Advanced Pair-Trading Tips

So I'm sure some of you know about pair-trading.

It's a particularly useful approach to use during more choppy seasons when alpha is harder to come by.

This is a primer on pair trading and some more advanced techniques.

✨ THE GOOD PAIR TRADE

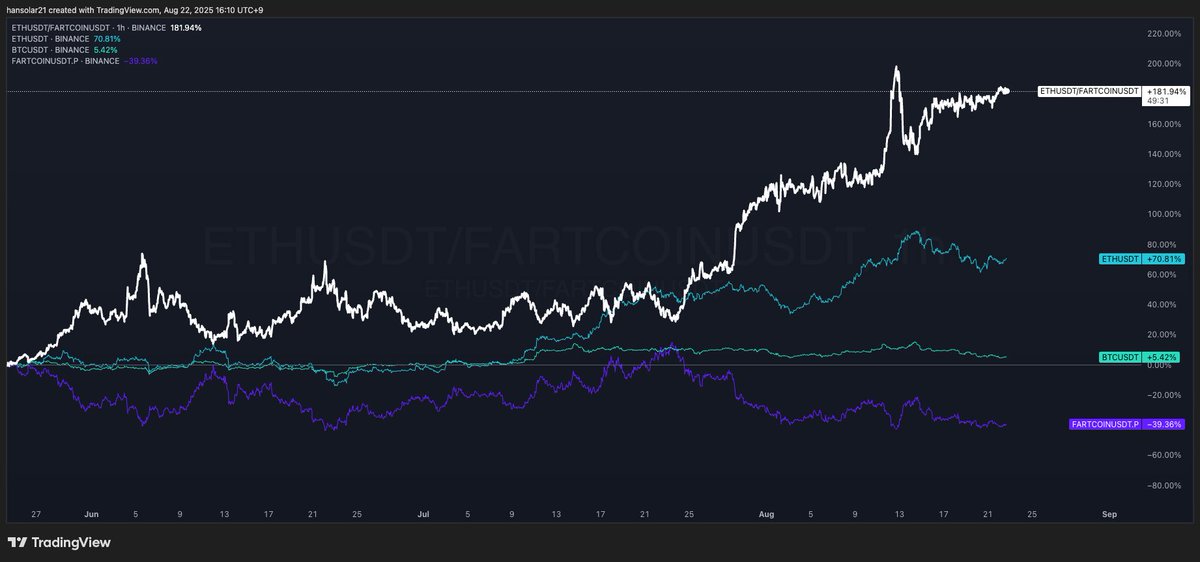

Take for instance the ETH/FARTCOIN pair.

That would mean being long ETH 1x your account and short FARTCOIN 1x of your account.

Another way to write this is as below:

ETH^1*FARTCOIN^-1

(Fartcoin to the power of negative one is the same as dividing it.)

Over a three-month period, the pair returned 130%,

while BTC did +5%, ETH did +70%, and FARTCOIN did -39%.

So this is all rosy and looks super easy, but the truth of the matter is this is much harder than it looks.

Narratives change quickly in crypto, and theses expire faster than milk left out on a hot summer day.

Also, historical performance is not indicative of future returns.

So it is more a useful tool to look at retrospectively on what worked and what didn't.

✨ THE OK PAIR TRADE

The above example is usually not how a pair trade would go.

Usually, you are trading the relative outperformance of one asset relative to the other.

What this means in an upward-trending market is that your shorts will be seeing losses, but the long side should be outperforming the shorts and generating the alpha.

You could also be underperforming the benchmark, but as long as you're reducing volatility, it means you can potentially lever up.

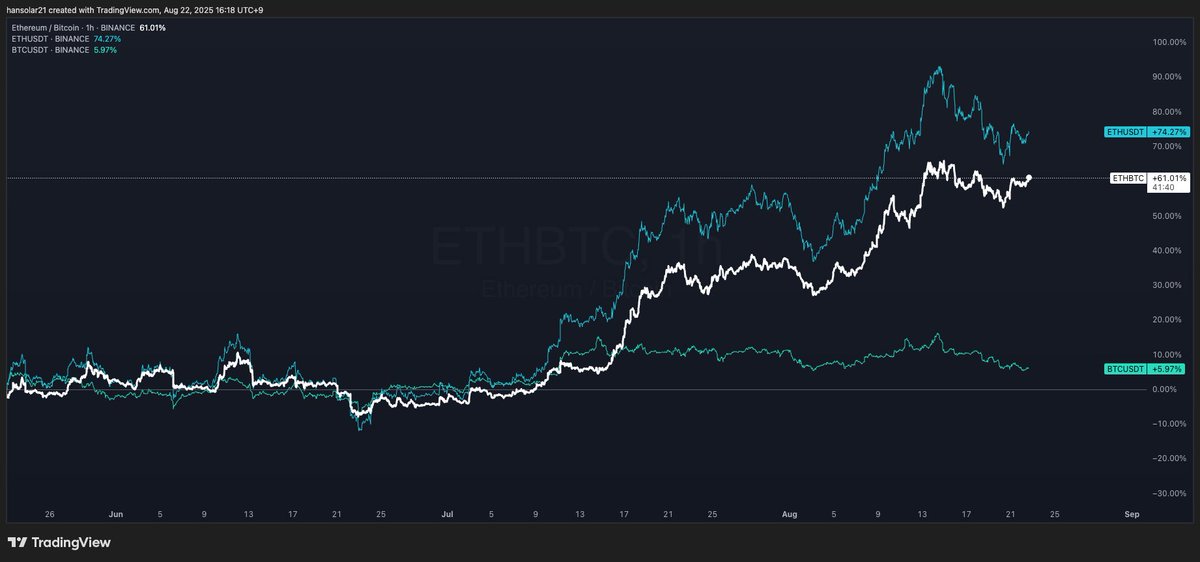

For instance, take the currently hot ETH/BTC trade.

