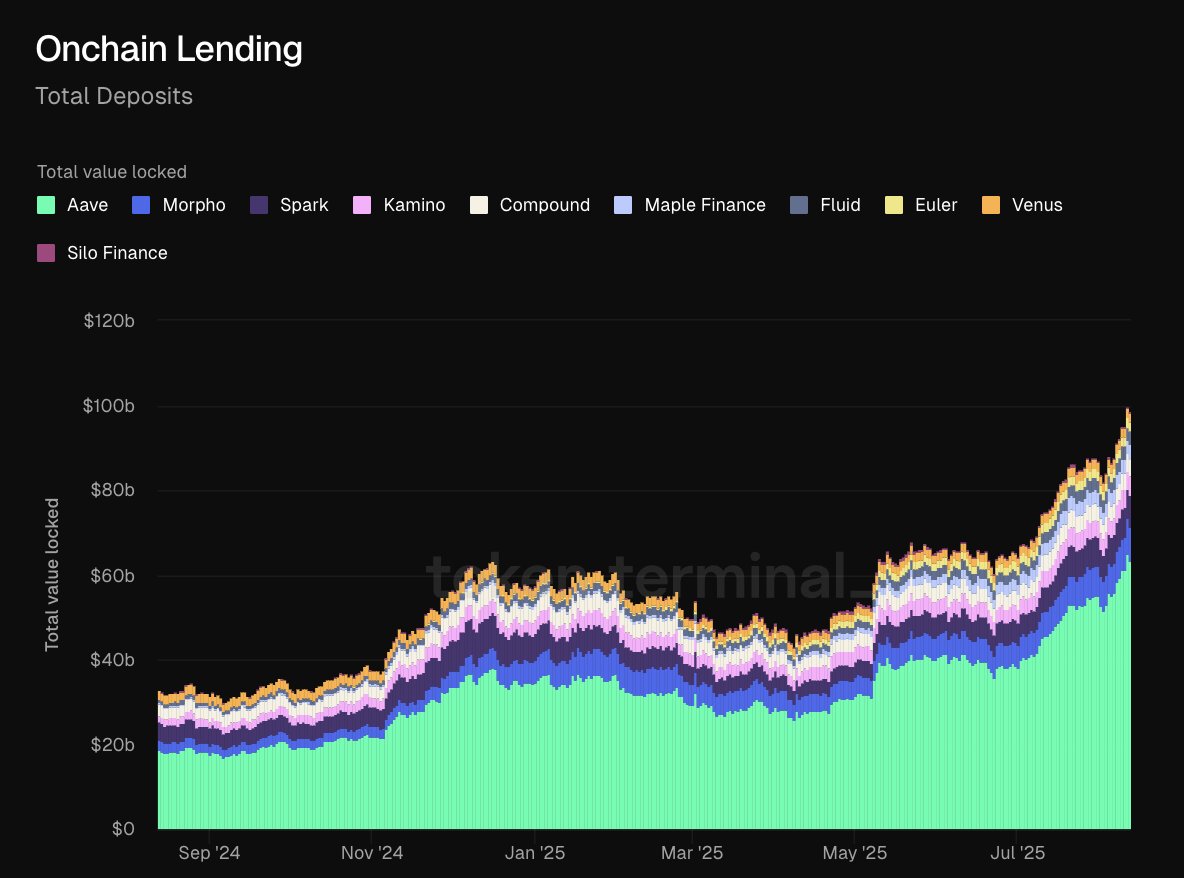

Onchain banking liquidity has surpassed $100B for the first time ever.

@aave alone holds $63B worth of deposits, which would rank it among the top 40 largest US-chartered commercial banks, ahead of household names like Barclays ($45B) and Deutsche Bank ($40B).

There is now over $42B active loans onchain, and 9 different protocols with at least $2B in total deposits, including:

Aave ($63B)

@MorphoLabs ($8B)

@sparkdotfi ($7.6B)

@KaminoFinance ($4.5B)

@compoundfinance ($4.1B)

@maplefinance ($3.3B)

@0xfluid ($3.1B)

@eulerfinance ($2.3B)

@VenusProtocol ($2.2B)

And treasury strategies and strategic reserves haven't even begun to deploy.

Buckle up.

h/t @tokenterminal

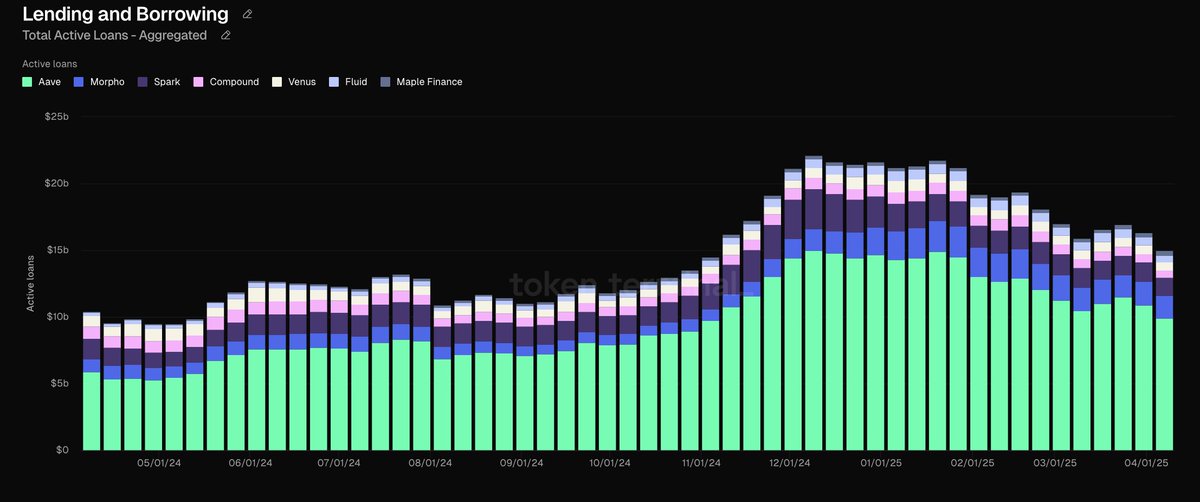

The state of the current lending and borrowing market:

🏦 major lending protocols including @aave, @MorphoLabs, and @compoundfinance currently service $15B in loans throughout the space

💳 aggregate active loans are down 29% YTD, but are still up 11% from their pre-election levels in November

💵 $38.4B of aggregate liquidity available, up 11% since November, representing a 39% utilization rate.

h/t @tokenterminal

16.38K

45

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.