Sonic Assets x Euler ➞ The DeFi Yield Engine

More than $36M in Sonic Assets are actively deployed on @eulerfinance ➞ powering the most composable and capital-efficient DeFi loop today

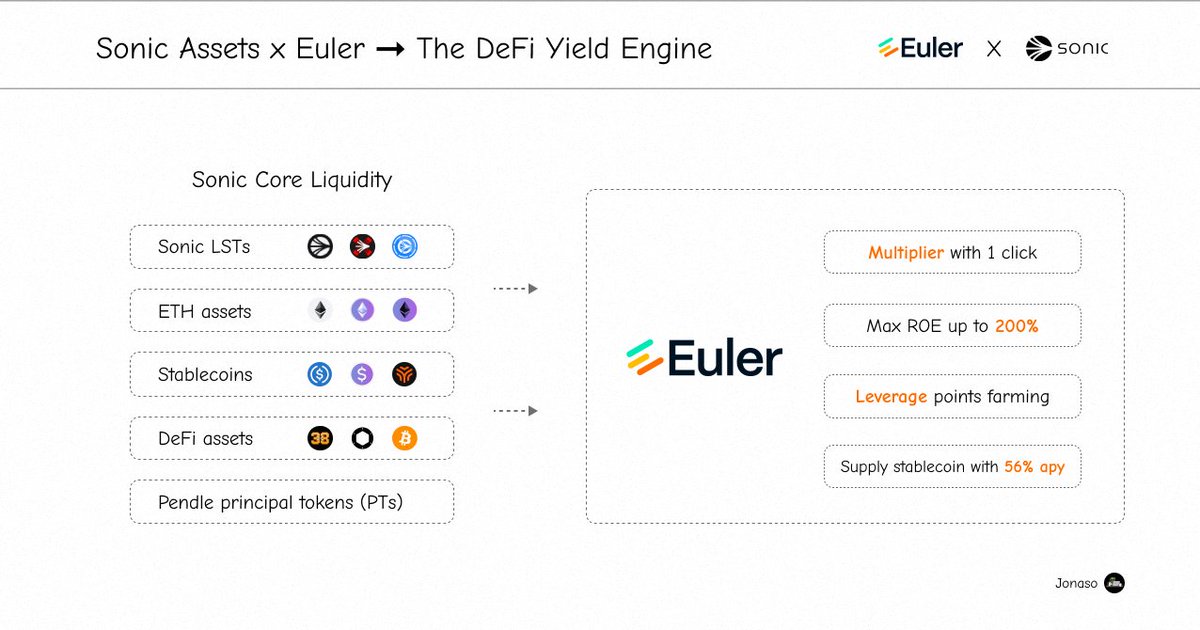

@SonicLabs Core Liquidity in Euler ↓

Pendle PTs

DeFi assets ➛ xBTC and x33

Sonic LSTs ➛ stS, wS, and wOS

Stablecoins ➛ USDC, scUSD, and xUSD

Ethereum assets ➛ WETH, scETH, and xETH

➢ This makes Sonic one of the most versatile liquidity layers emerging in 2025.

Supply Sonic Assets on Euler to get ↓

→ multiplier with 1 click

→ up to 56% APY with scUSD

→ up to 6x Sonic Points and other Protocols Points

→ up to 200% ROE with x33/USDC and x33/scUSD Vault

Sonic assets are now a key part of the Euler ecosystem. Users can earn more yield, farm more points, and be used in advanced DeFi strategies with just 1 click.

Show original

2.4K

39

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.