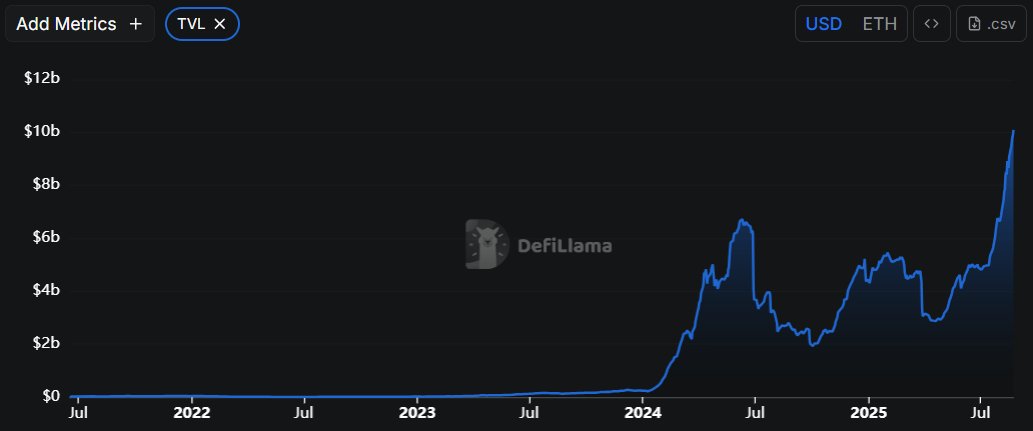

$PENDLE: TVL Breakout, Fees Accelerate, Multiples Compress

- TVL hits $10B (+28% from $7.8B since last coverage), setting a new ATH.

- Trading at an FDV of $1.7B, +11% WoW and +13% since last coverage ($1.5B).

- 30D revenue at $6.6M (+53% from $4.3M since last coverage), ≈$80.3M annualized; FDV/fees multiple compresses 27× → 21×.

- HyperEVM TVL surges $100M → $540M (+440%), while stablecoin deployments expand via stcUSD and atvUSDC.

- Strata integrates PT-pUSDe; Sonic’s x33 relaunch

- Pendle adopts Chainlink standard for Boros; $140M notional volume in its first week of launch.

- Boros roadmap points to Sol, BNB, Bybit, Hyperliquid, with collateralized funding and shariah compliant products.

- Forward: Watch Boros exchange integrations, HyperEVM scaling, and Pendle’s adoption cycle driving fee trajectory.

@pendle_fi

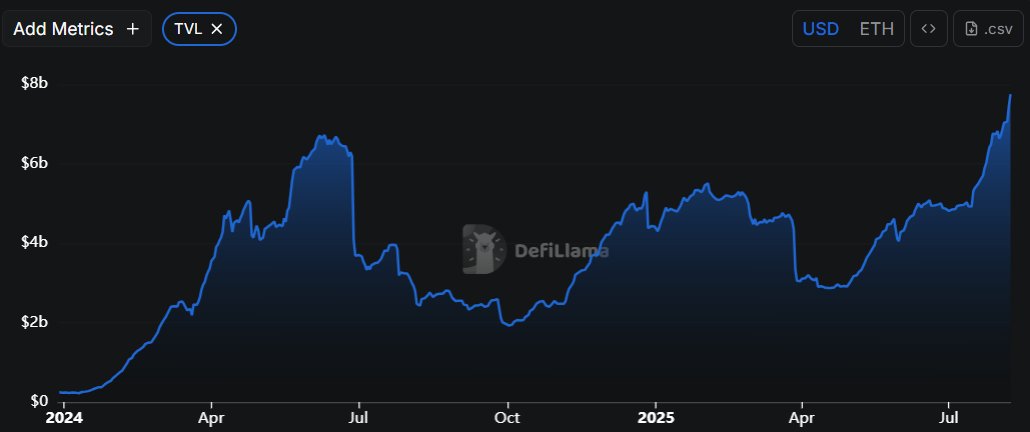

$PENDLE: TVL Hits $7.8B ATH, Boros Launches, Yield Infra Expands

- $PENDLE up +20% (24h), +32% (7d), trading at $1.5B FDV.

- TVL rose +56% in 30 days to $7.8B; 30d revenue $4.3M, annualized $52M → ≈27x FDV/fees multiple.

- Boros launched enabling onchain funding rate trading for BTC/ETH perp markets.

- Ethena/Aave PT-USDe looping fuels ecosystem: $3.7B USDe supply growth in 20 days, $3.3B+ PT-USDe collateral on Aave.

- HyperEVM TVL surpasses $100M; new pools offer 14-25% APYs with boosted incentives.

- Incentive model updated: dynamic caps based on fee contribution, swap fees cut to ~1.3%.

- Euler Finance supports new PT tokens as collateral, expanding borrowing options.

- AEON partnership enables $PENDLE payments at 20M+ merchants globally.

- Forward: Pendle’s expanding fixed yield infrastructure, institutional ready Boros product, and growing crosschain presence position it to capture major stablecoin yield market growth through 2030.

@pendle_fi

7.71K

6

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.