After the launch of Binance Alpha, the currency price skyrocketed, how many rat warehouses does USELESS have?

Written by Alex Liu, Foresight News

On the morning of July 28, Binance Alpha announced the launch of USELESS, and its BSC chain token rose above 0.6 USDT in a short period of time, an increase of more than 50%. Behind the carnival, what is the risk behind it? Is USELESS a high-control token, and is the chip structure healthy?

Onchain analytics account Onchainmetrics recently published a long article analyzing on-chain data around USELESS to respond to questions about "Bonk Cabal (cabal) controls all chips", and presented the project's true distribution structure and internal wallet behavior through on-chain tracking.

What is a "rat barn"? — Early buyer portrait

The term "Insider" in Onchainmetrics' analysis refers to addresses that completed purchases within the first two hours of USELESS's launch, during the project's market capitalization of $15–300,000. This criterion will not only include project insiders, but may also include some "lucky early bird" users.

Based on this analysis, a total of 18 Insider wallets and more than 300 "Insider Descendants" (associated sub-wallets) were identified, forming the core sample of this tracking.

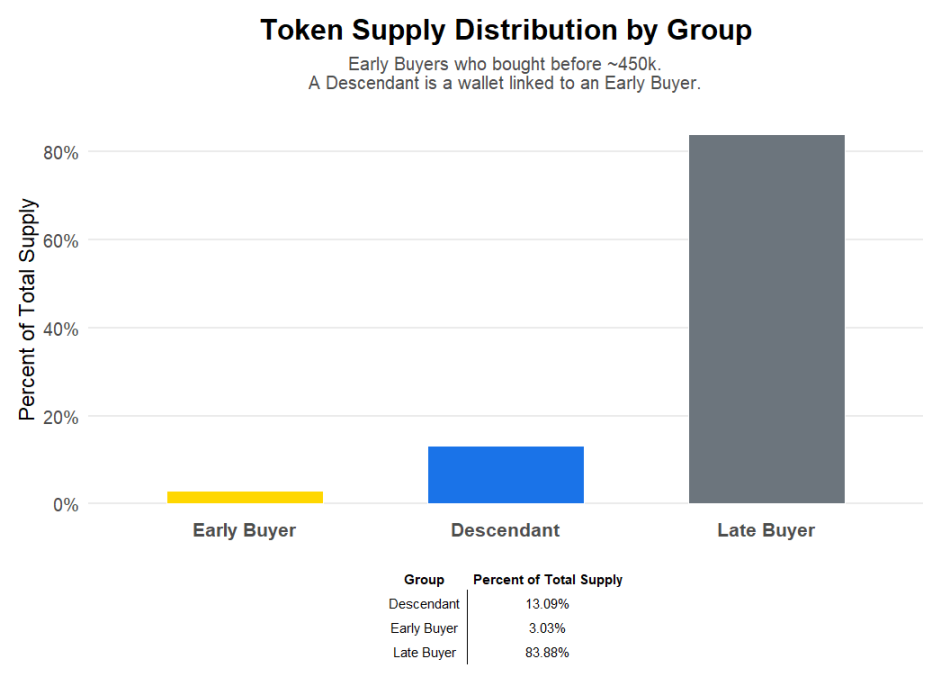

Distribution: Proportion of Insiders and retail investors

According to statistics, 18 Insiders and their sub-wallets currently hold a total of 16.12% of the total supply of USELESS, while late-stage buyers (a total of about 25,000 addresses) hold the remaining 83.88%.

This also means that although there are indeed "rat warehouses" holding large positions in the early days, there is no concentration phenomenon of "Bonk Cabal controlling all chips", and the statement of "absolute monopoly supply" is not valid.

