The big bull market needs a bigger bubble, what stage of this cycle are we currently in?

Article source: Outside the words

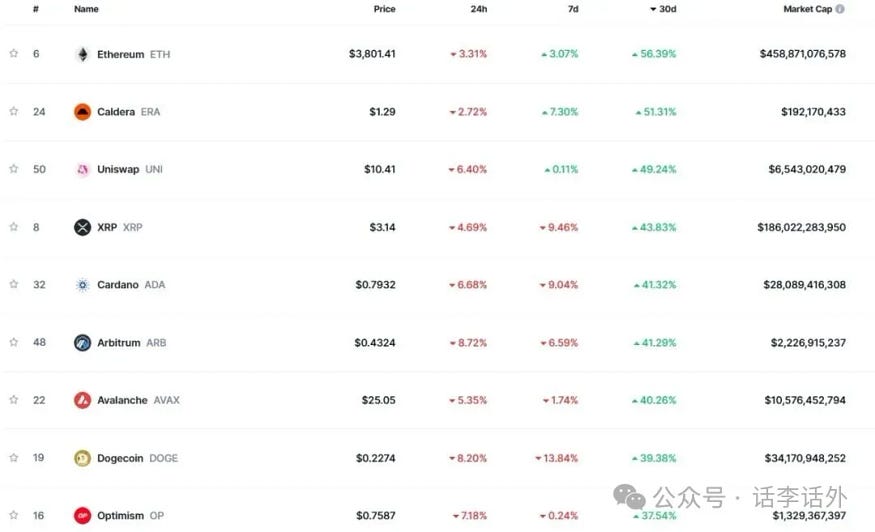

Sinceentering July, Bitcoin has continued to challenge all-time highs, and Ethereum has also risen a lot, even like XRP and ADA Such old coins have also risen by more than 40% in the past month. As shown in the figure below.

1.Where are we currently in this cycle?

With the recent recovery of market sentiment, there seems to be less voice calling for a bear market than some time ago, but some people do not want to admit that it is still a bull market, so they continue to fall into new entanglements.

Regarding the definition of bear market and bull market, different people may have different opinions, this depends on what you think, as we mentioned in the article on March 13: some people think that as long as Bitcoin falls below MA200, it is a bear market, some people think that Bitcoin falls below 50,000 is a bear market, not that the bear market will lose money, the bull market can make money, in fact, whether it is the so-called bull market or the bear market, as long as the market is still there, as long as the liquidity is still there, then the opportunity is, We must not only follow the trend, but also go against the trend.

Although the new round of phased gains since this month (July) is good, not only Bitcoin has reached a new high, but TOTAL2 has also reached a high of around $1.56 trillion, as shown in the figure below.

However, the overall market value of the altcoin has not broken the previous high, and compared with the previous two rounds of bull market cycles, I feel that the current sentiment of retail investors seems to be relatively pessimistic, and has not yet reached the state of FOMO in the big bull market, of course, this is just my personal feeling.

Looking at the period from 2023 to the present in this cycle, there have indeed been many cases of retail investors getting rich, but it seems to be mainly focused on MemeCoin, and the proportion of the overall number of people is relatively not high. In other words, the profits generated under this round of encryption cycle have not spread too far and too widely, and compared with the scale of retail wealth creation in the first two rounds, I feel that it is a little weaker.

According to a report by NewTrading, the number of global cryptocurrency users will reach 861 million by 2025. According to the latest statistics released by CoinLaw in July 2025, it is estimated that about 5.2% of adults in Chinese mainland own or use cryptocurrencies (about 5,000–60 million people), as shown in the figure below.

As of this writing, the platform has more than 22 million addresses (i.e., wallet addresses), and the cumulative number of MemeCoins created on it has exceeded 12 million, but it has only created a few hundred millionaires (wallet addresses), as shown in the figure below.

Moreover, how many of the so-called hundreds of millionaires here belong to real retail investors, and these also need to continue to be questioned.

So, what does a real bull market feel like? It's the kind of thing where everyone feels like they're about to get rich, everyone feels like making money is as simple as breathing, the market is rising every day and looks like it's full of gold, during this period, no one pays attention to and studies any fundamentals, candlesticks, or anything, all you can see is people's crazy FOMO desires.

