the market fluctuated downward, he continued to replenish the margin through the chain, and the liquidation price was adjusted to $104,360 and $104,150 successively, and finally was pushed to around $103,610, which is only about $20 away from the actual market price.

As leverage approached the threshold of liquidation, Wynn launched a fundraising request on social media, publicly saying, "If you want to fight against the market-making group and support me, please transfer USDC to the designated address." He promised to return the crowdfunding funds 1:1 if the deal was successful. This move quickly sparked controversy, and even Liang Xi burst into James's comment section to say that this kind of behaviour is "infringement".

Related Read: Who's Directing James Wynn's Reckoning? 》

Circle raises its valuation before pre-IPO

Recently, Circle will expand its Nasdaq IPO, raising its valuation to $7.2 billion from $5.4 billion previously. The company and some shareholders will issue 32 million shares priced at $27 to $28 per share, raising up to $896 million, reflecting the capital market's focus on stablecoins and RWA narratives.

Driven by this, a number of on-chain projects have become the focus of capital chasing, mainly including:

1. ONDO: Partnered with BlackRock to issue OUSG U.S. bond tokens, with a current market capitalisation of $2.6 billion;

2. KTA: The RWA project on the Base chain has increased by more than 10 times in recent months;

3. ENA: Stablecoin sentiment concept stock, which has been included in the Coinbase listing plan

4. B: The meme stablecoin on the BSC chain may attract market attention due to the transfer of USDC from Circle to Binance.

Related reading: "Circle quasi-listing, what targets can be speculated?" 》

Circle's IPO is considered to be a landmark event for crypto-native companies to hit the Nasdaq capital market again after Coinbase and Antalpha. Behind it is not only the verification of the business model of stablecoin infrastructure, but also seen as an important signal that the on-chain dollar and RWA narrative have once again been recognised by mainstream capital.