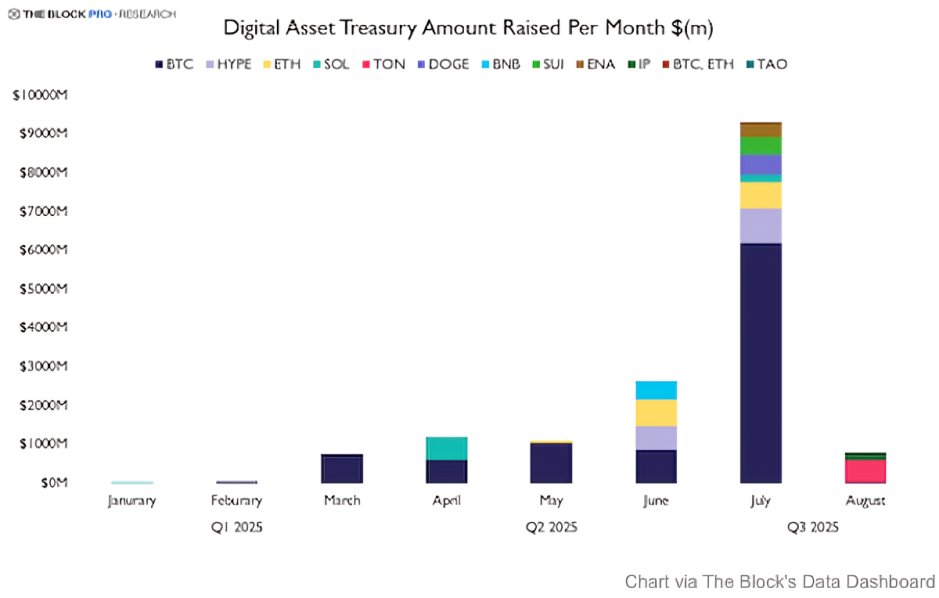

DATs Raise $15B as Venture Deals Fall 56% 📉

Digital asset treasuries (DAT) have emerged as the dominant force in crypto funding, raising over $15B through August 2025.

> July alone accounted for $6.2B, the highest monthly total ever recorded.

> Companies announcing DAT strategies are seeing immediate market reactions.

> Lion Group’s $600M Hyperliquid treasury facility driving a 20% jump in its share price.

> Bitcoin is still the main reserve asset.

> However, Hyperliquid’s HYPE token has drawn $1.5B, showing growing appetite for altcoins.

In contrast, traditional venture deals have collapsed, dropping 56% year-over-year from 1,933 in 2024 to just 856 in 2025.

> Institutional players like DCG, Paradigm, and Galaxy are increasingly channeling funds into DATs, viewing them as a faster, more liquid path to crypto exposure than startup investments.

Read More Here:

Show original

14K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.