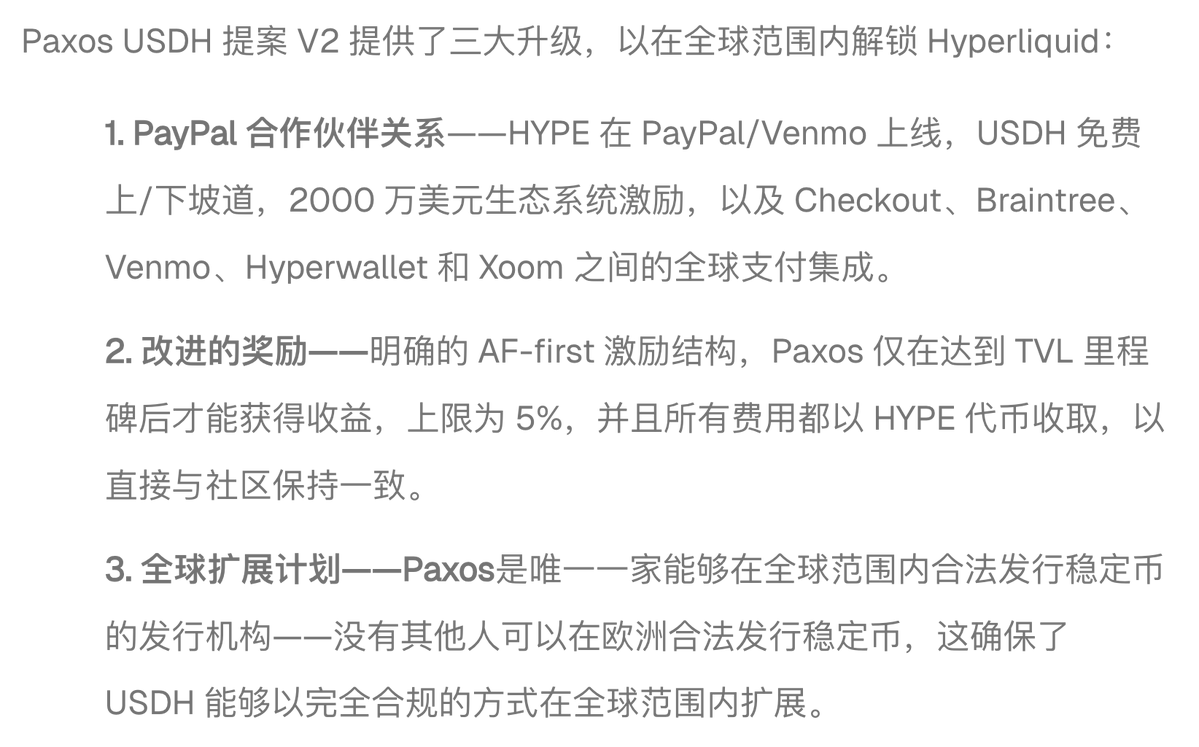

As soon as he finished combing it, Wang Bomb came! Paxos has just formed a bidding alliance with global payments software PayPal to publish a new proposal:

· Facilitate the listing of HYPE tokens on PayPal and Venmo.

· USDH stablecoin is fully integrated into PayPal, covering all supported countries, and supports 0-fee fiat currency deposits and withdrawals.

· The plan is based on USDH to create on-chain interest and liquidity products.

· 100% of the initial revenue will be used for Hype construction, including 20% of it allocated to the Community Assistance Fund for buying back HYPE, and the remaining 80% for ecological incentives, Paxos does not collect money at this stage.

· Only after the subsequent TVL increase, Paxos will take up to 5% of the share, which will be denominated and rewarded in HYPE tokens.

At the same time, Paxos added that none of the current USDH issuance bidders are qualified to issue stablecoins in Europe, but only I can.