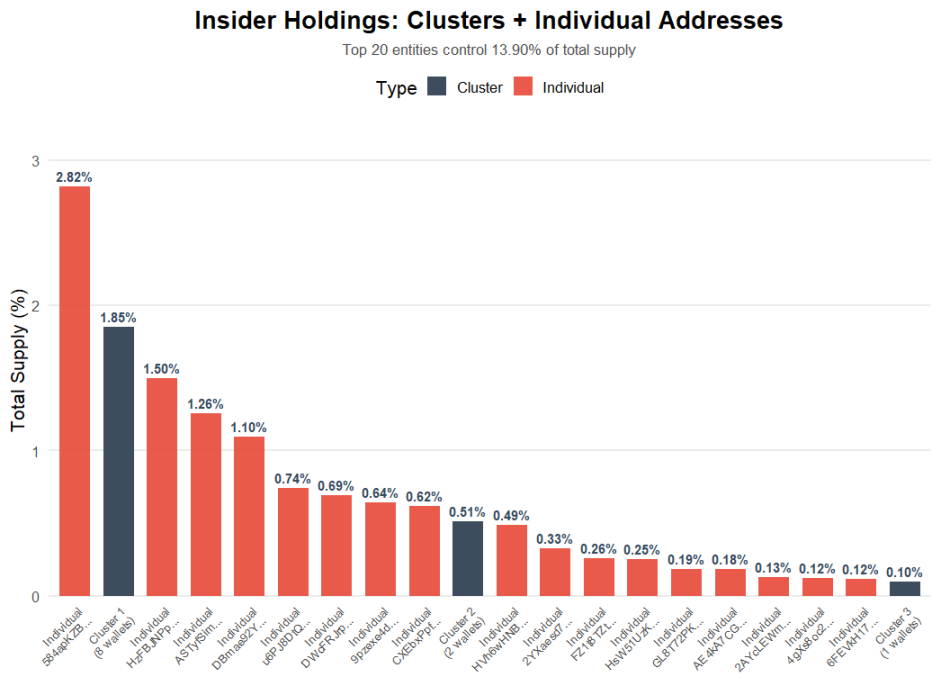

Rat warehouse structure: large households are more individuals

After further analyzing the network structure of these Insider wallets, all bot and smart contract addresses were removed, and multiple "rat warehouse clusters" with funds linked to each other were identified.

It's important to note that most heavyweight Insider wallets are not part of a cluster but are held by individuals. The largest single Insider wallet currently holds 2.82% of the supply, while the largest cluster holds 1.85%. This suggests that the current chips are mainly concentrated in a few individuals rather than organized groups.

