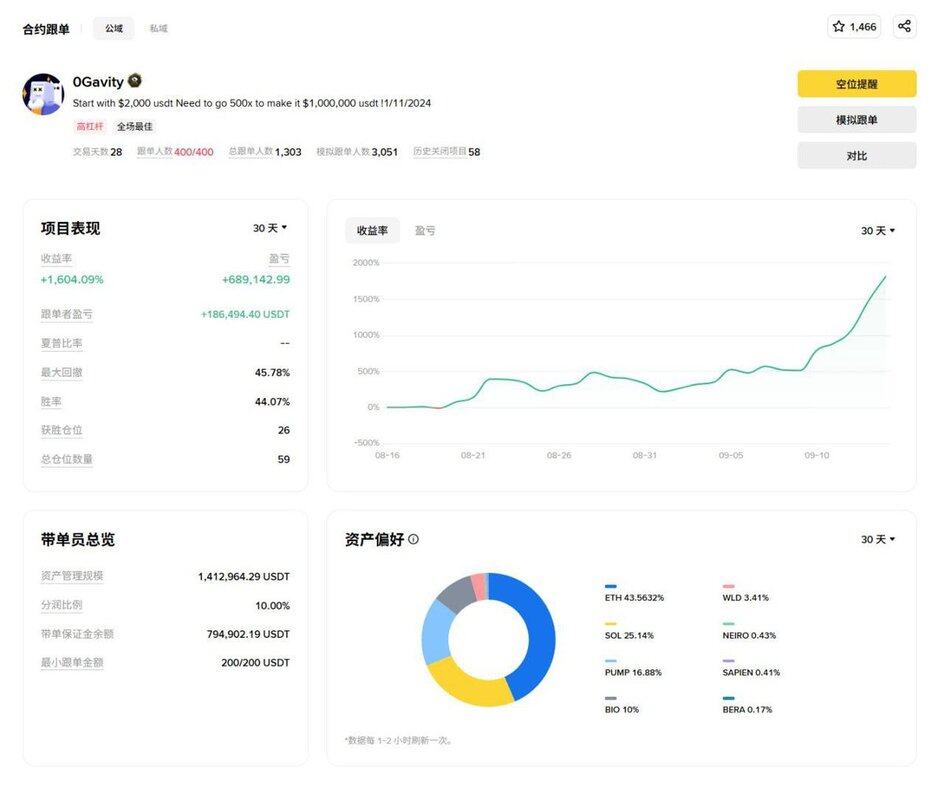

OGavity | 30 Days of Trading Analysis (Copy Trading Perspective) #币安实盘聪明钱 Trading Style: Primarily trend/momentum, capturing "market acceleration phases." Win rate 44%, but with a high risk-reward ratio, relying on a few large trades for profits; maximum drawdown 45.8% → strong momentum, high volatility. Positioning and Rhythm: Not holding many positions at the same time (total positions 59, currently held 26), concentrated positions + incremental adjustments; the curve has significantly increased volume since mid-September, leaning towards "post-breakout follow-up," and will "hold for a while" when profitable. Asset Preferences (Last 30 Days): Core: ETH 43.6%, SOL 25.1% (mainstream trend positions) Offensive: PUMP 16.9%, BIO 10%, WLD 3.4% (thematic/emotional targets, entering during small-cap rallies) The remaining NEIRO/SAPIEN/BERA have a very small proportion, used for experimental layouts. Risk Metric: Able to withstand drawdowns for explosive gains (1604% return corresponding...

Show original

36.2K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.