Bitcoin’s transformation is underway from a digital gold store of value into a yield-producing asset.

Despite a $2T+ market cap, less than 1% of BTC is being used in DeFi, highlighting an enormous untapped opportunity. Remaining liquidity suggests Bitcoin could power a significant portion of future on-chain capital flows.

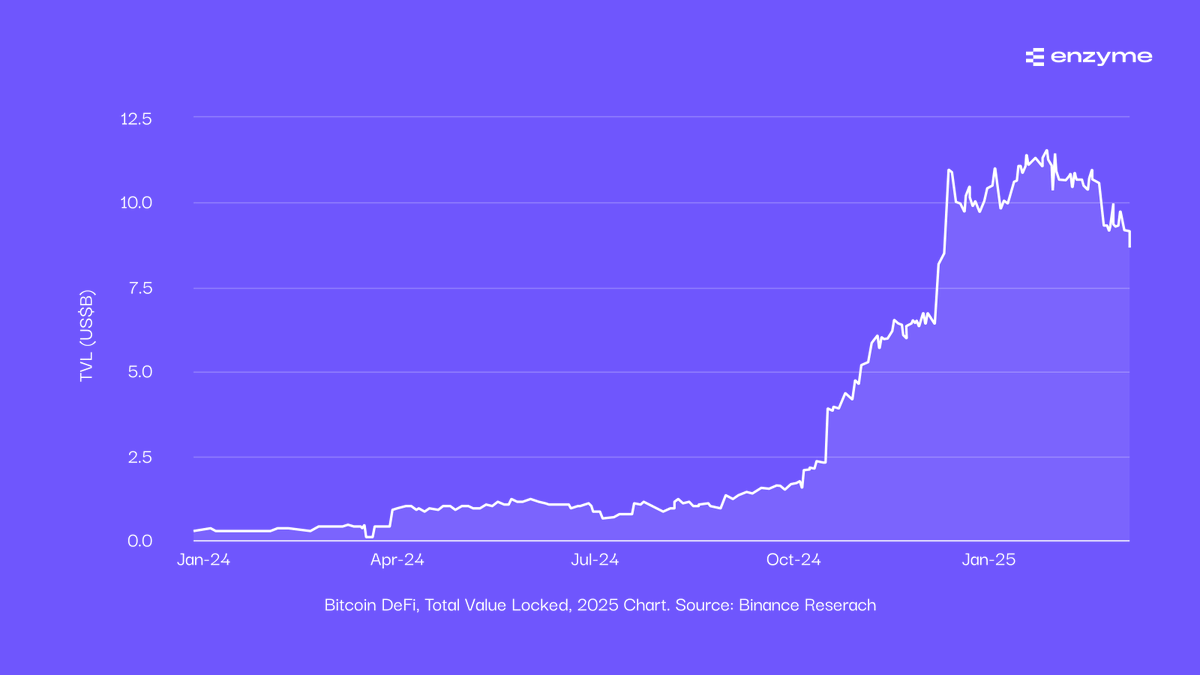

Meanwhile, the Bitcoin DeFi ecosystem is growing fast. Total value locked has jumped over 2,700% year-over-year, with around $5-6 billion of BTC currently locked in DeFi protocols.

These figures signal that holders are looking for ways to actively put Bitcoin to work, not just HODL it. As BTC earns yield across liquid staking, lending, and structured products, it’s becoming an instrument of capital efficiency.

Enzyme lets you activate your BTC in custom Vaults whether it’s to sell options, provide liquidity, or manage treasury yield strategies, all with transparent, programmable infrastructure.

Let’s talk:

Show original

1.55K

7

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.