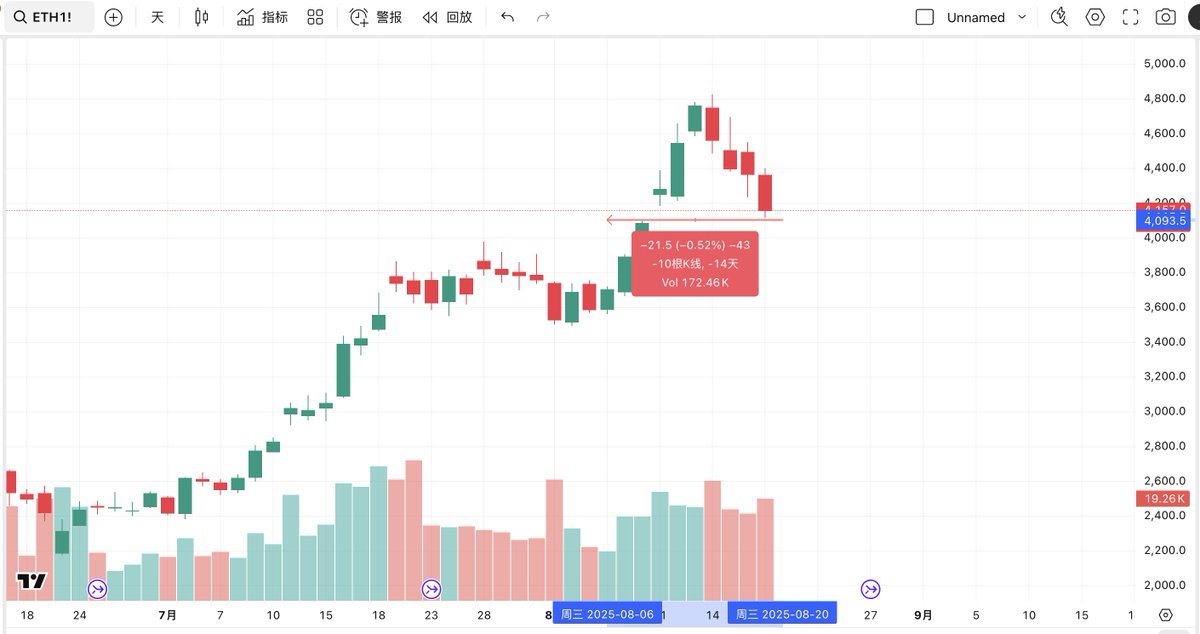

The gap in #ETH has not been completely filled; futures data shows that it is still about 20 points away from being fully filled.

It should be noted that when I previously said the gap was "mystical," it was a joke.

In fact, strictly speaking, a gap can be understood as a futile search for a sword in a boat.

Looking back at the historical market trends, we find that gaps are likely to be filled, which is why the gap theory is used.

Of course, it's the same old story: gaps are divided into "breakout" gaps and "regular" gaps.

The gap for #Bitcoin at 92,000 is currently a typical breakout gap, which is difficult to fill in the short term.

#ETH The magical "gap filling" has begun, ETH is falling along with #Bitcoin into the "gap filling zone", and the price must drop to 4096 to completely fill the gap.

If we look at the drop percentage of ETH's gap filling, there is still 1.7% room left.

If it falls in sync with BTC, that means BTC would need to drop to the third support mentioned in today's report, which is around 111,300.

Of course, it's important to remind again that gap filling does not happen all at once. As mentioned frequently over the past few months, it often rebounds halfway through the filling, then oscillates for a few days before filling completely, so please be careful to distinguish.

17.75K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.