From bearish to over-raised 25 times, Circle's IPO reversed

一个月前,社交媒体上有关稳定币发行商 Circle 讨论最多的话题,还是「40 亿美元卖给 Coinbase 或 XRP」的传闻。4 月初 Circle 发布招股书后,业内对其市占率下滑、毛利率偏低、盈利渠道单一的质疑声不绝于耳。圈内投资者普遍认为,Circle 时隔多年重新启动的 IPO 计划可能难以打动市场。

然而资金对稳定币概念的热度彻底超出了加密从业者们的预期:Circle 以每股 31 美元完成上市,估值达到 69 亿美元,超额认购倍数高达 25 倍,成为加密行业近年最受关注的 IPO。是什么让市场态度发生如此剧烈反转?Circle 的基本面真的改善了,还是市场正在经历一次关于稳定币叙事的「情绪重估」?

两个月,市场预期大逆转

今年 4 月左右,当稳定币发行商 Circle 重启 IPO 计划时,市场普遍态度谨慎甚至偏空。不少分析指出 Circle 的业务存在结构性瓶颈,如收入过于依赖 USDC 储备利息、毛利率过低、营收增长后劲不足等。

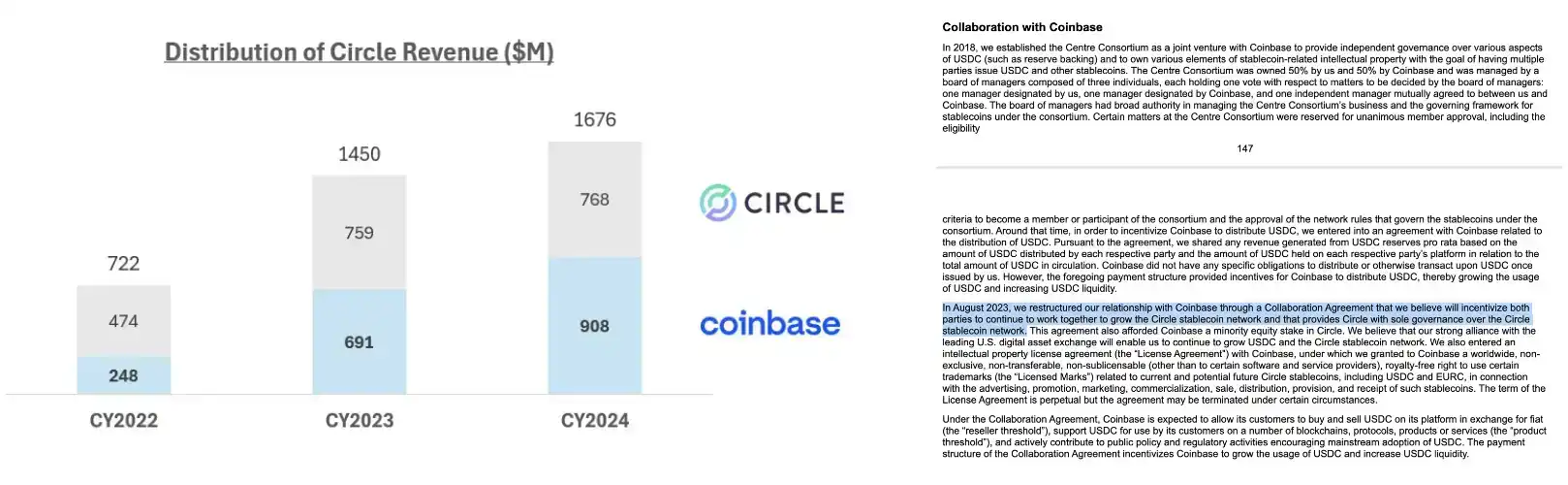

根据 Circle 招股书,其 2024 财年收入约 16.7 亿美元,同比增长 16%,但净利润从 2023 年的 2.676 亿美元骤降至 1.557 亿美元,降幅达 41.8%。一方面,USDC 带来的利息收益属于顺周期红利,一旦美联储进入降息周期,Circle 储备收益将系统性下降。另一方面,Circle 为推广 USDC 付出了高昂成本,尤其是支付给 Coinbase50% 的分销成本,导致其毛利率极低。据统计,Circle 毛利率已从 2022 年的 62.8% 迅速下降到 2024 年的 39.7%。

Circle 招股书中对 Coinbase 分润条款的详细描述

简言之,不少投资者质疑:Circle 盈利模式过于单一且脆弱,缺乏长期看点。

与此同时,市场还流传着关于 Circle 的出售传闻。5 月 Cointelegraph 报道称,包括 Ripple、Coinbase...