Crypto ETF Weekly Report | Last week, U.S. Bitcoin spot ETFs saw a net inflow of $548 million; The U.S. Ethereum spot ETF saw a net inflow of $2.852 billion

Finishing: Jerry, ChainCatcher

Crypto spot ETF performance last week

USBitcoin spot ETF net inflow of $548 million

Last week, the U.S. Bitcoin spot ETF had a three-day net inflow, with a total net inflow of $548 million and a total net asset value of $151.98 billion.

Last week, the three ETFs were in a state of net inflows, mainly from IBIT, BTC, and BTCO, with inflows of $887 million, $32.9 million, and $4.9 million, respectively.

Source: Farside Investors

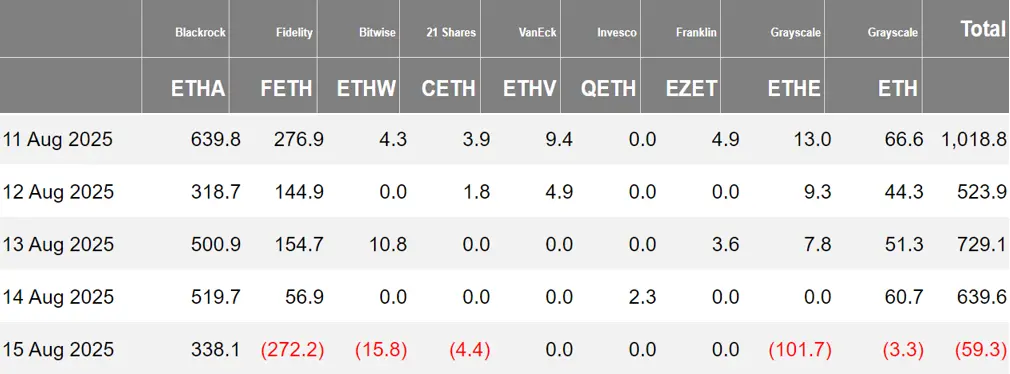

U.S. Ethereum spot ETF net inflow of $2.852 billion

Last week, the U.S. Ethereum spot ETF saw net inflows for four consecutive days, with total net inflows US$2.852 billion, with a total net asset value of US$28.15 billion.

Last week's inflows were primarily from BlackRock ETHA, with a net inflow of $2.317 billion. 7 Ethereum spot ETFs are in a state of net inflows.

Source: Farside Investors Hong

Kong Bitcoin spot ETF saw a net inflow of 31.49

Bitcoins Last week, Hong Kong Bitcoin spot ETFs saw a net inflow of 31.49 Bitcoins, with a net asset value of $512 million. Among them, the issuer Harvest Bitcoin's holdings fell to 292.83, and Huaxia increased to 2,330.

The Hong Kong Ethereum spot ETF had a net inflow of 2595.57 Ethereum, with a net asset value of US$124 million.

Data source: SoSoValue

Crypto Spot ETF Options Performance

Asof August 15, the total notional turnover of U.S. Bitcoin spot ETF options was $1.32 billion, The nominal total traded long-short ratio is 4.28.

As of August 14, the total notional position of U.S. Bitcoin spot ETF options reached $29.87 billion, with a notional long-short ratio of 1.77.

The market's short-term trading activity for Bitcoin spot ETF options has increased, and the overall sentiment is bullish.

Additionally, the implied volatility is 41.72%.

Data source: SoSoValue

Summary ofcrypto ETF dynamics last week

Grayscale applied for a Dogecoin ETF and intends to list under the symbol "GDOG"

According to The Block, Grayscale filed an application with the U.S. Securities and Exchange Commission (SEC) on August 15 to plan to transform its Dogecoin trust into an ETF. According to the filing documents, the ETF will be listed on the New York Stock Exchange Arca platform under the trading symbol "GDOG".

Several institutions, including Rex-Osprey and Bitwise, have submitted similar applications at present.

Hedge fund Brevan Howard discloses holding over $2.32 billion in BlackRock Bitcoin spot ETF

According to CoinDesk, hedge fund Brevan Howard disclosed that he holds more than $2.32 billion worth of BlackRock Bitcoin spot ETF.

Li Lin's family office Avenir Group holds about $1.01 billion in BlackRock Bitcoin ETF

Accordingto the 13F filing filed by Hong Kong-based Li Lin's family office Avenir Group, it currently holds a $1.01 billion BlackRock Bitcoin ETF, about 16.55 million shares. This is an increase from the previous report of 14.7 million shares in May.

The U.S. SEC postponed the decision on Bitwise and 21Shares' Solana ETF proposals until October 16

According to The Block, the U.S. Securities and Exchange Commission (SEC) has delayed its decision on whether to approve Solana's exchange-traded fund (ETF) proposal. The SEC said in its filing that the next deadlines for the Bitwise Solana ETF and 21Shares Core Solana ETF are set for October 16. "The Commission believes it is appropriate to designate a longer period of time to issue an order approving or denying the proposed rule change so that the Commission has sufficient time to consider the proposed rule change and the issues raised therein," both documents said. "

TheSOL ETF proposal is making progress as companies amended their filings last month to obtain SEC approval. Companies including Proshares, Grayscale, Canary, 21Shares, and others are awaiting SEC approval.