At present, I have not really seen such a situation happen, which may mean two situations: first,

the market has completely changed, no longer operating according to the historical cyclical law, and retail investors are no longer an important part of the market.

Second, the market has not yet entered the final carnival stage, that is, we have not yet ushered in the real bull bubble stage (from the timeline, we may still be in the middle of the current cycle).

Recently, many KOLs on the Internet are inclined to say that the market will break the cyclical law and become a long bull in the future, and I will still maintain a neutral view on this matter for the time being, as we mentioned in the article on January 17th: The most important logic to break the cyclical law and enter the long bull is "change", and some of the changes we have seen so far include the continued popularity of crypto ETFs, the deep participation of more and more large institutions (such as micro-strategies), and the inclusion of Bitcoin in the national (US) strategic reserve...... Wait a minute.

But I don't think these changes are enough, that is, we don't have the foundation to enter the bull market for the time being, but in terms of Bitcoin's performance, we seem to be stepping on a key point in the changing times. My guess is that we will still follow certain existing laws in this cycle, but the time may be slightly longer, and perhaps from the next cycle onwards, we will really usher in or stand at the starting point of a new era of change.

2. The big bull market still needs a bigger bubble

We wrote about the big bull market bubble stage above, the word bubble should not be completely regarded as a derogatory term, as we mentioned in our article on July 19: because the most advanced way to play price is actually to form bubbles, and what the big bull market needs most is more bubbles. MicroStrategy has amassed more than $71 billion worth of Bitcoin with a genius play, and we have also witnessed the price of Bitcoin constantly breaking through historical highs, and if there are no new black swan events in the macro environment, then ETH and some altcoins will most likely continue to rise. Making money can be summed up as a process of embracing bubbles, enjoying bubbles, staying away from bubbles, and continuing to look forward to the next new bubble formation.

If we look at historical cycles, every bull market will give birth to a new crypto bubble, and this process will bring incredible wealth creation opportunities, but it will often have a more tragic ending. For example, after the bull market in 2021, we experienced the bubble of Terra (LUNA), which was known as the "Moutai of the currency circle" at the time. For example, after the bull market in 2017, we experienced an ICO bubble.

So far in this cycle, we haven't seen any signs of a bubble like the one above, but as more and more companies are copying the gameplay of companies such as MicroStrategy, this seems to be changing, especially as companies like SharpLink Gaming begin to shift their targets from Bitcoin to altcoins, which also makes me start to see some possible signs.

More and more companies are starting to peg their stocks to BTC/ETH and hype up, and these actions (buying) of theirs have also had a huge positive impact on the price and market sentiment of cryptocurrencies. In addition to BTC and ETH, some companies are also starting or planning to catch up and accelerate hype on other altcoins, such as: Bit Origin plans to raise $500 million to buy DOGE, Upexi plans to raise $200 million to buy SOL, and Nano Labs plans to raise $200 million to buy BNB...... Wait a minute.

It is very clear that more and more companies have run to join the hype of cryptocurrencies.

