Ethereum Price Prediction: Record-Breaking Institutional Trading Signals $10K ETH Ahead

The Ethereum price (ETH) is holding strong at $4,421 today, consolidating after a powerful rally even as the wider crypto market takes a breather.

The second-largest cryptocurrency is now up 17% in the past week, 45% over the last month, and an impressive 67% year-on-year.

This surge follows a record-breaking July, when Ethereum’s CME futures volume hit an all-time high of $118 billion, signaling growing institutional interest and setting the stage for what could be its next major breakout.

This signals a massive rise in institutional demand for the token, and when combined with its superior fundamentals, it also points to a very positive long-term Ethereum price prediction.

Data from The Block reveals not only that the volume of CME Ethereum futures topped $118 billion last month, but also that open interest currently stands at $6.04 billion.

This is also a record figure, and it is higher today than it was at the end of July, signalling that institutional interest in Ethereum continues to rise.

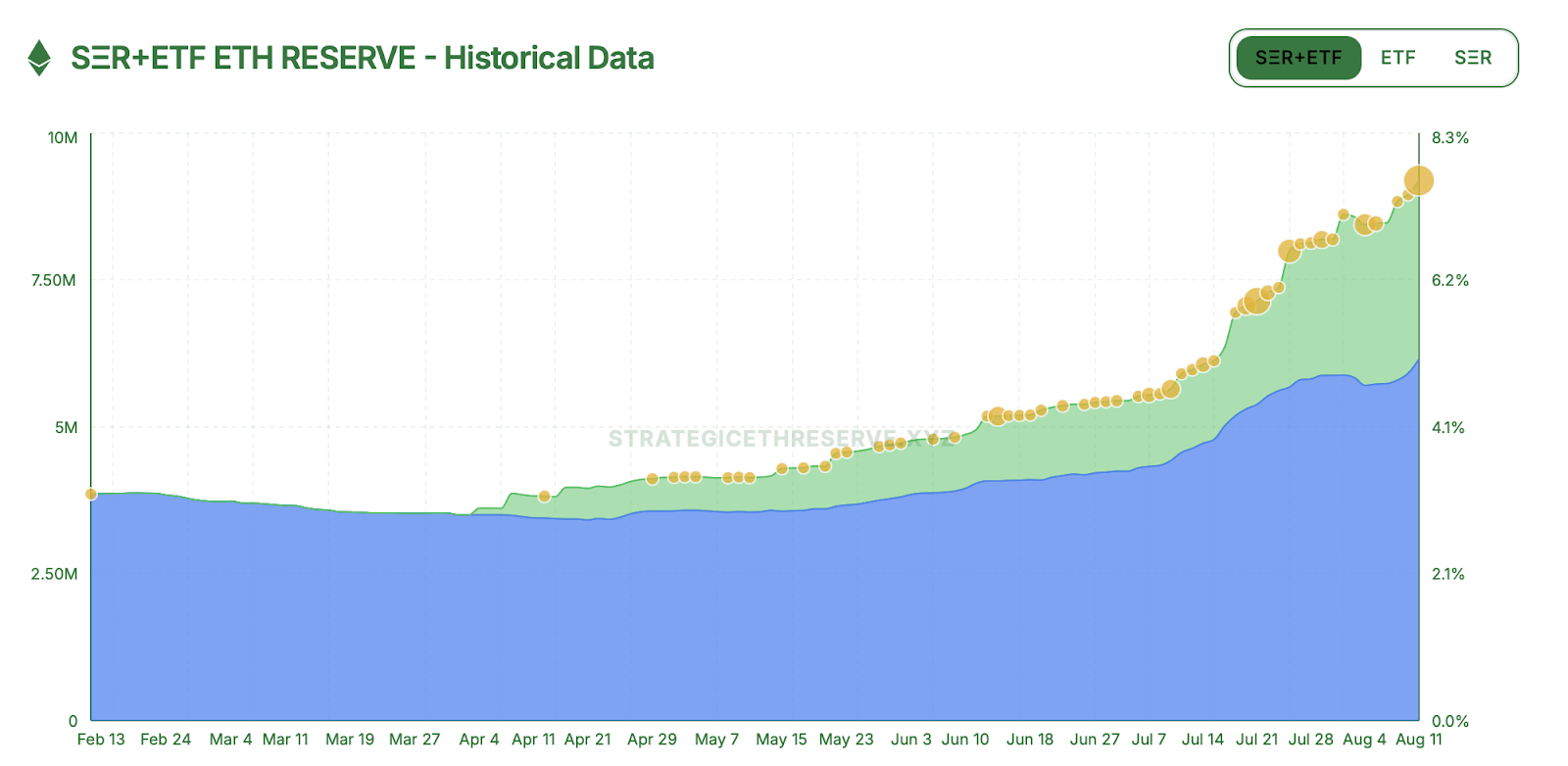

Other bullish data includes the fact that Ethereum ETFs and strategic ETH reserves now account for around 7.98% of the total circulating supply of Ethereum, up from only 3% as recently as the beginning of April.

Source: Strategic ETH Reserve

The growth in such holdings has even accelerated in recent weeks, and currently shows no immediate sign of slowing down.

And if we look at Ethereum’s price chart today, we see that its momentum remains incredibly strong.

Its MACD (orange, blue) has recently touched its second-highest level of the year, while its relative strength index (yellow) remains above 60, having risen from an oversold 25 a week ago.

This signals buying pressure, and while things have cooled a little today, it’s likely that we’ll see renewed gains by the end of the week.

What’s particularly bullish about Ethereum is that it still remains 12% below its ATH of $4,878, which it set in November 2021.

Source: TradingView

As such, it still has more room to grow, and may not enter another quiet period until it clears $5,000.

And in the medium- and long-term, we could see it reach higher levels by the end of the year.

This is because Ethereum comfortably remains the biggest layer-one network in terms of total value locked, which stands at $91.67 billion (or 61% of the entire crypto sector).

For this reason, the Ethereum price could pass $6,000 by Q4, before heading towards $10,000 in 2026.

Bitcoin Hyper Presale Raises $8.6 Million: Could It Become the Next Big L2?

As big as Ethereum is likely to remain, many traders may also opt to diversify into smaller, newer tokens, since these can often outpace the market.

We’ve seen this already this year with such newcomers as SPX6900, Pudgy Penguins and Hyperliquid, and we’ve also seen it with presale tokens such as Solaxy.

One token currently conducting a successful presale is Bitcoin Hyper (HYPER), a Solana-based layer-two network project.

$HYPER is on the Moon!

— Bitcoin Hyper (@BTC_Hyper2) August 9, 2025

8M Raised!pic.twitter.com/7ZskFBsFgd

It has raised an impressive $8.6 million in its ongoing ICO, with investors flocking to buy its native token before it lists.

As an L2 for Bitcoin, it will provide Bitcoin users with faster transaction speeds and lower transaction fees, helping to tap into the Bitcoin network’s enormous value for the purposes of DeFi.

It harnesses zero-knowledge proofs and Solana’s Virtual Machine, giving it considerable scalability and security.

As its native token, HYPER will be necessary to pay for transaction fees, meaning that the token could attract big demand once the platform goes live.

Investors can buy it now by going to the Bitcoin Hyper website and connecting a compatible wallet such as Best Wallet.

HYPER is currently selling at $0.01265, although this will rise in a couple of days, and will continue to rise over the course of the sale.

Click Here to Participate in the Presale