How to Bid the Spot Ticker and Deploy Spot on HyperCore

Here we just help a project to get the ticker on hypercore, and I found that there is still some part which is not quite clear on existing doc. But thanks for the dedicated core team member of HL @xulian_hl and experienced ticker bidder @NMTD8 to answer lots of my questions.

Out of appreciation and also considering that there are not so many people who can get 2k testnet Hype, I believe that sharing my experience would be helpful for anyone who wants to get the ticker on hypercore and deploy the spot.

Ticker auction page on mainnet and testnet

Mainnet:

Testnet:

First of all, there are 6 steps from ticker bidding to hyperliquid deployment on hypercore for spot order book.

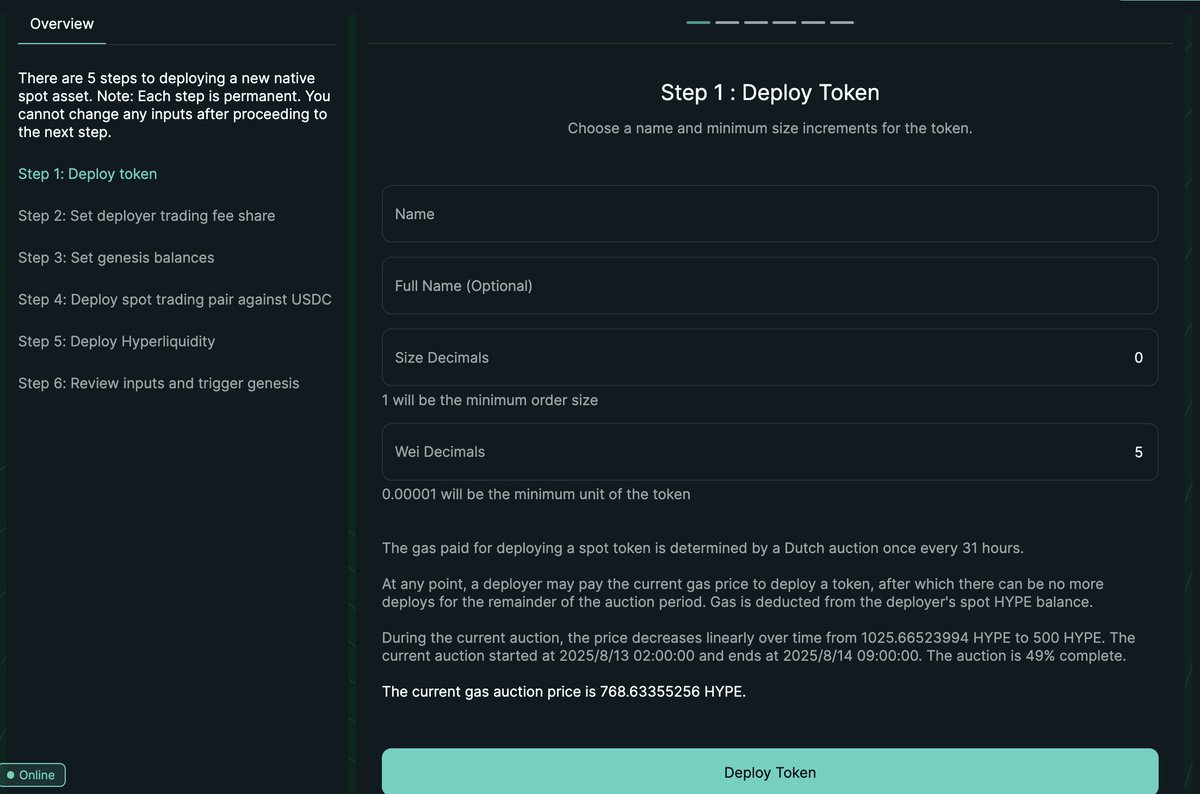

Step 1, Name & Decimals:

1. Name (6 chars max) & Full Name (Optional): it can be any name as long as the ticker has not been taken on hypercore.

2. Size Decimals: The size here is trading size on hypercore order book to control minimum trade increments.

For example, if your “size decimal” setting is 0.1, you cannot place an order for 1.02 tokens—it must adhere to the chosen size granularity.

3. Wei Decimals: it defines the smallest indivisible unit of your token (like “wei” for ETH). This ensures granular control over how tokens are counted and transferred.

Note according to hyperliquid spot bid side, the wei decimals should be between 0 ~8.

Important note: Once you click the "Deploy Token" then it means that you are going to pay the $HYPE token as gas for ticker auction. When it shows "Registered token" in the corner of your page, it means that you have successfully gotten the ticker.

Once you get the ticker, you need to set further parameters such as fee sharing, genesis balance, trading pair deployment, and hyperliquidity. But you can deploy it anytime as long as you complete step 1 and win the gas auction.

