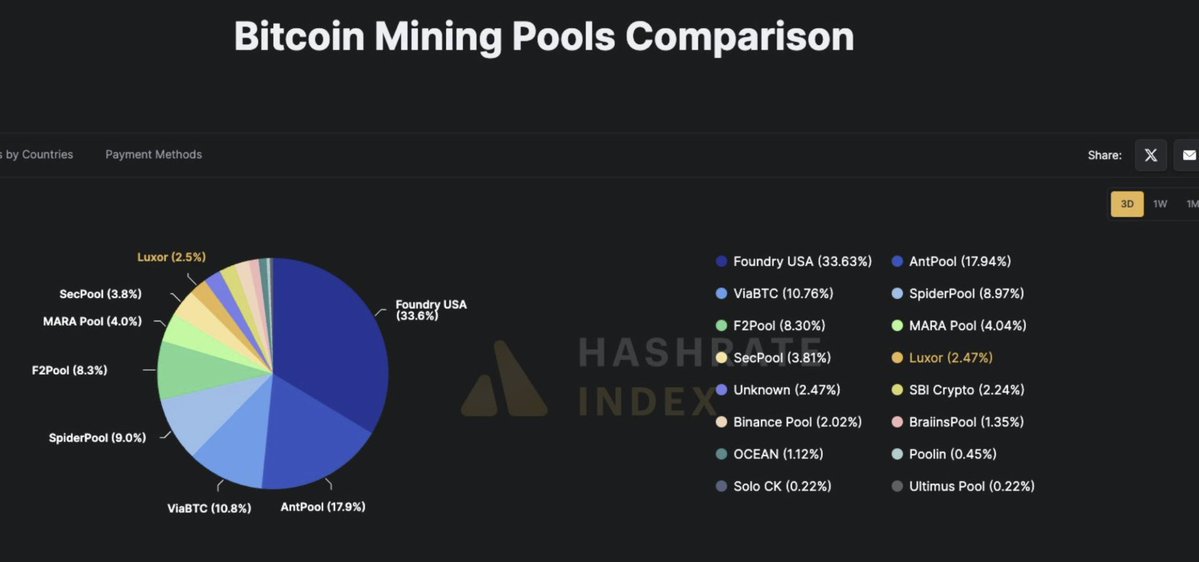

Two Bitcoin mining pools now control over 51% of the network. The door is wide open for a 51% attack, which could completely destroy BTC.

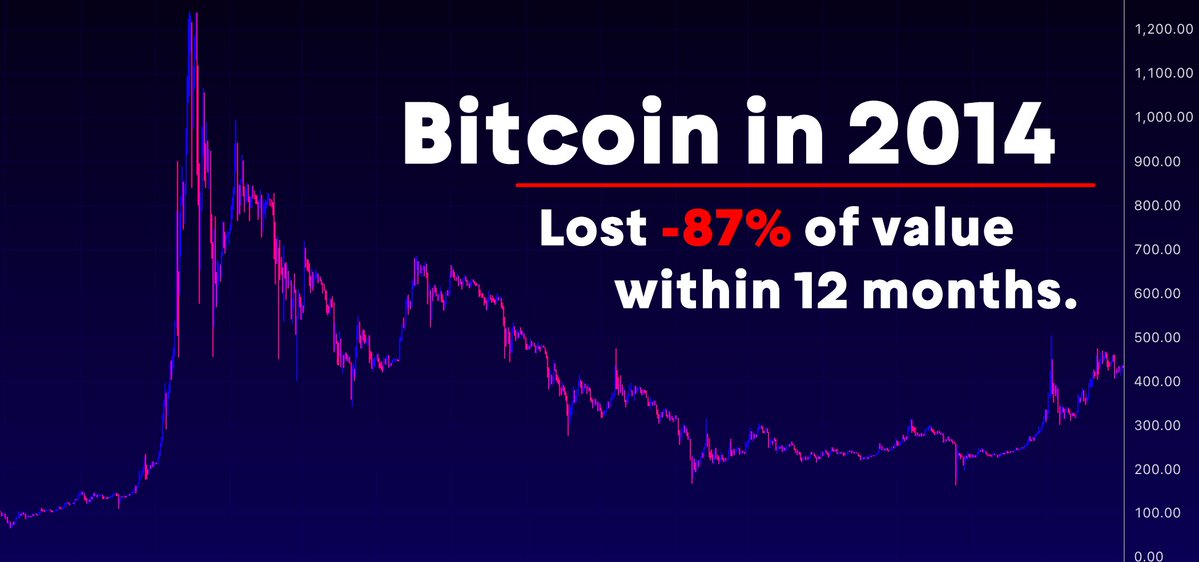

For context, the last and only time this happened was 11 years ago, in 2014, with GHash.io. They had to voluntarily reduce their hashrate to quell centralization concerns, but panic still ensued. BTC tanked over -87% in a few months, marking one of its worst bear markets ever.

In 2015, GHash was hit by severe DDoS attacks, targeted by maxis, and eventually forced to cease operations. They try to cover up this event and these centralization issues, but they’re back today. I think this will be a major topic again and could be enough to pop the mega-bubble.

Better yet, OTC data already shows many big whales jumping ship. Even "Bitcoin Guru" crook Michael Saylor has reversed his “promised” strategy and created a plan to dump/dilute his holdings and exit the Ponzi quickly. He knows exactly what’s coming.

Let’s not forget that the entire market is propped up by three things: fraudulent stablecoin injections, emotional retail FOMO, and narrative illusions pushed by the maxi cartel.

Once reality sets in about how centralized, manipulated, and useless Bitcoin truly is, everything will collapse faster than ever. It’s essentially a giant game of musical chairs!

Show original

173.57K

1.32K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.