On-Chain Fees Reveal DeFi Shift to Derivatives and Treasury Yields

Key Insights:

- Stablecoins dominate DeFi fees as Tether and Circle rake in yields from U.S. Treasuries, turning tokens into passive income machines.

- Derivatives protocols like Jupiter and Hyperliquid are rising fast, with record fees and TVL spikes driven by traders betting on volatility.

- Lido is losing ground as DeFi shifts away from staking, restaking, and real-world yield options are now stealing the spotlight.

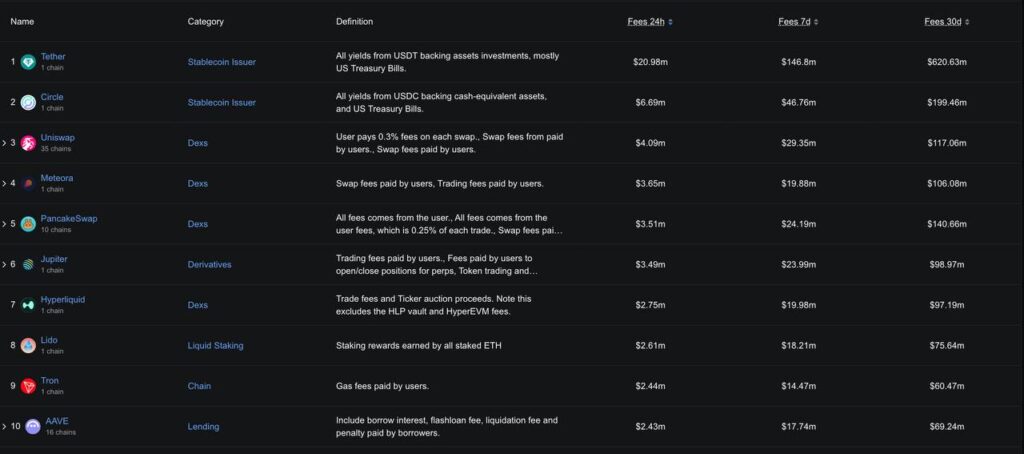

The top 10 DeFi protocols by on-chain fees show something big: DeFi is changing. Instead of just swaps and staking, more money is now flowing into protocols linked to treasury yields, derivatives, and real trading activity.

Stablecoin issuers like Tether and Circle are making the most fees, not the big-name DEXs like Uniswap or PancakeSwap. And newer protocols like Jupiter and Hyperliquid are catching up fast.

Here’s what the data is telling us, and what it means for DeFi going forward.

Stablecoins Are Becoming the New Income Machines

Stablecoins are no longer just about sending money or holding value. Now, they’re making serious money from U.S. Treasury bills.

The latest fee chart shows Tether and Circle at the top. These are stablecoin issuers.

Tether earned $620 million in the last 30 days, while Circle brought in nearly $200 million. This money doesn’t come from crypto trading; it comes from yield.

Both companies invest the dollars backing their stablecoins (USDT and USDC) in safe government bonds, mostly U.S. Treasuries. These pay them interest (called APY or yield). So every dollar of USDT or USDC helps them earn passive income. That’s why they top the fee charts.