Here I recommend you to bid the ticker first and then go to @HyperliquidX's discord to get the ticket for requesting the testnet Hype with your txn of gas auction. And then you can get enough tokens to test the deployment on testnet.

Step 2, Setting the deployer trading fee share

It is a simple step just to type into the number as a percentage of the trading fee you (deployer) would like to share.

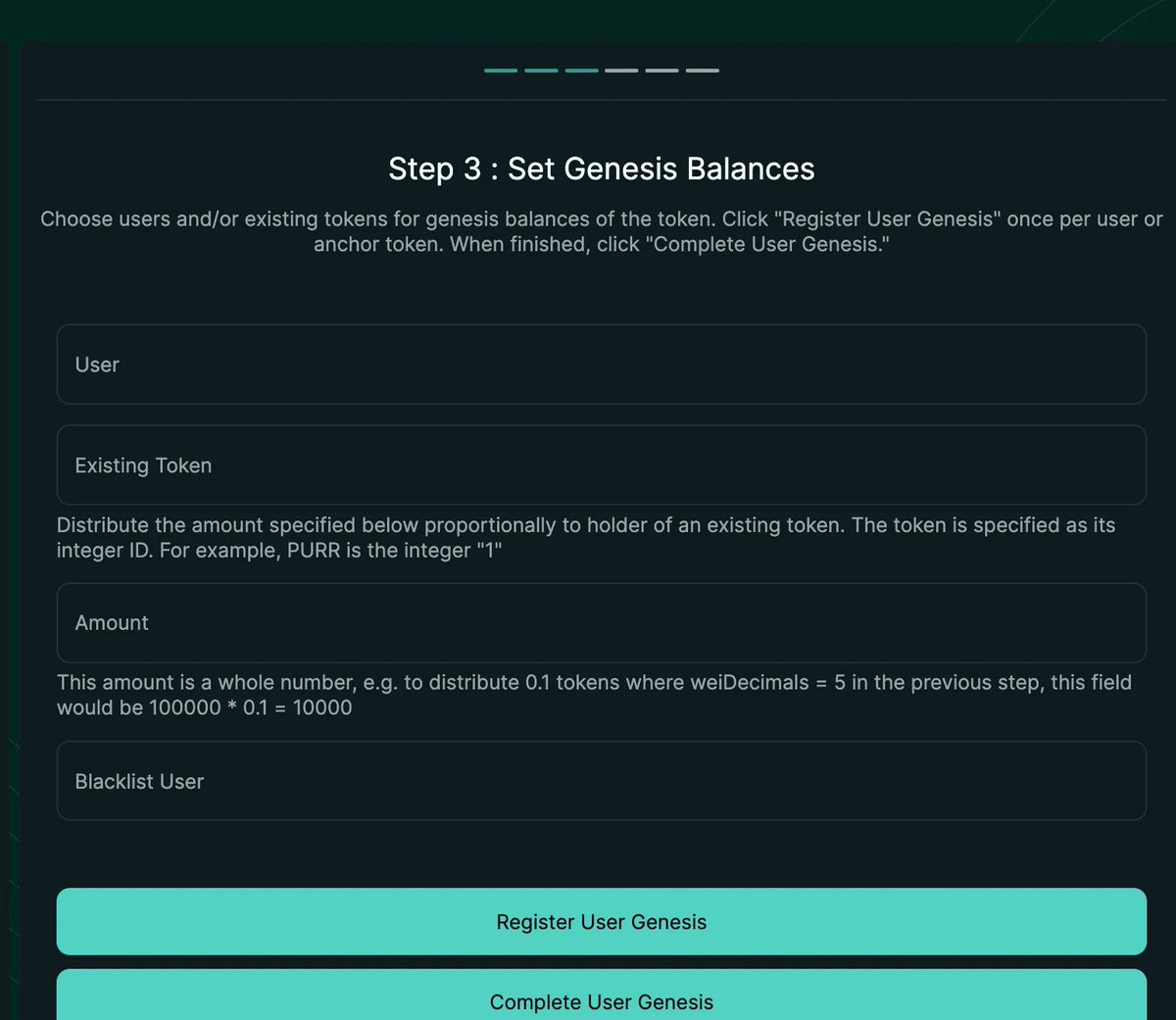

Step 3, Get Genesis Balances

To note, the hip1 token on hypercore is the token with the fixed hard-capped amount which cannot be updated after the genesis balances setting.

So if your token has already been deployed on the other chain, I would recommend using the largest amount of your token's tts to ensure that all the tokens on hypercore are enough to do bridge implementation.

usdt0 is a good case study:

Step 3-1: choose the user or existing token

You can choose to type the user's address or id of existing token on hypercore.

