Here's every >$1m liquidity pool on @Plasma across all its dapps 👇

Plasma has achieved $14b from just 10 dapps in 3 days:

1. @aave ($4.5b) largest liquidity lending protocol

2. @Plasma ($3b) savings vault, redeposited into Aave through Veda's vault infra

3. @veda_labs ($2.8b) infra for compliant, risk-adjusted onchain yield products and vaults

4. @0xfluid ($474m) unified liquidity layer with lending markets and a capital-efficient DEX

5. @eulerfinance ($256m) modular lending with isolated permissionless vaults and markets

6. @Balancer ($179m) DEX with automated portfolio management

7. @uniswap ($39m) leading liquidity pool DEX

8. @term_labs ($38m) Fixed-rate, fixed-term lending protocol

9. @curve ($28m) leading stablecoin and pegged asset DEX

10. @GearboxProtocol ($7.6m) modular leverage protocol with margin trading and leveraged farming

Ofc, savvy readers of my recent @DefiLlama post ( will see that Plasma's TVL ranges from $5.5b to $14b depending on whether you count vaults and borrowing

The main asset across these dapps is about $5.4B in @ethena_labs USDe and @Tether_to $USDT routed through @LayerZero_Core (

@Plasma aims to be the go-to chain for payments through gasless USDT transfers

It's important for any chain to understand how @PlasmaFDN achieved this growth and where it's TVL is distributed

Read on for the full TVL figures per dapp 🧵👇

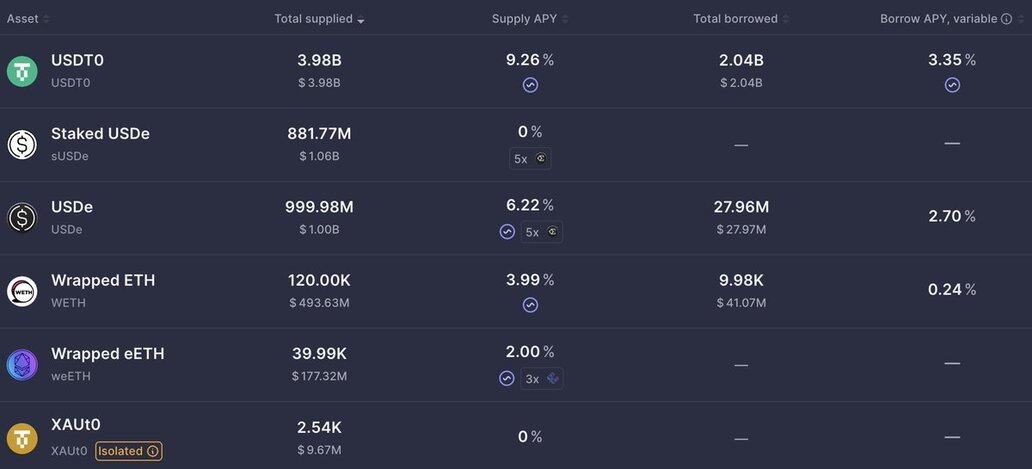

Plasma on @aave 9/29

- $USDT $3.98b

- $sUSDe $1.06b

- $USDe $1.00b

- $WETH $493.63m

- $weETH $88.68m

- $XAUt0 $9.62m

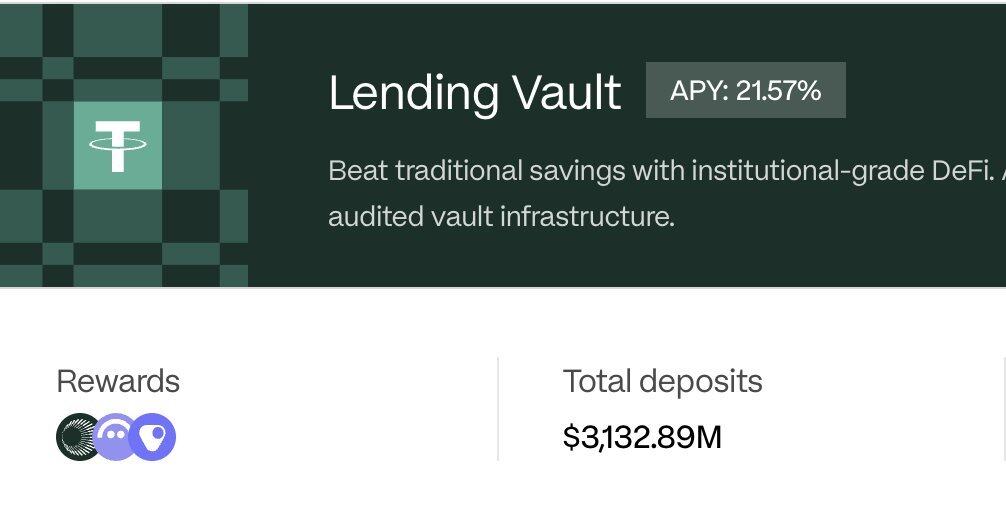

Plasma's Saving Vault powered by @veda_labs

- $USDT0 $3.132b

Plasma on @0xfluid

- $USDT0 $466m

- $USDe $32m

- $ETH $30m

Plasma on @eulerfinance

- $USDT0 into @USDai_Official $120m

- $USDT0 into @ethena_labs $95m

- $USDai into @USDai_Official $59m

- $xUSD into @TelosConsilium $58m

- $USDT0 into @TelosConsilium $50m

- $sUSDe into @ethena_labs $35m

- $USDT0 into @ResolvLabs wstUSR $11.74m

- $USDT0 into @ResolvLabs RLP $5.99m

- $sUSDai into $4.1m

- $USDT0 into @maplefinance $4m

- $RLP into @ResolvLabs RLP $3.45m

- $wstUSR into @ResolvLabs wstUSR $2.98m

- $USDT0 into @EtherFi $2.55m

- $WETH into @EtherFi $1.46m

- $syrupUSDT into @maplefinance $1.45m

4.31K

9

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.