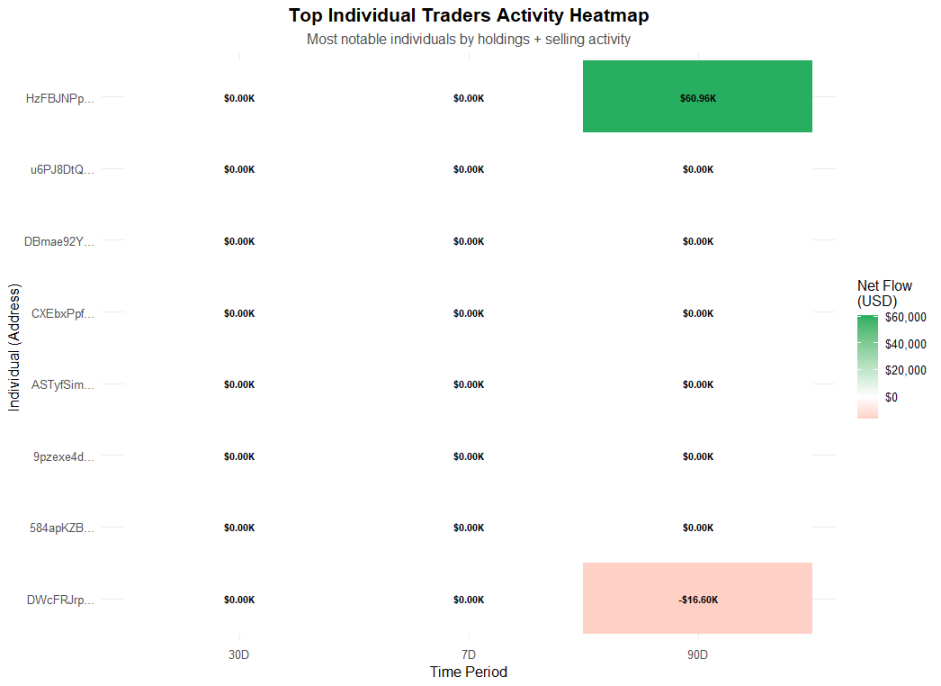

The vast majority of rat warehouses choose to "hold" or continue to buy

Onchainmetrics has constructed a comprehensive evaluation formula that selects the 8 most representative Insider wallets based on their holdings, historical holdings, selling behavior, etc., and conducts a visual analysis of their transaction behavior.

The results showed that almost all of these 8 wallets were in a state of "continuing to hold or increase their positions", and only 1 wallet showed obvious selling behavior. Considering that the asset size of these wallets generally reaches seven figures or even higher, the collective choice to "hold" is particularly conspicuous, which also reflects their optimism about the market outlook.

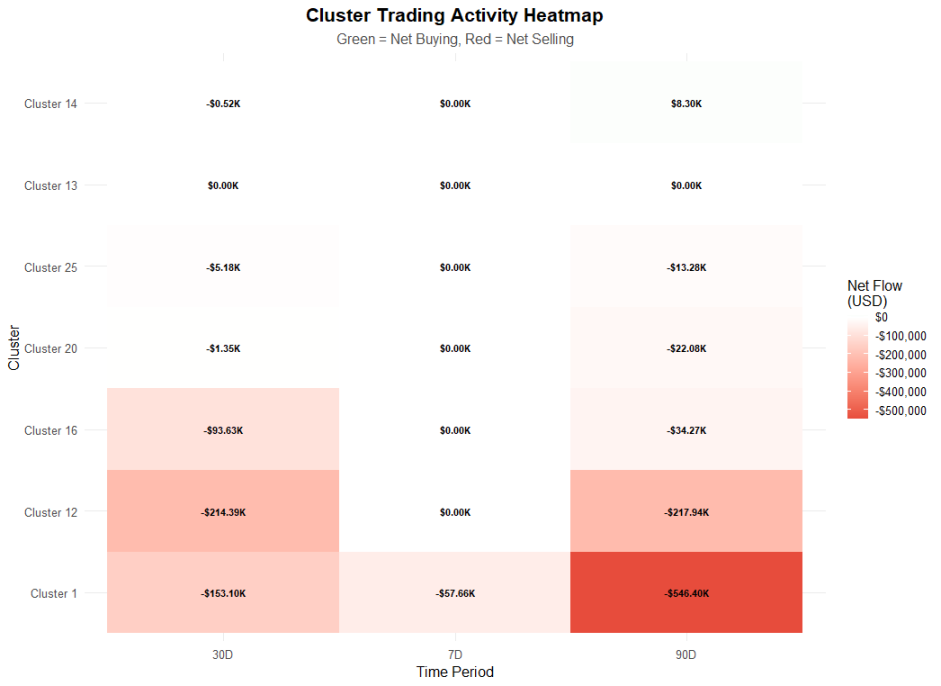

Insider cluster behavior: Individual clusters are still shipping

Unlike individual behavior, the Insider cluster as a whole is in the "gradual distribution" phase. Currently, liquidity mainly comes from two clusters: Cluster 1 (Cluster 1) has 1.9% of the remaining tokens and Cluster 12 has 0.53% left. Other clusters have either completed distribution or are still in silent holding.

Conclusion: Is it the "healthiest chip"?

Although USELESS's token distribution structure is not perfectly "decentralized", it is more decentralized than many projects overall. This trend of low selling pressure after a 1000x increase is unusual by conventional project measurement.

Most of the current selling pressure mainly comes from a few clusters holding about 2.5%, while core investors choose to continue to "hold" or even increase their positions, and on-chain analysis agency Onchainmetrics concluded: "They want higher prices."