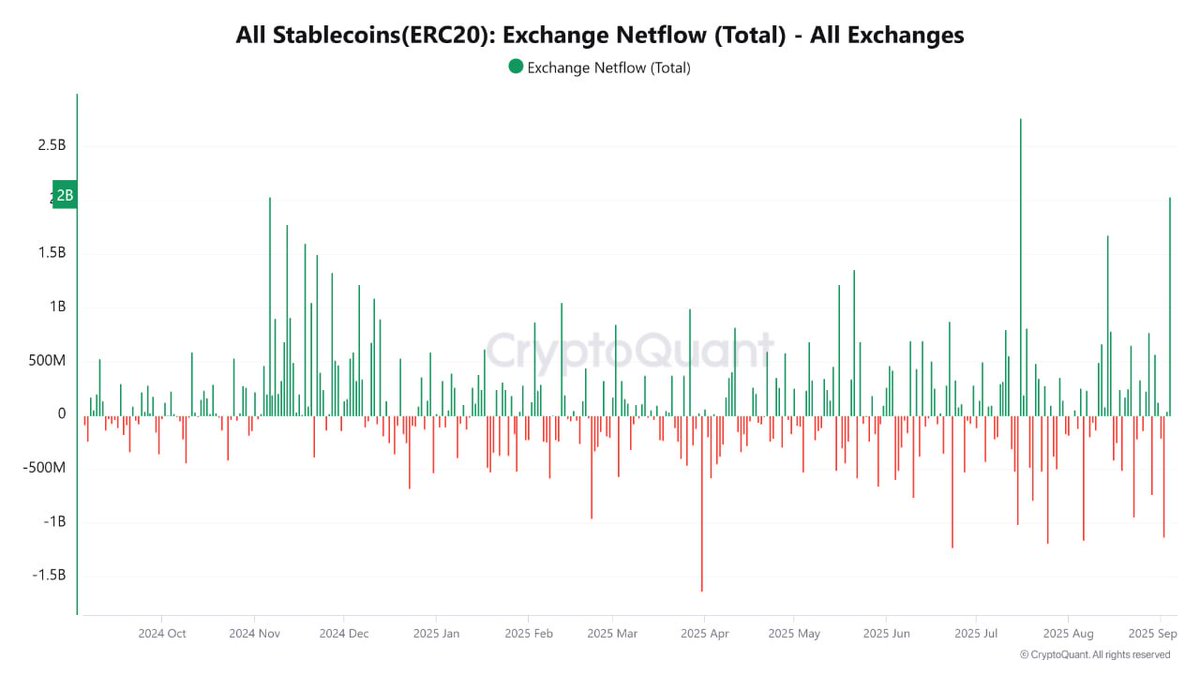

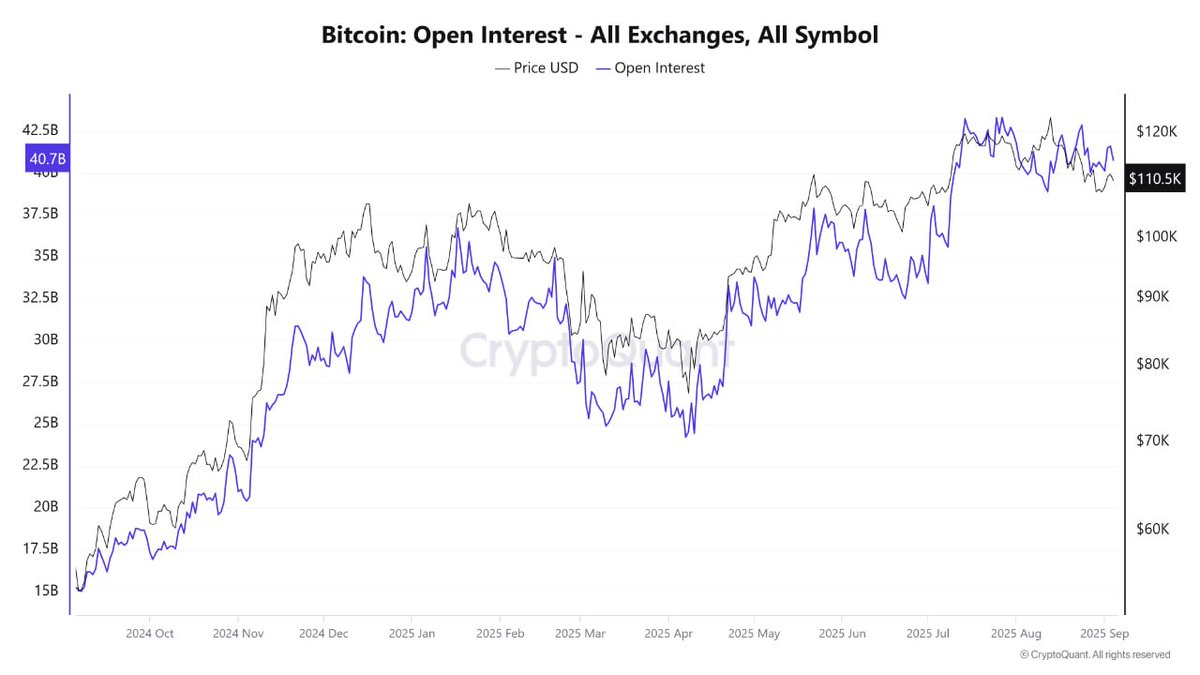

"On-chain data bullish market indication" While the U.S. employment report to be released tonight is drawing attention, the on-chain data already reveals that the market is preparing for an upward movement. Surge in Stablecoin Inflows Recently, the amount of stablecoins entering exchanges has significantly increased. In the past, ahead of major macro events, an increase in USDT and USDC inflows often led to immediate investments in BTC and ETH. The situation appears to be similar this time. Market participants are ready to either buy the dip or ride the momentum. High Open Interest The open interest for Bitcoin is maintaining near an all-time high of over $40 billion. This indicates that positions continue to build even while prices take a breather around $110,000. When stablecoin inflows and high open interest appear simultaneously, it generally precedes significant movements. Positive Macroeconomic Environment With the Federal Reserve's interest rate cut possibility reaching 97%,...

Show original

11.62K

17

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.