Citigroup considers offering stablecoin custody and payment services, explores crypto ETF support

According to Reuters, Citigroup is exploring providing stablecoin custody and other services. After Congress passed a law paving the way for the widespread use of crypto tokens for payments, settlements, and other services, Citi became one of the few traditional institutions considering a foray into the stablecoin space.

Biswarup Chatterjee, head of global partnerships and innovation at Citigroup's services division, said that providing custody services for high-quality assets backing stablecoins is a top choice for Citi is considering.

Additionally, Citi is exploring digital asset custody services that support crypto-related investment products and the use of stablecoins to speed up payments, allowing customers to send stablecoins between accounts or convert them to USD for instant payments.

The Hong Kong Stock Exchange will list two new spot virtual asset ETFs on August 21

According to documents from the Hong Kong Stock Exchange, MicroBit's MicroBit Bitcoin spot ETF and MicroBit Ethereum spot ETF will be listed on the Hong Kong Stock Exchange next Thursday (August 21), and the management fee of the two ETFs is 0.5% of the net asset value per year, which is the lowest among existing virtual currency spot ETFs.

BOCI Prudential Trust acts as the custodian and administrator, the virtual asset trading platform is HashKey Exchange, and the virtual asset sub-custodian is Hash Blockchain Limited, and the participating securities firms include China Merchants Securities (Hong Kong), Eddid Securities Futures, Mirae Asset Securities (Hong Kong), Solomon Oriental (Asia), Huasheng Capital Securities and Shengli Securities.

U.S. SEC confirms acceptance of Invesco Galaxy spot Solana ETF application

According to official documents, the U.S. Securities and Exchange Commission (SEC) has confirmed that it has accepted Invesco Galaxy's application for a spot Solana ETF.

Grayscale incorporated the Cardano & Hedera Trust ETF in Delaware

According to official documents, GRAYSCALE CARDANO TRUST ETF and GRAYSCALE HEDERA TRUST ETF were both incorporated in Delaware, USA, on August 12, 2025, as general statutory trusts, and the registered agents are CSC Delaware Trust Company in Wilmington, Delaware.

Kazakhstan Launches First Spot Bitcoin ETF in Central Asia

Fonte Capital, an asset manager in Kazakhstan, launched the first spot Bitcoin exchange-traded fund (ETF) in Central Asia on August 13 on the Astana International Exchange (AIX), CoinDesk reported. The fund is traded under the symbol BETF and is denominated in USD.

Each fund share is backed by physical Bitcoin, provided by BitGo, a licensed custodian in the United States, and provides insurance coverage of up to $250 million. BitGo employs measures such as offline cold storage and secure vaults to ensure asset security.

Bloomberg analyst: Roundhill has submitted an application for a meme ETF

Bloomberg senior ETF analyst Eric Balchunas posted on the X platform that investment institution Roundhill has submitted an application to regulators for a meme exchange-traded fund "Roundhill Meme Stock ETF", but did not disclose further details.

Roundhill has previously submitted an application to the U.S. SEC for the Ethereum Covered Call Strategy ETF (Roundhill Ether Covered Call Strategy ETF, ticker YETH).

Trump Media Technology Group: Bitcoin ETF to launch later this year

According to Golden Ten, Trump Media Technology Group (DJT. O) announced that a Bitcoin ETF will be launched later this year.

Trump Media & Technology Group Submits Bitcoin ETF Amended Registration Statement

According to Jinshi, Trump Media & Technology Group (DJT. O) filed an amended registration statement for a Bitcoin ETF.

Trump Media Technology Group (DJT. O) said that Bitcoin ETFs will directly hold Bitcoin and provide shares to investors, aiming to reflect Bitcoin's price performance.

Market news: CANARY TRUMP COIN ETF has been registered in Delaware

CBOE for Canary's pledged INJ ETF filing

application documents Views and analysis on crypto ETFs

President of The ETF Store: To gain exposure to crypto assets, you should choose to directly hold coins or spot ETFs, and it is not recommended to buy through "treasury companies"

Nate Geraci, president of The ETF Store, tweeted, "Put aside those noises, if you really believe in Bitcoin or Ethereum, then buy it directly, or buy a spot ETF." You don't need financial engineering like a 'treasury company'.

Bloomberg analyst: The combined trading volume of Bitcoin and Ethereum spot ETFs hit a record high this week, thanks to the surge in Ethereum ETF trading volume

Bloomberg ETF analyst Eric Balchunas posted on social platforms that this week, spot Bitcoin and Ethereum ETFs traded at about $40 billion, a record high, thanks to the strong rise of Ethereum ETFs. The trading volume is huge, equivalent to the top five ETFs or the top ten stocks combined.

Among them, the weekly trading volume of Ethereum ETFs is about $17 billion, a record high. "It's like it slept for 11 months and then compressed a year's worth of volume into six weeks."

President of The ETF Store: Spot ETFs are not "takeovers", BTC and ETH have achieved significant gains

Nate Geraci, president of The ETF Store, said that there have been cases where crypto spot ETFs are called "takeover liquidity," but the data shows otherwise. The Bitcoin spot ETF was launched at $47,000 in January 2024 and has now risen to $123,000. The Ethereum spot ETF was priced at $3,500 when it launched in July 2024 and has now risen to $4,700.

Cathie Wood: The success of ETFs lies in actively responding to market demand for transparency

According to CoinDesk, ARK Invest CEO Cathie Wood said that the ETF's success and ARK's outstanding performance stemmed from meeting the market's need for transparency.