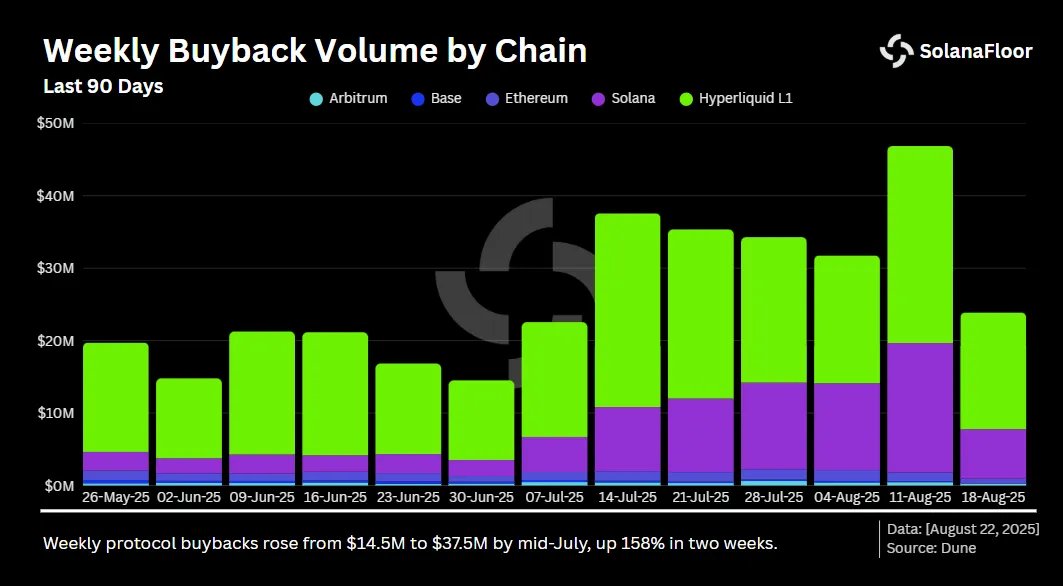

📊 Solana Data Insights – @Solana Projects Now Account for 40% of Weekly Token Buybacks Across Crypto

✍️ @ario_57_

Key takeaways:

• Weekly token buybacks jumped from $14.5M to $46.8M in just two weeks (+158%).

• Solana protocols now account for 40% of weekly buybacks, up from 10.8% in June.

• Hyperliquid leads with $27.1M weekly (58% share).

• Ethereum falls to just 2.5% of buyback share.

• Jupiter commits $1M–$2.3M weekly to $JUP repurchases.

• Raydium buys back $500K–$1.5M of $RAY each week.

• Step Finance directs 100% of revenue (~$120K) to $STEP buybacks.

• ramped $BONK buybacks from $2.6M to $6.6M in July.

• surged from $125K to $13M weekly, now ~29% of total.

• Across all protocols, $340M+ spent on buybacks in 90 days.

• Profitability diverges: Raydium +19%, +11.8%, BONK –26%.

Subscribe for the full breakdown👇

Show original

23.83K

24

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.