Aave currently dominates 64% of the lending market share and we are still early.

Great write-up on how Aave will scale to 1 trillion TVL.

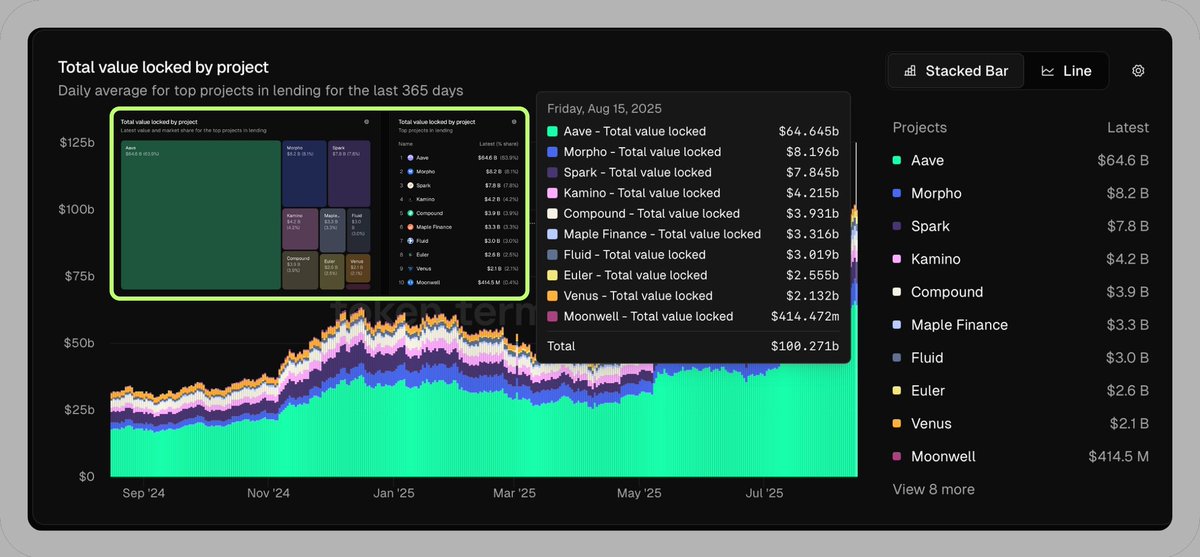

Total deposits into Lending Protocols have surpassed $100 billion.

It has reached ~$100.2 billion, up from $32 billion, a 3.13× increase in the last year.

Aave holds $64.6 billion, representing 64% of the lending market.

Over the past year, @Aave has seen 3–4x growth across all key metrics such as TVL, fees, revenue, and active loans.

I believe the lending protocol has more potential than we think. Its adoption has only just started.

We haven’t even reached 1% of the deposits we may see in the next 10 years. Deposits will compound in the coming years.

Why Lending Protocols Will Become the World's Largest Banks

1/ Borderless Access to Capital:

If you have an internet connection, you can borrow or lend — no matter where you are.

2/ Better Yields for Lenders:

Banks typically pay just 1–3% interest on savings, while DeFi lending protocols offer significantly higher rates.

3/ 24/7 Instant Liquidity:

Need a loan or want to repay? It happens in minutes, any time of day, anywhere in the world. No paperwork. No waiting.

4/ More Types of Collateral:

Crypto, NFTs, tokenized stocks, gold, silver, and more can be used as collateral.

5/ Global Rate Opportunities:

Borrow where rates are lowest, lend where returns are highest.

Example: Use Apple stock to borrow on Aave at 5%, or lend USDT on another protocol offering higher yields.

6/ Everyone Will Join In:

Hedge funds, corporations, banks, pension funds, sovereign wealth funds, universities, endowments, insurance companies, non-profit organizations, and even governments.

Everyone can join

Aave is a leader in lending protocols. Now, let's understand Aave's potential with an example.

What if you want to buy Apple stock and don’t live in the U.S.?

1st Step

First of all, choose a broker that allows you to trade U.S. stocks and complete KYC with Proof of address.

You may also need to submit tax forms (e.g., W-8BEN) for U.S. tax compliance and reduced dividend withholding.

2nd Step

Fund your account with your local currency (e.g., INR, EUR) or GBP if you have a foreign account.

The broker will convert your funds to USD when you buy Apple shares.

Pay Fees:

- Currency conversion: 0.5–2%

- Brokerage fees: 0.1–0.5%

Restrictions:

Some countries under U.S. sanctions can't buy the US stocks.

Because of tokenization, anyone can buy U.S. stocks from anywhere, without KYC or proof of address, and at low fees, which could drive greater demand for U.S. equities.

If anyone wants to borrow money for a short or long period, Aave will offer loans at around 4–6%. Similarly, in TradFi, we can pledge our stocks as collateral to borrow.

The best thing is that the interest rates would be the same for everyone, whether you’re from America or Burundi.

Many countries charge higher interest rates to their citizens, and their stock markets are often stagnant.

Thanks to tokenization, they would be able to invest in the best-performing stock markets and use their stocks as collateral for borrowing.

Today, the combined market cap of the top 10 U.S. stocks is $23 trillion. If just 10% of that market cap comes on-chain in the next five years, it would amount to $2.3 trillion.

If only 10% of that goes into Aave for lending, it would be $230 billion.

I am not assuming any growth in these stocks, even though they are likely to grow at least 2x over the next five years.

I’m pretty sure Aave will reach at least $500–700 billion in TVL by 2030.

33.87K

318

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.