Over a three-month period, the pair returned 62%,

while BTC did +5% and ETH did +74%.

This would mean you saw losses on the BTC short.

Assuming you're an ETH maxi and ETH is your benchmark, you've underperformed a pure ETH long, but you have successfully hedged some downside exposure and reduced volatility relative to ETH.

ETH 30d vol: 71

ETH/BTC 30d vol: 53

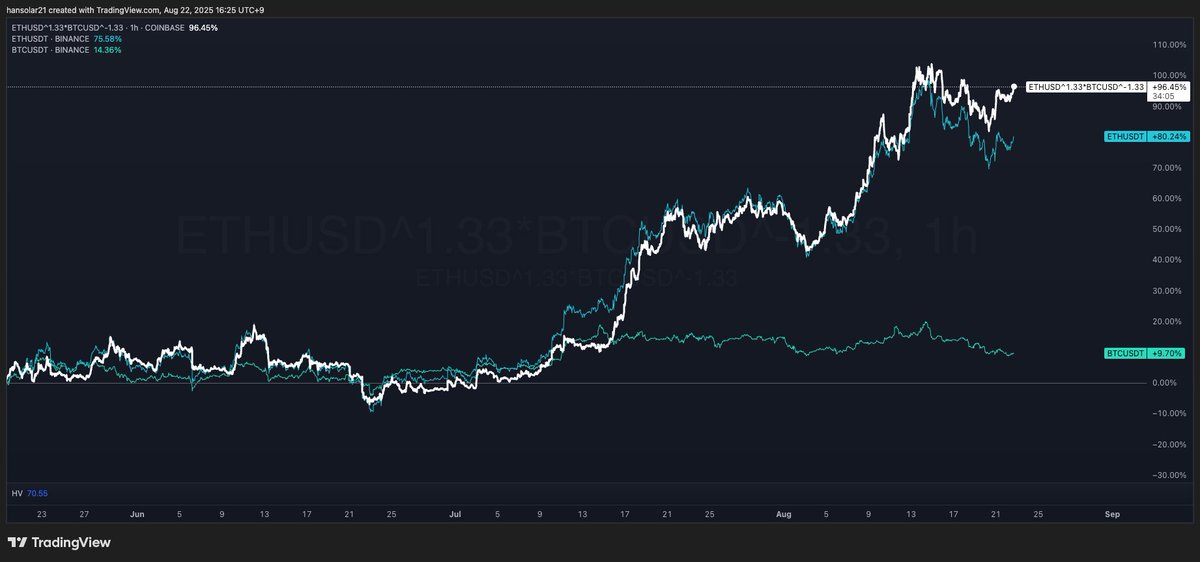

So assuming you would've been comfortable with ETH levels of volatility and you are banging your head about the missed gains of being just long ETH, you can up the leverage a tad.

If you think you can stomach ETH levels of volatility, you can say increase the leverage by 33%.

You do this by using the following formula:

ETHUSD^1.33*BTCUSD^-1.33

This gives you the same volatility of just longing ETH, but results in an increased return of 96%.

✨ THE UGLY PAIR TRADE

So more times than not, you actually get it completely wrong.

You think a narrative continues, but that ends up being the exact point at which the narrative switches.

This could result in BOTH your longs and shorts turning red.

This is super painful, and I'd close immediately and think hard about your underlying thesis.

A good pair-trader will usually have at least half of his book in the green.

✨ THE ADVANCED PAIR TRADE part 1

Now some people like to neatly compartmentalize their long and short pairs per thesis (ie @hufhaus9), but the way people actually trade is much messier.

It is usually a mixed basket of longs and shorts that are constantly changing.

For instance, I personally have one or two main longs and a basket of weak coins to short in all different sizes.

My current positioning being:

Long Short ratio 1:1

Longs: HYPE ETH

Shorts: FARTCOIN BONK TRUMP SOL FLOKI SEI BTC

I've had trouble thinking about what my general portfolio is doing relative to BTC or ETH and have been copy-pasting my entire position table into chatgpt to create a consolidated chart.

That ends up looking like this:

HYPEUSDT^0.5145*FARTCOINUSDT^-0.1280*BONKUSDT^-0.1099*TRUMPUSDT^-0.0866*SOLUSDT^-0.0376*FLOKIUSDT^-0.0306*SEIUSDT^-0.0299*BTCUSDT^-0.0231*ETHUSDT^0.0221*IPUSDT^-0.0176

Try plugging this equation into your tradingview symbol search text box and you'll get something similar.

Not the prettiest looking chart, but the reason for I'm longing this particular group of coins is a whole different story.

This is useful to see how your particular positioning has done in the past to make decisions for the future.

... continued in the next post.

Show original

27.78K

152

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.