【 $ETH's Strong Market, E Reserve Data Update 💡】

It has only been a month since the establishment of the ETH Maxi list, yet it feels like a lifetime ago.

$ETH has risen from $3000 to the current $4700 🚀🚀

New highs are not just casually mentioned; often, it feels like the crypto space still underestimates this institutional buying, even Tom Lee @fundstrat himself mentioned that the current speed at which Bitmine is purchasing $ETH is 12 times that of Strategy's purchases of $BTC.

By the way, it seems a new "Ethereum Foundation" has emerged in the market. Hashkey Capital transferred over 7000 ETH to exchanges today, selling off $34M 💀

From last night to today, it's clear that opinions in the market have diverged.

💡 BTC seems to have not sustained its new high.

💡 $ETH is astonishingly strong on its own, with $SOL following suit.

💡 Altcoins have not followed the rise.

The interest rate cut in September seems to be settled; as usual, we still need to watch the performance of Bitcoin. If Bitcoin does not break through this time, altcoins will continue to struggle.

I looked at the spot trading volume of mainstream coins, and it seems to have reached the previous high point again, which previously saw a short-term pullback ⚠️.

The spot trading volumes then and now are:

ETH: 4.2 billion, 4.3 billion

BTC: 2 billion, 3.1 billion

USDC: 2.4 billion, 3.6 billion

A few days ago, ETH was around 2 billion.

The $OTHERS indicator has also surpassed the previous high at the end of July (315B, 315 billion USD), peaking at 324B this morning before retreating to around 316B now.

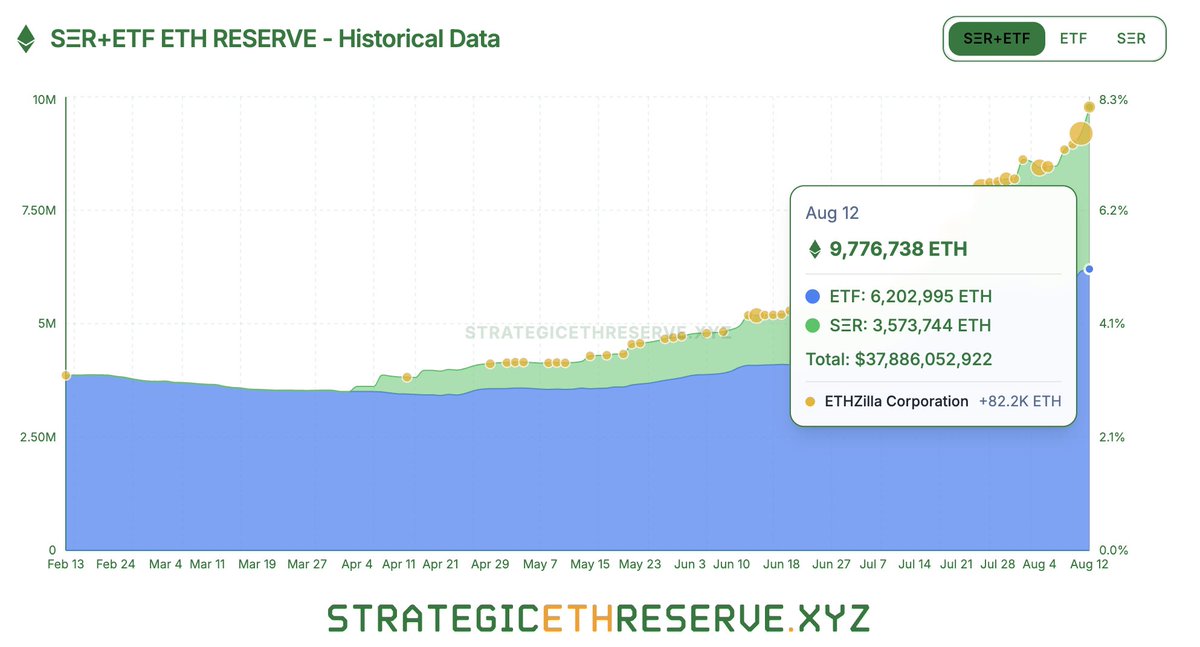

Looking back at the current purchasing data for ETH:

Since mid-July, the holdings of SΞR+ETF ETH have grown from 24M to the current 37M, a growth of 54% in one month.

The top 3 reserve companies currently hold 9.6B, which is nearly 10 billion USD of $ETH, while the Ethereum Foundation holds 1.07B, a difference of 9 times.

I believe we can monitor market changes on a weekly basis. Unless the growth rate slows significantly, there is no need to be overly pessimistic.

The current ETH/BTC exchange rate is also starting to show a turning point. $ETH remains strong and continues to surge ⚡️.

If it's now the micro-strategy moment for $ETH, how high is the upward space for $ETH? 🦇🔊

The strategy was announced back in September 2020.

In these four years, the price of $BTC has risen from 15K to the current 117K, an increase of 681.42% 📈

@SharpLinkGaming can be said to be a key player in accelerating the ETH reserve strategy.

📈 Current data from the website (strategicethreserve[dot]xyz) shows that there is a total of 1.3M $ETH, worth nearly 4 billion dollars, accounting for 1.11% of the circulation.

📈 The website indicates that the holdings of these companies have grown from 110K ETH to 1.3M in the past three months, representing a 1200% increase.

📈 Currently, there are 48 entities holding more than 100 ETH.

It's important to note that the quantity mentioned earlier regarding @BitMNR is currently pending. According to news reports, they are about to push for a $250 million scale of $ETH reserves, which would rank them in the top ten if calculated with 100K holdings at $2500.

Now, besides the original major DeFi protocols, there are also mining companies like BTC Digital entering the game.

According to news from June 26, they plan to convert their entire $34M worth of $BTC holdings into $ETH.

we're still early 🦇🔊

23.74K

38

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.