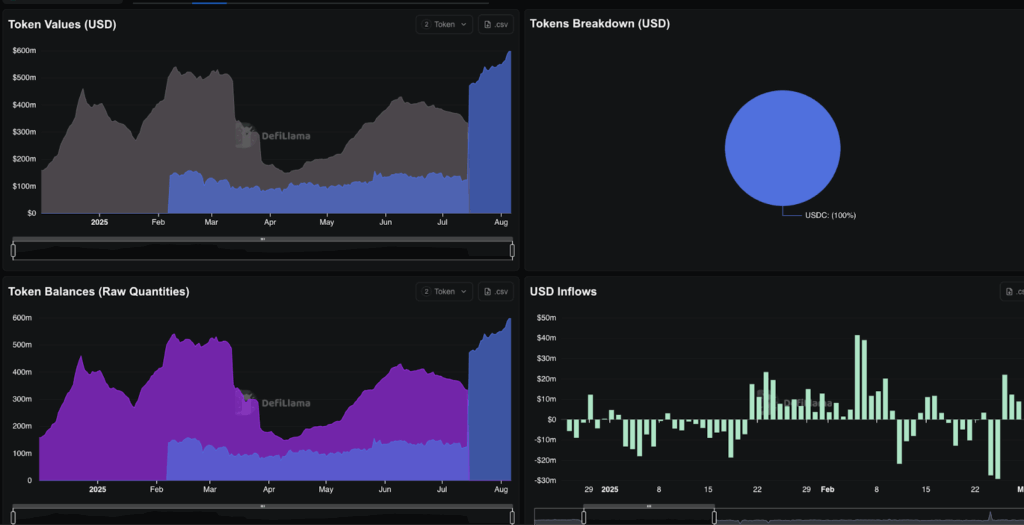

Another insight: Chain-specific stablecoin market caps are rising again, especially on Tron, Solana, and Ethereum. The more stablecoins issued, the more yield these issuers earn. In short, stablecoin issuers are now DeFi’s top earners, and they don’t even offer swaps, staking, or lending.

DeFi Derivatives Protocols Are Gaining Fast

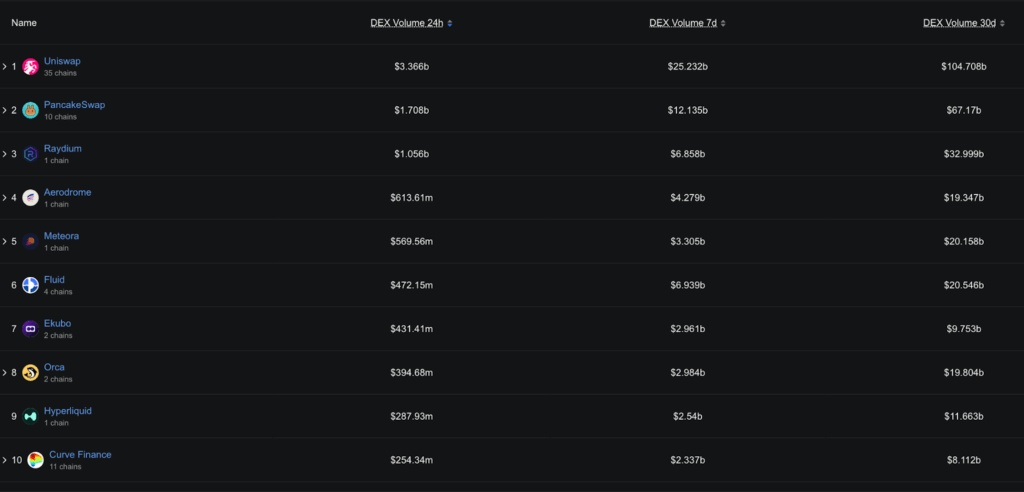

Old-school DEXs like Uniswap, PancakeSwap, and Meteora are still earning well. But they’re starting to lose ground.

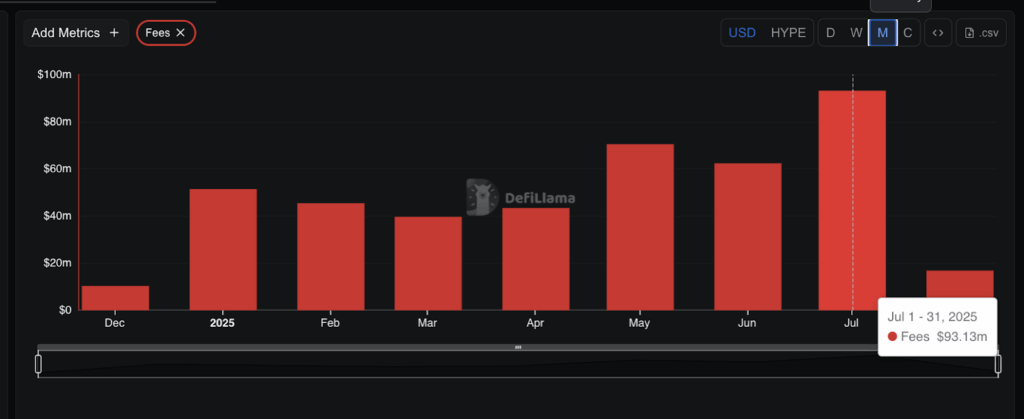

Jupiter, a Solana-based trading protocol, and Hyperliquid, a perps-focused DEX on its own chain, are surging in fees. In July, both had one of their highest fee months ever.

