Stripe's Tempo: Bullish or bearish for $ETH? 🤔

1 Current Picture

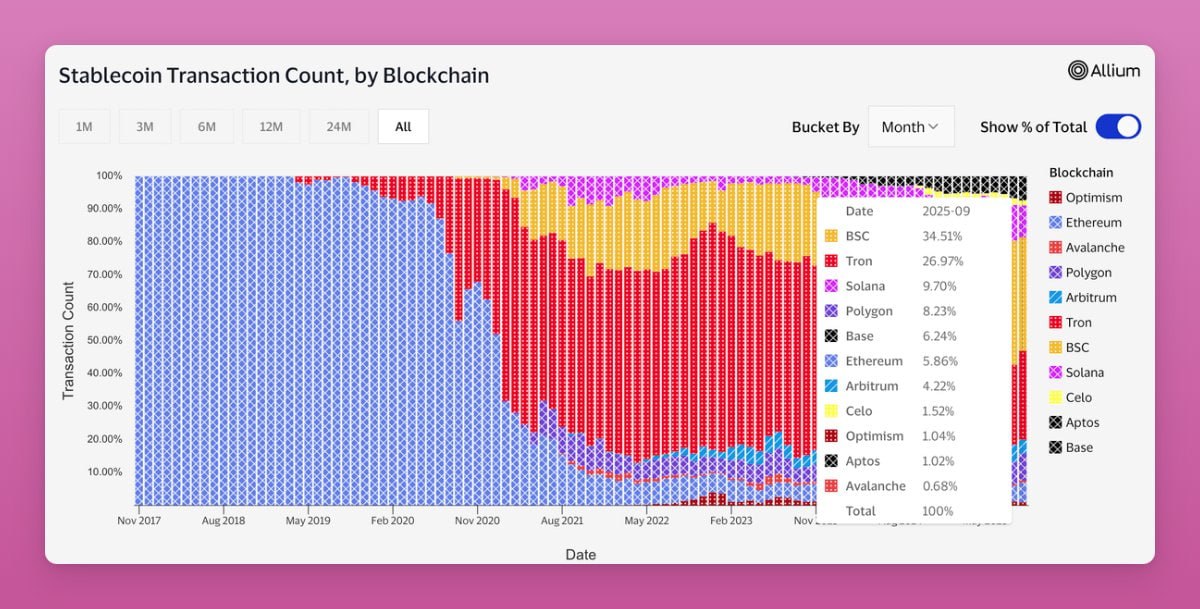

$ETH is not leading in stablecoin transfers, so the initial "cannibalization" effect is still small. The group under more pressure seems to be Tron, followed by Solana, Polygon, and other L2s.

2 Changing Usage Flow

Stripe's choice of L1 over L2 reduces the demand for holding $ETH and decreases fee burn. Stripe also owns the Bridge Privy toolchain and now Tempo, so users and volume tend to flow within Stripe's ecosystem rather than consuming Ethereum blockspace.

3 Dilution Risk

If Tempo issues a token, capital and attention will be further diluted. This is another disadvantage for the story of accumulating value for ETH in the short term.

4 Significant Positive Aspects

Stripe still chooses to be EVM compatible. The growth of stablecoins is a positive signal for the entire market. Users coming through Stripe can definitely flow back to #DeFi on Ethereum to seek yield and more complex products over time.

