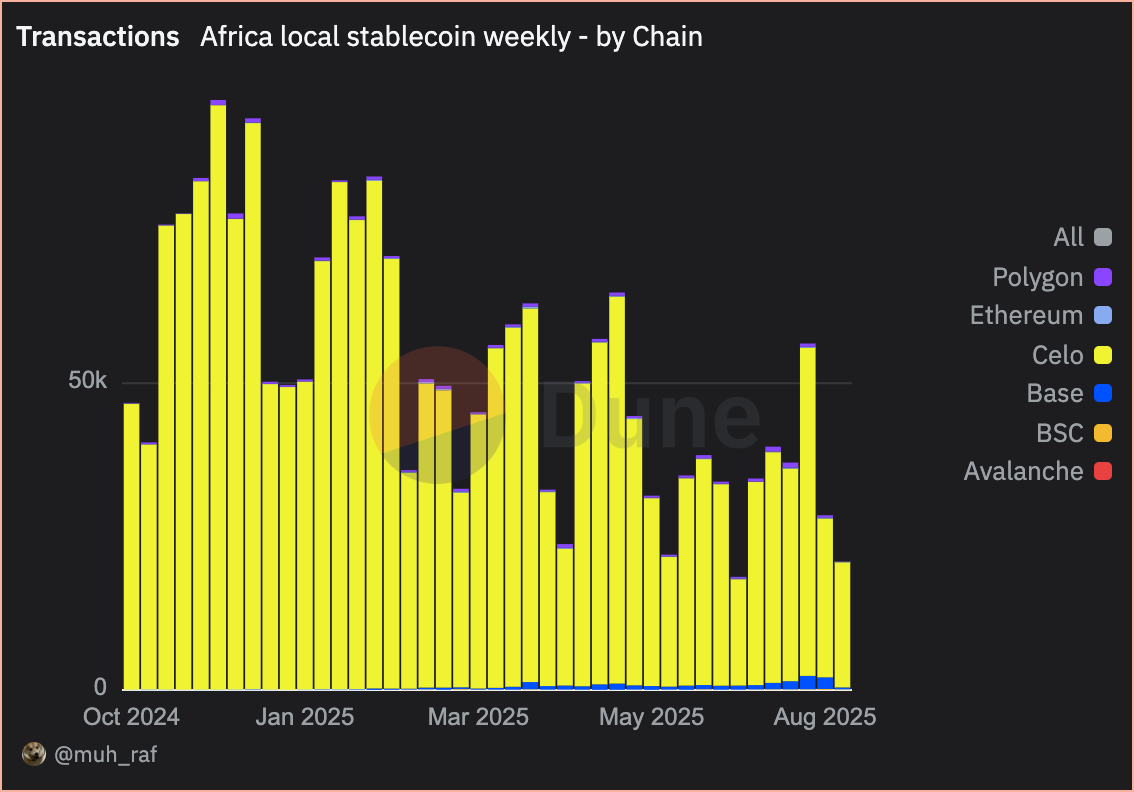

While Polygon dominates Latam and Asia, @Celo continues to gain traction in the African market with products such as @minipay, supported by @cLabs and @opera, and the stablecoin $cUSD.

Regional stablecoins such as $cGHS and $KES on @Celo account for 90% of the total volume in Africa.

thx for data: @_muhraf_

Stablecoins offer good stability in the form of pegging to the USD, low fees, fast cross-border payments, and inclusivity for the unbanked population, serving as an alternative to weak local systems in Latam, Africa, and some regions of Asia.

There are exceptions in the form of regional stablecoins such as $BRZ/Brazil, which is mainly active on @0xPolygon, and $IDRX/Indonesia, which is mainly active on Polygon and @base.

Latam leads in adoption: ~90% of crypto activity is related to stablecoins as a hedge against inflation. They are used for remittances, salaries, and trading, with a volume three times greater than Btc.

The region has the highest percentage of stablecoins to GDP according to IMF 2025 analytics.

Platforms such as @Bitso and @mural_pay on Polygon integrate stablecoins for P2P payments. 71% of companies already use them for cross-border transactions due to high infrastructure and demand.

I am closely following these three markets, especially Latam, because there is freedom for the development of crypto payment projects there.

6.93K

40

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.