From crypto whale James Wynn to market manipulation, unravelling the opportunities and concerns of on-chain contract Hyperliquid

Written by: Lawrence, Mars Finance

Hyperliquid: The new overlord of on-chain liquidity

InMay 2025, the crypto market ushered in a new round of market breakthroughs, with Bitcoin breaking through the $110,000 mark and Ethereum standing at $2,600.

On

On

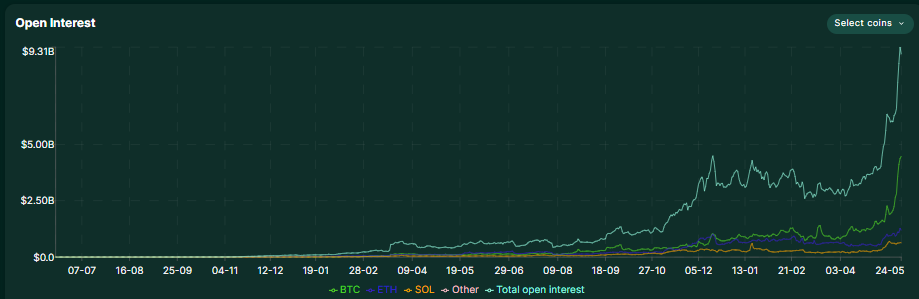

May 26, Hyperliquid officially announced that its open interest reached $10.1 billion, 24-hour fee income reached $5.6 million, and USDC lock-up exceeded $3.5 billion, all three of which reached record highs.

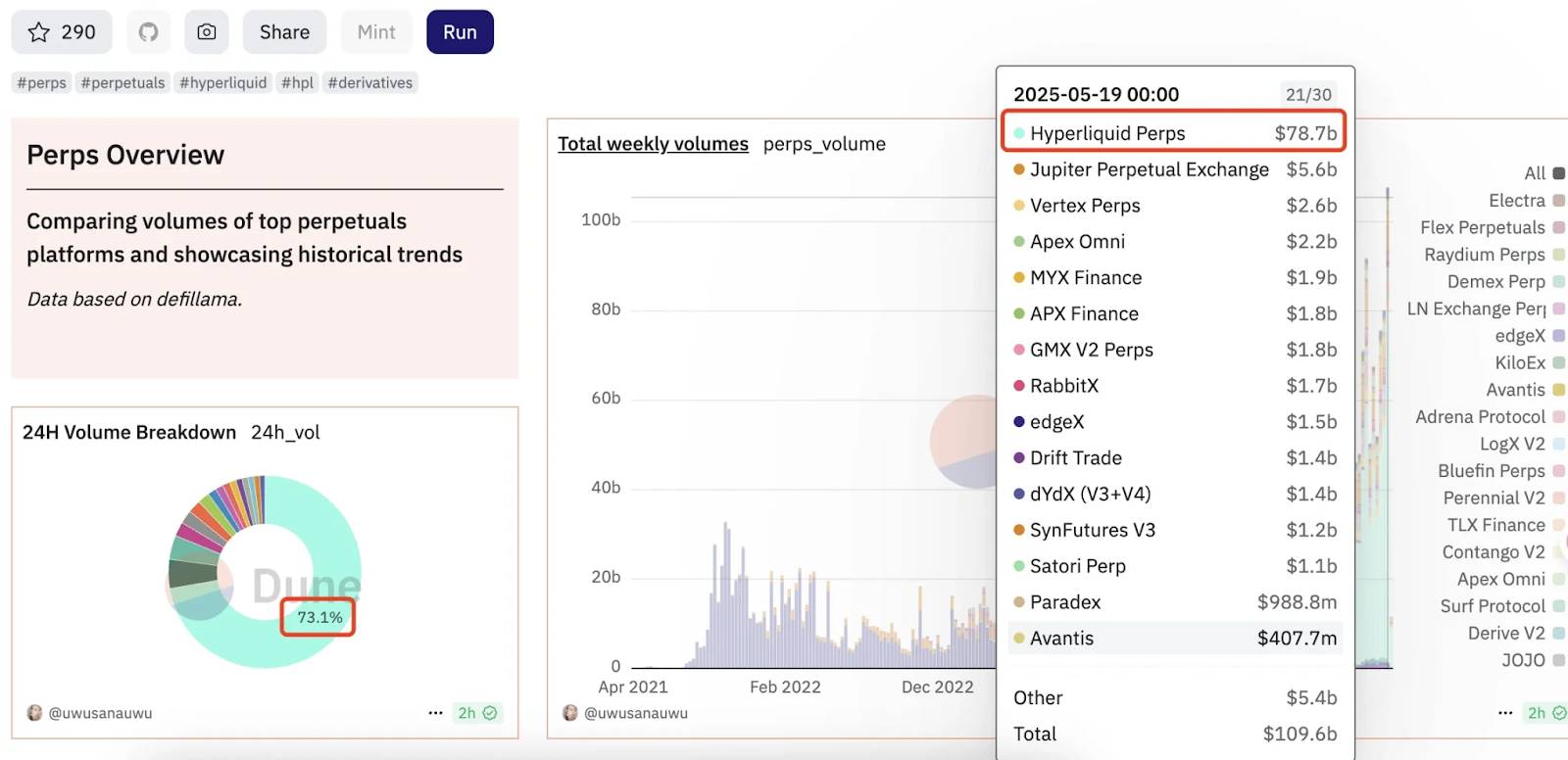

This achievement not only marks Hyperliquid's emergence as the traffic centre of on-chain contracts beyond traditional CEXs (such as Binance and Bybit), but also reveals a new trend: crypto whales are moving the battlefield from centralised exchanges to on-chain, and Hyperliquid has become their "hunting ground".

The rise of Hyperliquid is not accidental. Its average daily trading volume accounts for more than 70%, and the 7-day trading...