The lesson here is that you need to form a thesis. When the trade goes the wrong direction, reevaluate the thesis. If it still holds, it means you now have a better entry and you should double down. If it continues to move and the thesis holds, bet more.

Conviction pays. Emotional trading decisions do not.

Easier said than done, but this trade outlined why the above is how to make $$ but so few people have the balls to fire when they're deep in the red.

Oh and also, always have reserve capital...and only leverage trade with a small portion of your overall portfolio/wealth.

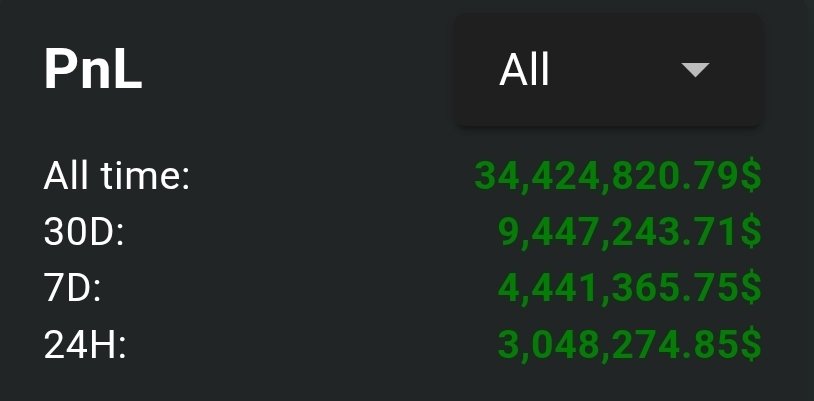

Best trader I know shorted $20m ETH @ $4240

When price kept climbing he added $5m collateral

24hrs later with -$2m unrealized he deposited another $2m

Finally he shorted $20m BTC @ $123k, another $20m ETH around $4650, and $25m across SOL & other shitcoins

What's the lesson?

3.86K

7

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.