UPDATE $APT

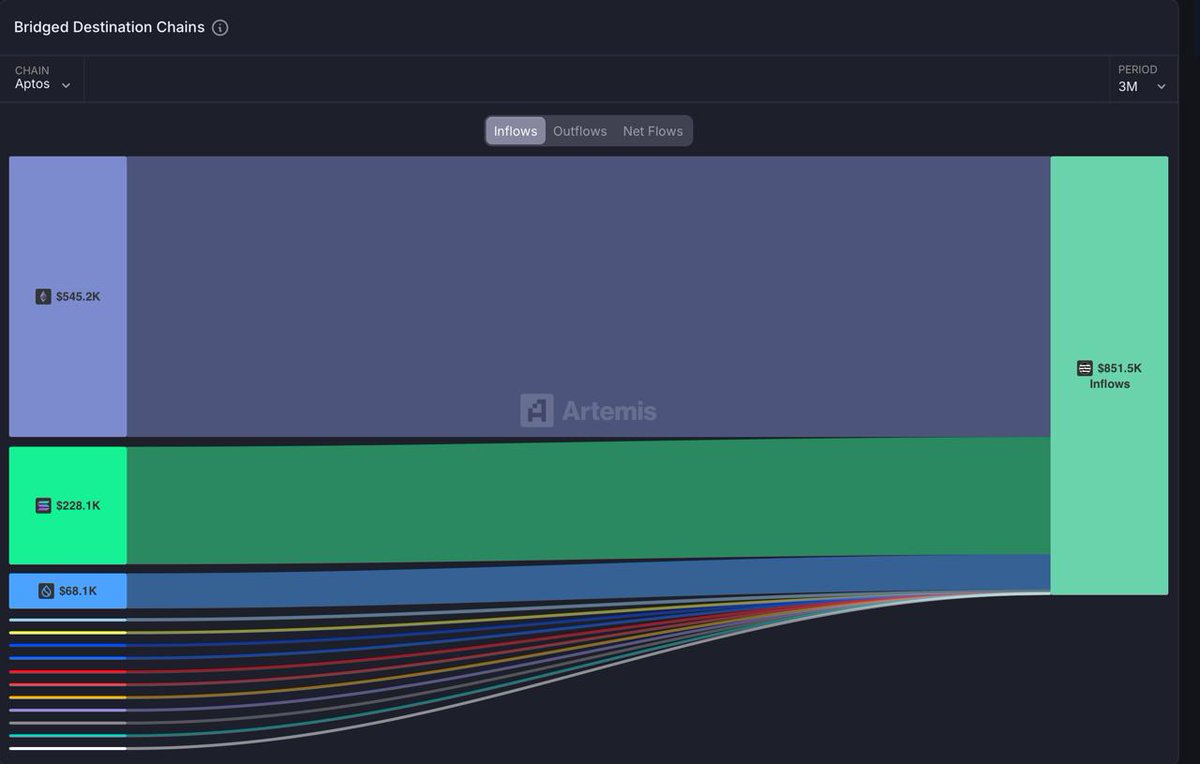

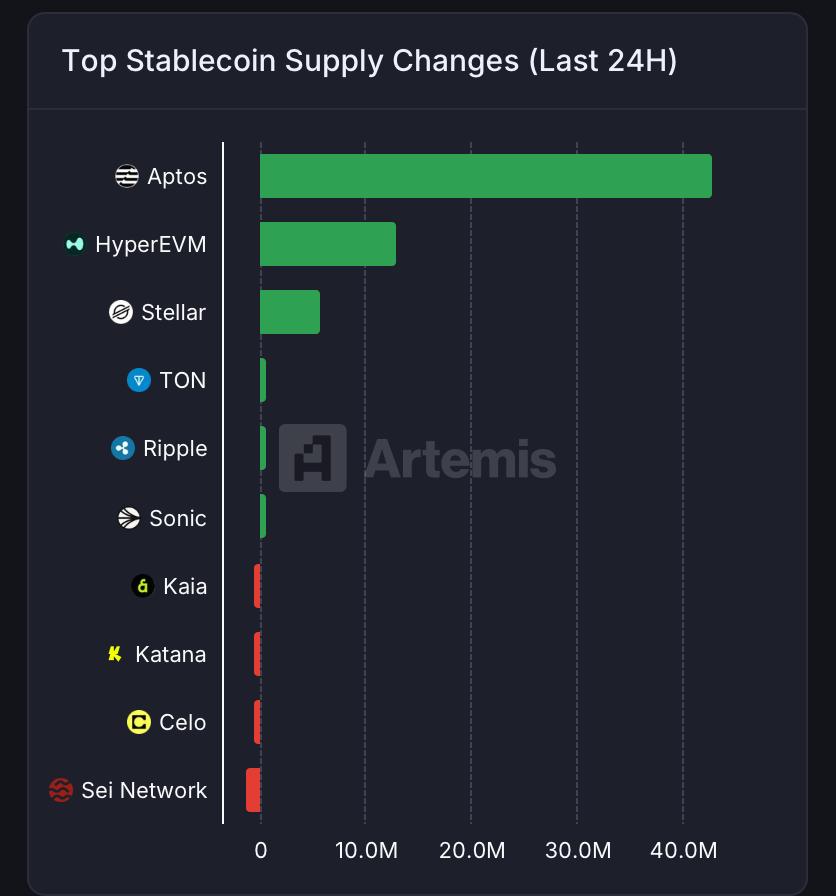

- In the past 24 hours, $APT has led the inflow of funds attracted the most recently.

- Especially, the current inflow of $APT mainly comes from: $SUI, $SOL, with $APT being the primary.

Currently, $APT is still in the accumulation range of 3.8x-4.3$, so you should pay attention to get the best buying opportunity.

18.71K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.