Jupiter earned nearly $99 million in the last 30 days, and Hyperliquid wasn’t far behind at $97 million.

This shows that users are moving toward leverage-based trading (called derivatives) rather than just spot swaps. Why? Because volatility brings opportunity. Traders love perps, and these platforms are gaining from it.

Hyperliquid’s TVL (total value locked) also spiked sharply, proving that users are not just trading; they’re trusting the platform with their capital.

Meanwhile, DEX market share is splitting. Uniswap still leads, but alternatives are gaining. Traders are looking for cheaper, faster, and more specialized platforms.

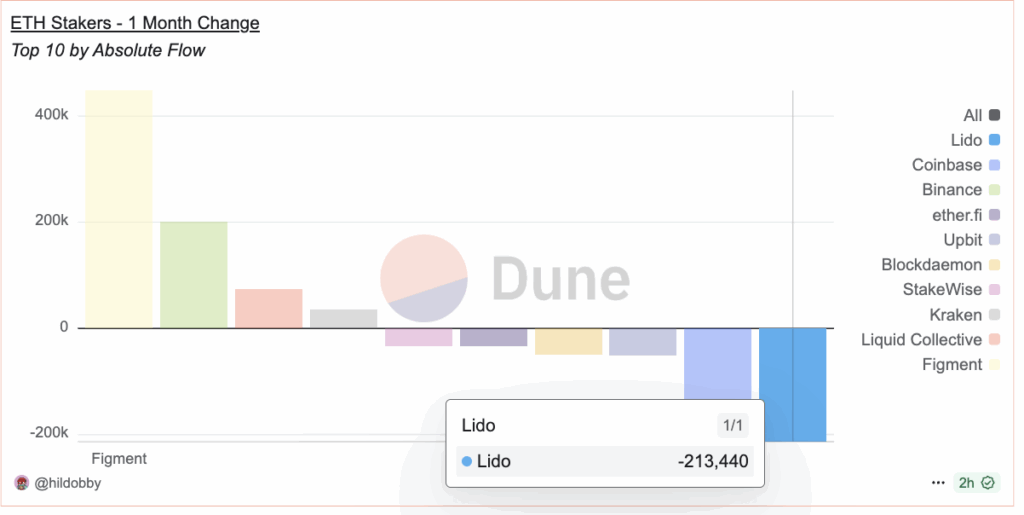

Lido and Liquid Staking Are Losing DeFi Attention

Just a year ago, Lido was a fee monster. Now, it’s sliding. Ranked #8 on the fee chart, Lido’s earnings are down to just $75.6 million in 30 days.

Why the fall?

First, Ethereum staking yields have dropped. Second, the rise of restaking and real-world yield platforms (like EtherFi and Renzo) means users have better places to park their ETH. The big DeFi money is moving where yield is higher and liquidity is better.

We also looked at the restaking TVL chart. It shows sharp growth compared to Lido’s flat or falling TVL. That means users are rotating away from simple ETH staking into newer staking narratives that offer more rewards or more utility.

The latest DeFi fee rankings make one thing clear: The game has changed. Stablecoin issuers like Tether and Circle are now leading thanks to treasury yields.

Traders are shifting to derivatives protocols like Jupiter and Hyperliquid. And liquid staking is no longer king, with Lido dropping out of the top spots.

Whether you’re a yield farmer, a trader, or just watching the space, the message is the same: follow the DeFi fees.

The post On-Chain Fees Reveal DeFi Shift to Derivatives and Treasury Yields appeared first on The Coin Republic.