Hyperliquid has done it so fucking well.

Tip my hat to them.

Hyperliquid has now entered the stablecoin wars.

We have multiple proposals from Paxos and Agora seeking to provide institutional-grade infrastructure and Genius Act compliance, sharing 95% and 100% of the revenue generated from USDH back to the assistance fund respectively.

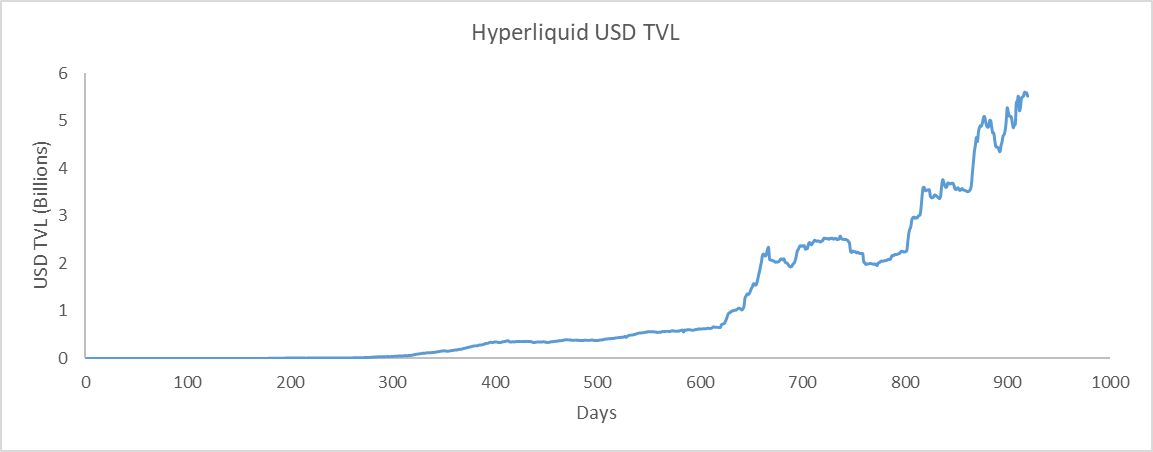

The amount of deposited USDC eclipses $5Bn, and I do not expect this to slow down as Hyperliquid scales to offer more markets on-chain via HIP-3 Dutch auctions, making traditional markets like indices, commodities, and equities available to on-chain users.

The DEX will soon direct 99% of all protocol revenue to buybacks, and now 95-100% of the revenue generated from USDH will be directed to buybacks of HYPE.

Why is Hyperliquid dominating the world of on-chain finance? Because the team does not suffer from token/equity value bifurcation. The cash flows directed to the token attract die-hard holders, institutional interests via DATs, and a whole new wave of builders fighting to make the ecosystem better.

Simply put, everyone wants to trade where the flows are, and those flows have the best liquidity and value accrual flywheel in the world. Yes, in the world. There is simply no other company doing this in crypto or outside of crypto.

I hope this bullish post is sufficient.

Hyperliquid

$HYPE

839

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.