DAT raises vs Market Cap is the cleanest forward indicator nobody is trading.

When a project raises capital, that cash isn’t theoretical. It’s new balance sheet strength, new liquidity, and new buyers committed at size.

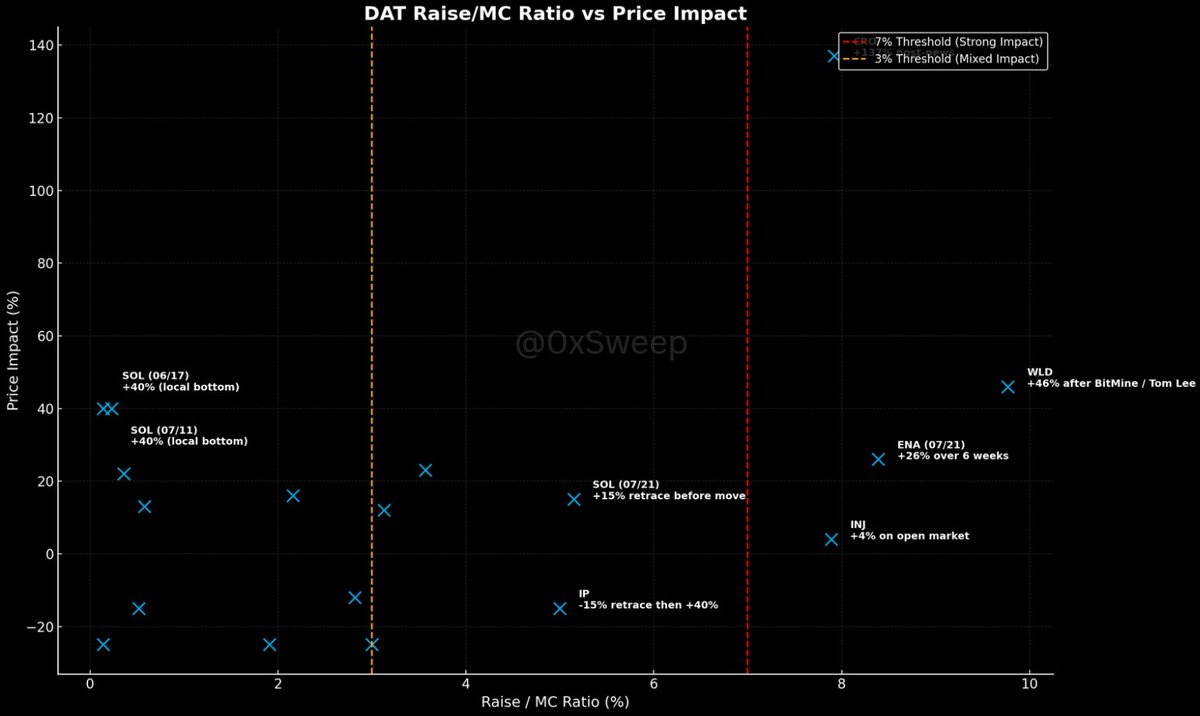

The impact scales with the raise relative to circulating market cap (Raise/MC ratio). That’s why it consistently moves price.

Cheat sheet:

≥7% Raise/MC → structural multi week trend ( $WLD +46%, $ENA +26%, $CRO +137%)

3–6% → volatile, works best on retraces ( $SOL, $TRX)

<2% → mostly noise, at best sets local bottoms

Playbook:

Track new raises as they’re announced

Wait for the 10–20% post news retrace (liquidity shakeout)

Hold 4–8 weeks → target +30–50% returns

It’s flows which have been the biggest catalyst of this cycle. Capital deployment sets the breakouts.

Right now $CRO, $WLD, $ENA are showing it.

The next ≥7% Raise/MC is the highest conviction trade you’ll see.

Show original

14.64K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.