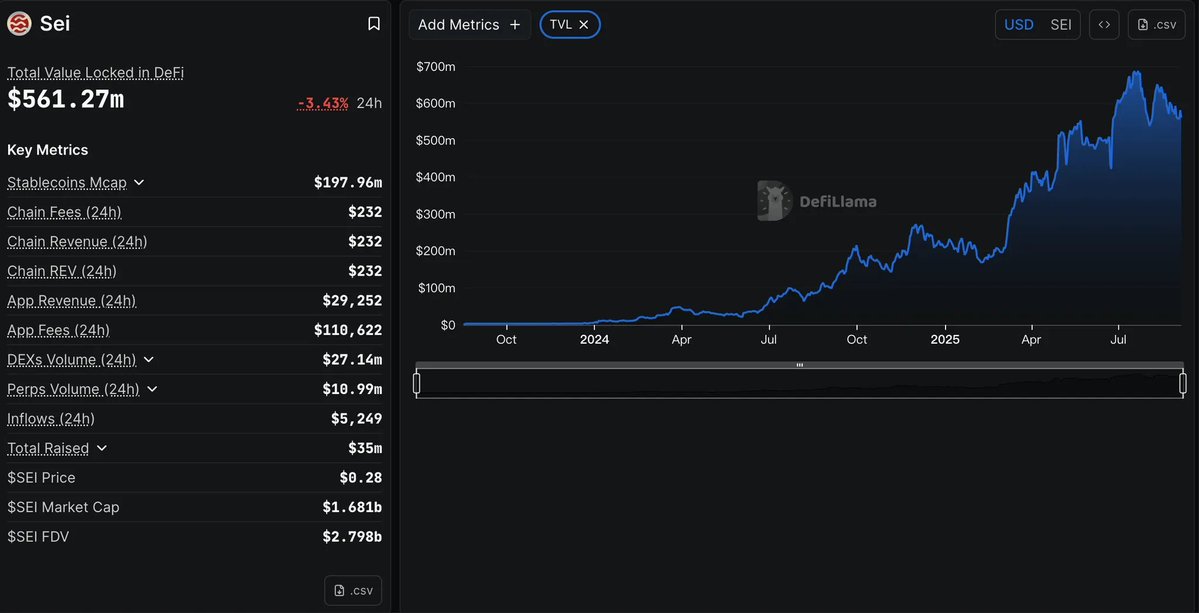

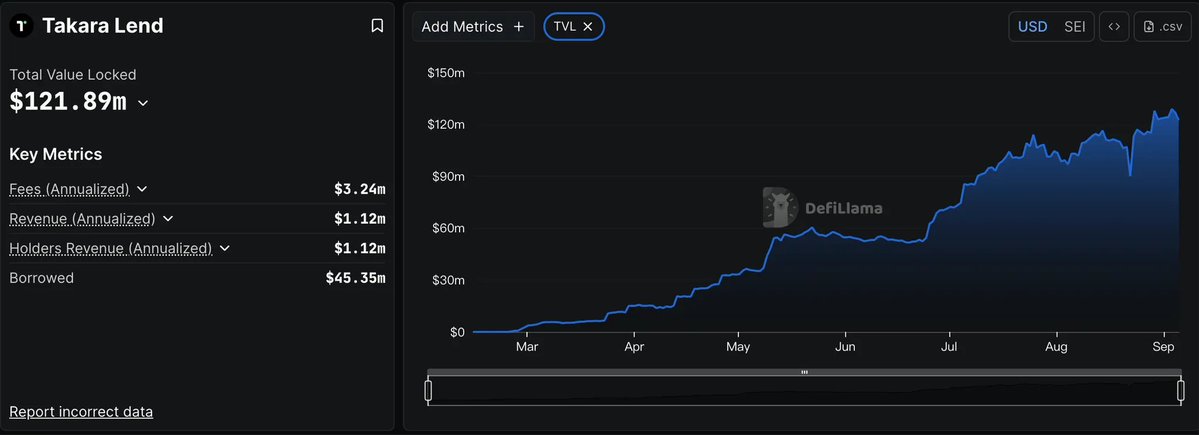

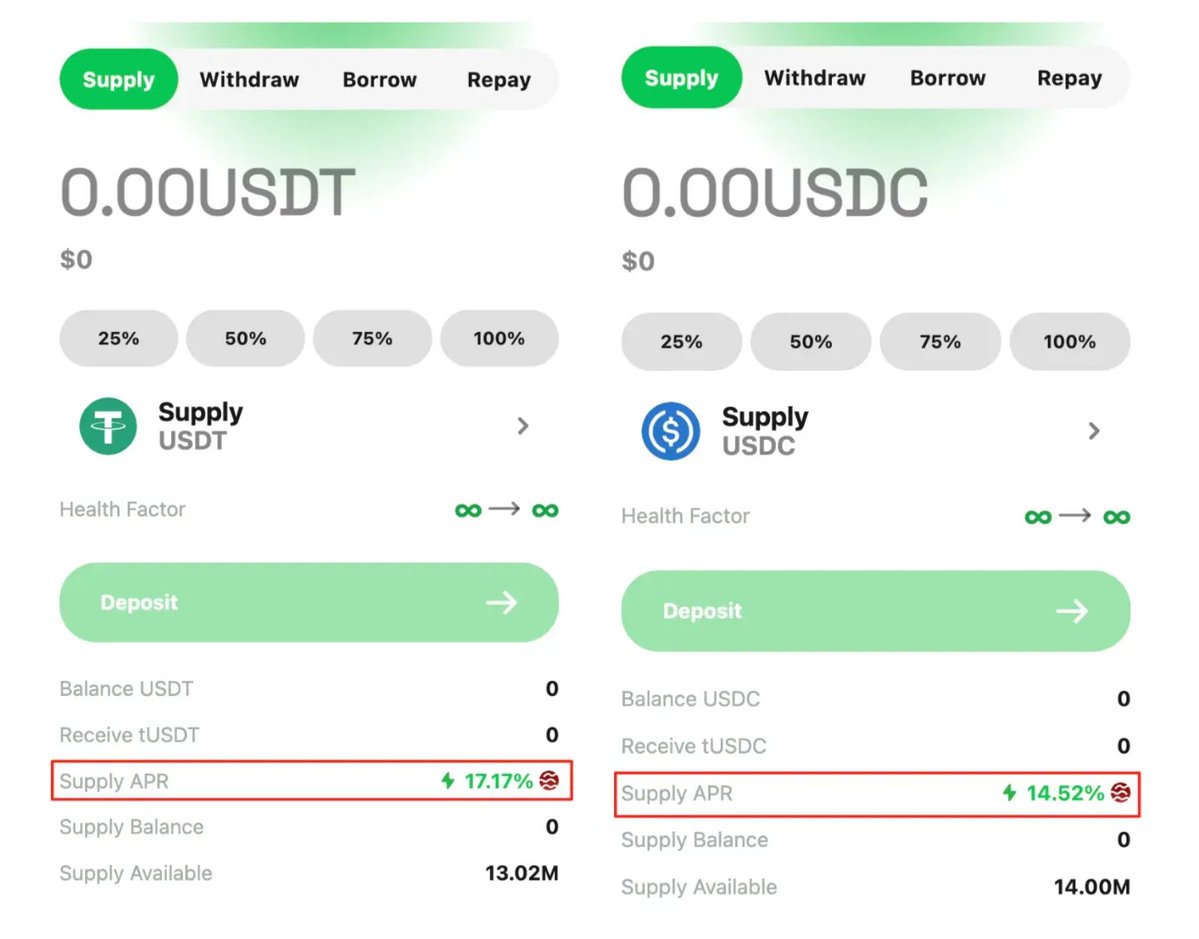

"The High-Growth Machine on Sei: Takara" Recently, I've seen many bloggers discussing Sei on Twitter, and I just started learning to look at on-chain DeFi data, discovering that Sei's DeFi volume continues to rise in 2025. According to the current data from Defilama, Sei's TVL is around $560 million, with a stablecoin circulation of nearly $200 million, and the 24-hour DEX trading volume remains around $27 million. This means that, on one hand, there is a sufficient "ammunition pool" available for collateral and borrowing on the Sei chain; on the other hand, continuous spot trading and matching depth provide the necessary liquidity environment for liquidation, hedging, and cyclical strategy execution. In other words, Sei's volume and turnover are providing a sustainable operational soil for the "lending—credit—payment" progression chain. My personal impression of Sei is their substantial subsidies in the DeFi ecosystem this year, which can be described as very generous. Among...

Show original

7.25K

12

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.