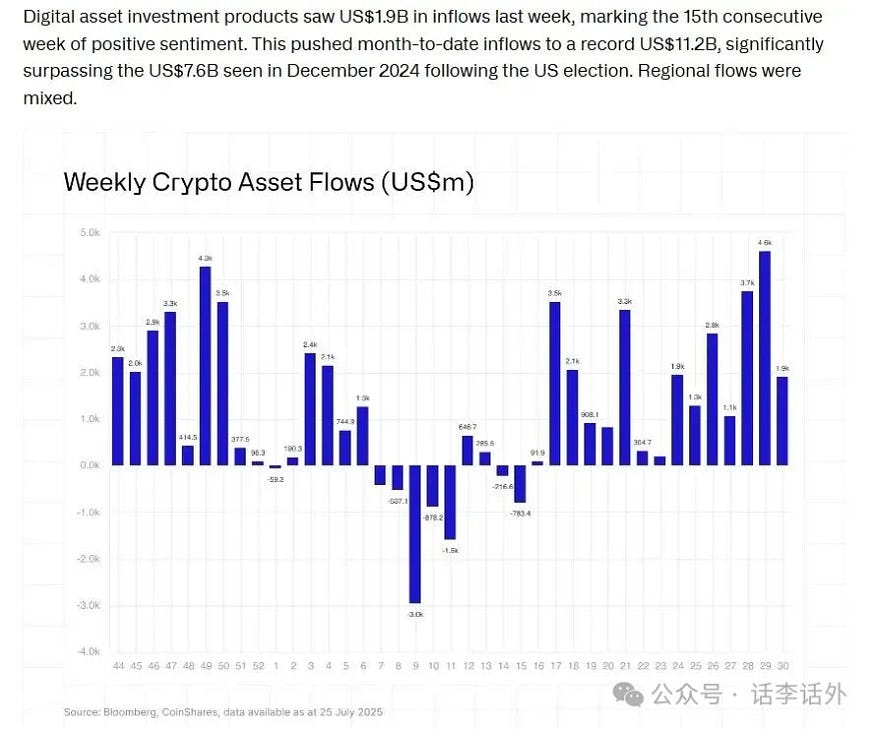

According to Coinshares, inflows since this month (July) have reached a record $11.2 billion, far exceeding the $7.6 billion in December 2024 after the U.S. election, driven by institutional investors, as shown in the chart below.

Specifically in terms of altcoins, year-to-date, ETH has seen $7.79 billion in inflows (more than the total inflows for the whole of last year), $8.43 billion in SOL, $7.21 billion in XRP, and $1.26 billion in SUI. As shown in the figure below.

However, there is another interesting phenomenon here, as some altcoins have been attracting huge inflows of funds recently, Some altcoins have seen outflows.

From this, we can also draw some conclusions (speculation): the current altcoin rally does not seem to have anything to do with people's emotions, but is mainly influenced by potential ETF expectations.

We have also talked about and mentioned the issue of altcoin ETFs several times in recent articles, such as in the July 19 article: With the passage of Bitcoin and Ethereum spot ETFs, the routes of other leading altcoin ETFs seem to have become clearer and clearer. Based on past circumstances, the fourth quarter of this year (such as around October) may become a new turning point in the history of crypto ETFs, when more altcoin ETFs may be approved, which is bound to bring more external liquidity.

The current rise seems to further highlight this potential ETF expectation, and funds may be betting or accumulating in advance on altcoins such as SOL and XRP, which are most likely to be prioritized through ETFs. In other words, this phased rise since the end of June can be called a mini-alt-type alt-season or a alt-to-do season driven by policy and ETF expectations (on the U.S. side), rather than the traditional all-round alt-of-season alt-doing.

If we continue to think about the time dimension a little longer, then we can also draw a conclusion (guess): this is only the early stage of more institutions running to join the army of hype cryptocurrencies, or the early stage of the formation of the big bubble in this cycle.

Whether it's MicroStrategy, which has already built up on BTC, SharpLink Gaming, which is now raising $5 billion to continue buying more ETH, or other institutions that are currently and may continue to hype potential ETF altcoins, they are creating a new huge cyclical bubble for us with cryptocurrencies.

From a short- to medium-term perspective, the crazy behavior of institutions is bound to continue to push up the prices of some cryptocurrencies, and even push the prices of some coins to a level that makes retail investors feel crazy; In the long run, as this bubble goes crazy rapidly, it is bound to burst in stages like those bubbles in historical cycles.

And if our above view (speculation) is true, then we can continue to give a new guess: in the second half of this year, we will continue to experience greater volatility, but all fluctuations are for better washing and hype, and in the fourth quarter of this year, the market may once again have the opportunity to shock retail investors, and may bring new large-scale FOMO emotions.

After all, this crazy behavior of institutions ultimately needs to be taken over by Everbright retail investors, and of course, there will be some institutions to take over when the final bubble bursts. In this market, the ultimate big winners can only be a few.

We are already in this game, we have seen a potential bubble, and I can't say exactly when the game will end this time, but we might as well keep an eye on it from the following angles:

- Which companies will buy a lot of accumulated crypto in the coming weeks or even months, and what exactly will they buy?

- Will the changes inthe market capitalization of these companies' shares continue to be played at a premium?

The process of bubble inflation to instant burst is often the most beautiful moment of the bubble, and the opportunity is always reserved for those who have enough patience and firm faith, since we have been sticking to this cycle for more than 4 years (2022–2025), then, look forward to it and enjoy the short beauty of the last round of this cycle.