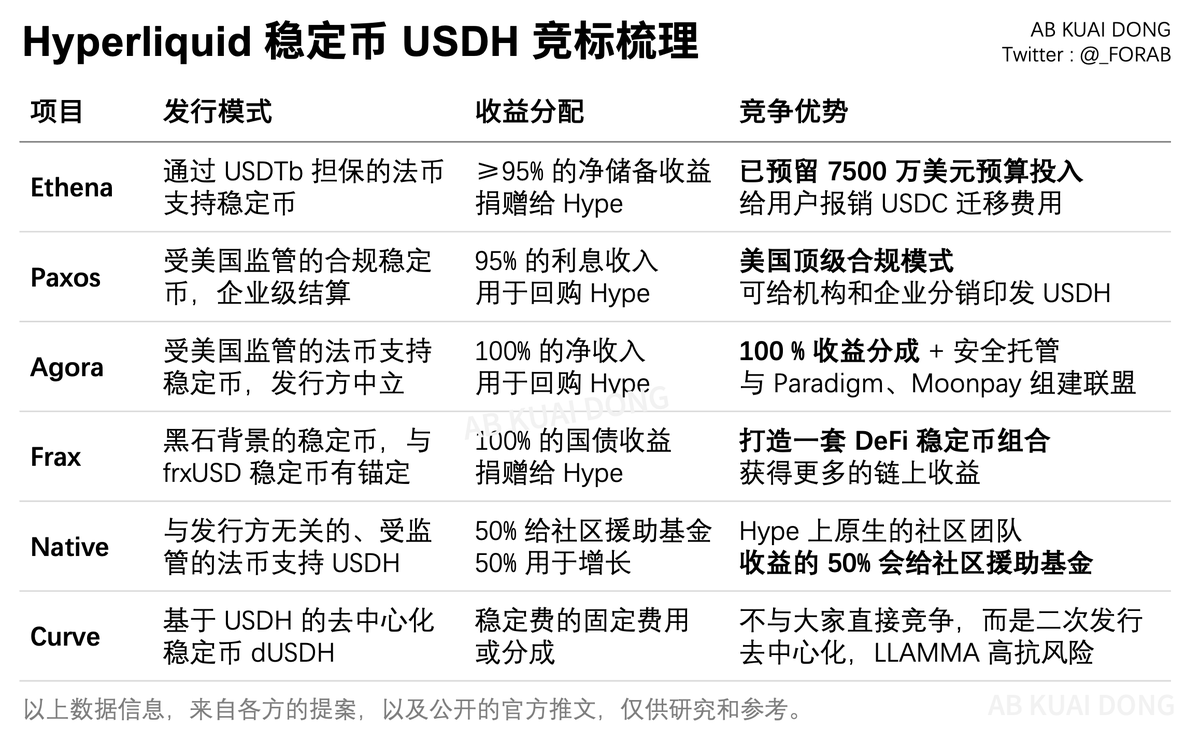

Today is the day when the Hyperliquid stablecoin USDH closes bidding proposals, and there are currently more than 10 companies that have publicly announced their participation in the bidding.

The community also speculates that Hype is to reduce its dependence on USDC and Coinbase, ensure that the initiative is in its own hands, and maximize the benefits of the community.

Participating are:

Ethena: A stablecoin guaranteed by USDTb, 95% of the reserve income is donated to the Hype project and users are reimbursed for migration costs from USDC.

Paxos: U.S.-compliant stablecoin, enterprise-grade settlement and auditing, 95% interest income for HYPE token buybacks and ecological distribution, currently predicted by the community to lead the way, helping Hype expand the U.S. market.

Agora: Formed a bidding alliance with Paradigm, Moonpay, etc., 100% of the net income, returned to Hype officials, used to buy back HYPE tokens, and provided a full set of fiat currency deposit and withdrawal solutions, and the community predicted that it would lead.

Frax: Anchored based on frxUSD, backed by high-quality bonds such as Blackstone's BUIDL fund, providing stable income, 100% of net income is fully returned to Hype officials, and a combination that seamlessly converts with USDT and USDC.

Native Markets: Proposed by the Hype native community, HYPE MicroStrategy representatives, it emphasizes cooperation in deposits and withdrawals, and should give income to community assistance funds and long-term growth for stablecoin issuance, rather than taking it all back.

Curve: Knowing that I can't beat everyone, I hope to collateralize the issuance of on-chain stablecoin dUSDH based on USDH, and then obtain fixed income and share of the stablecoin.

Circle: Although I did not participate in this bidding, I issued a statement saying that I have done a lot for Hype, shedding tears and blood for the party and the country, emphasizing that my USDC is never comparable to other companies in terms of deep liquidity and cross-chain swaps, but I still didn't mention so much income, how to give dividends or buy back HYPE tokens to everyone.

126.11K

280

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.