Chaos is a ladder, looking forward to the replay of the L2/L3 story of stablecoin public chains!

In the context of a future lacking innovative breakthroughs and a stablecoin market poised for a bull market, major stablecoin protocols are beginning to build their own public chains, essentially migrating the real transaction revenue that originally belonged to Ethereum or other stablecoin public chains into their own ecosystems.

🤔 So, will a situation similar to L2/L3 offloading Ethereum occur again after stablecoins build their own public chains?

The answer seems likely to be yes.

After all, stablecoins are the cornerstone of DeFi, and their migration also signifies the migration of DeFi.

Excerpt from a rhythmic article:

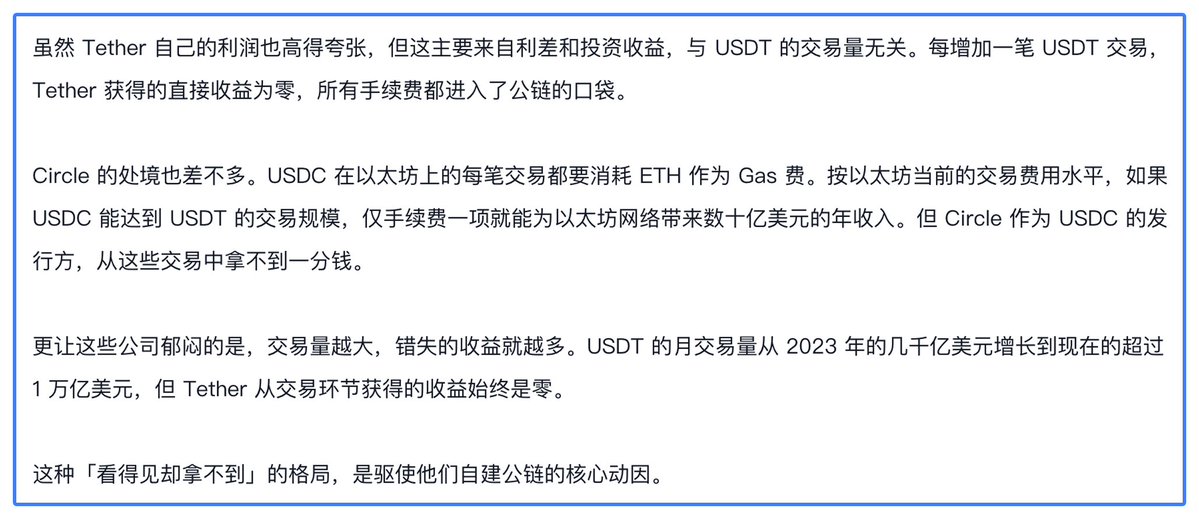

Although Tether's own profits are also exaggeratedly high, this mainly comes from interest rate spreads and investment returns, unrelated to the trading volume of USDT. For every additional USDT transaction, Tether's direct revenue is zero, as all transaction fees go into the pockets of the public chain.

Circle's situation is similar. Every transaction of USDC on Ethereum consumes ETH as gas fees. At the current transaction fee level on Ethereum, if USDC could reach the trading scale of USDT, just the transaction fees alone could bring tens of billions of dollars in annual revenue to the Ethereum network. However, Circle, as the issuer of USDC, receives not a penny from these transactions.

What frustrates these companies even more is that the larger the trading volume, the more missed revenue they incur. The monthly trading volume of USDT has grown from several hundred billion dollars in 2023 to now over one trillion dollars, yet Tether's revenue from trading remains zero.

This "visible yet unattainable" pattern is the core driving force behind their decision to build their own public chains.

4.86K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.