Solv and @chainlink create the first institutional-grade oracle with embedded Proof of Reserve.

We're setting a new global standard for asset transparency in DeFi.

It's the launch of Solv's Secure Exchange Rate feed🧵

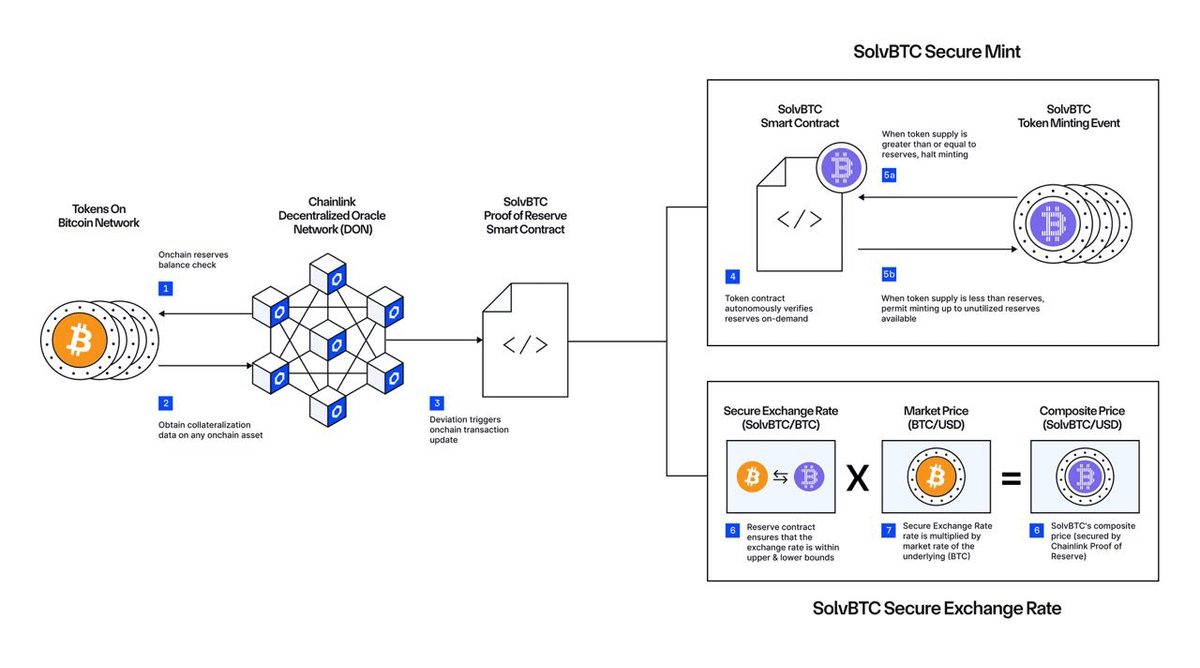

Solv Protocol (@SolvProtocol) collaborated with Chainlink to introduce a new Secure Exchange Rate feed for SolvBTC on @Ethereum, powered by Chainlink Proof of Reserve.

By embedding verified BTC reserves data directly into its pricing logic, SolvBTC is set to provide DeFi protocols with a reliable, tamper-resistant redemption rate for its wrapped BTC asset. This delivers new levels of secure collateral pricing and transparency for wrapped assets in DeFi, supporting their use in onchain lending markets like @aave.

Solv Protocol also plans to leverage Chainlink's Secure Mint feature, which utilizes Chainlink Proof of Reserve to help ensure SolvBTC assets cannot be minted unless there is sufficient BTC reserves to maintain a 1-to-1 backing.

18.11K

255

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.