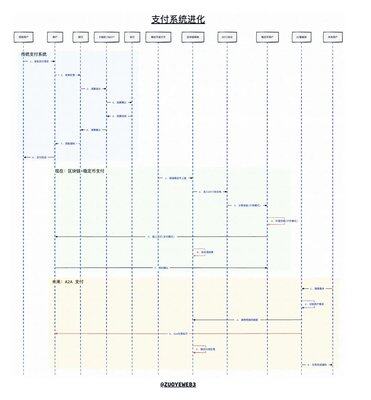

Stablecoin on-chain payments, clearing Web2 thinking In 2008, under the shadow of the financial crisis, Bitcoin attracted the first batch of ordinary users disappointed with the fiat currency system, stepping out of the niche community of crypto punks. At the same time, the term FinTech began to gain popularity around 2008, almost concurrently with Bitcoin, which may be coincidental. It could be even more coincidental; in 2013, the first bull market for Bitcoin arrived, with prices breaking through $1,000, and #FinTech also began to mainstream. At that time, the once-glorious Wirecard and P2P later fell, while Yu'ebao defined the yield system of the internet era, and Twitter founder Jack's new payment solution Square was valued at over $6 billion. This was not artificially manufactured; since 1971, the growth rates of gold prices and U.S. Treasury debt have been almost synchronized at 8.8% vs. 8.7%. After the gold dollar came the petrodollar; could the new energy dollar be...

Show original

16.95K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.