- User: input the user’s address.

- Existing token: put the id of the existing token on hip1.

Step 3-2: enter the amount the user can get.

Step 3-3: Register User Genesis

Once you click the register user genesis, it means that you have already completed the setting to distribute the genesis token to that user. And then you can keep adding user genesis multiple times until you complete all the users/existing token holders' genesis distribution.

If all the distribution is done, then we can click the "Complete User Genesis".

Step 4: Deploy spot trading pair against USDC

Here they only have a click to let you "deploy spot", click it and go to the next step.

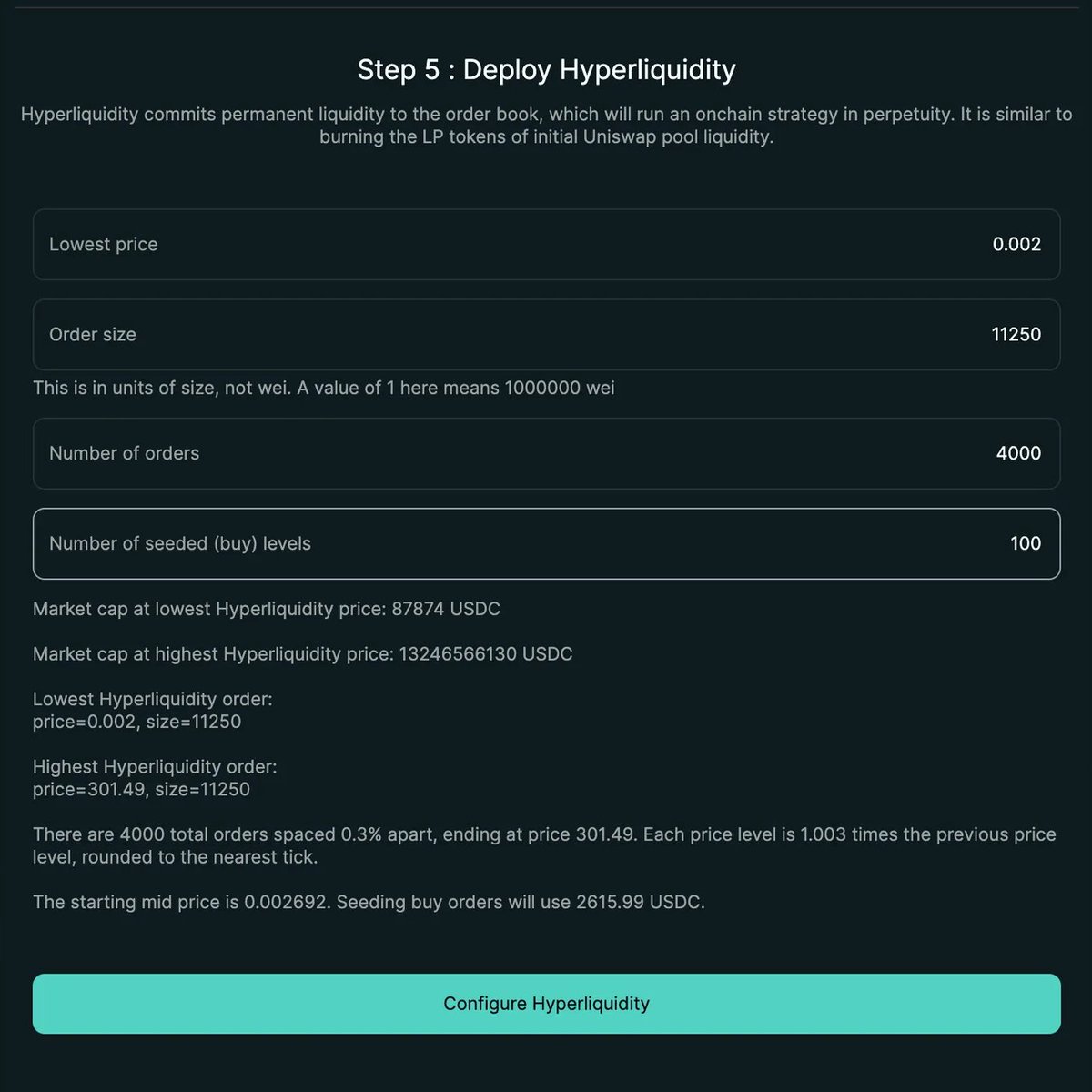

Step 5: Deploy Hyperliquidity

For this step, the main purpose is deploying the hyperliquidity according to HIP2.

To note: the liquidity on hypercore order must be more than 1% of tts.

Here we have 4 parameters to fill:

1. Lowest price

- It is the lowest price on hypercore order book you would like to set at the genesis hyperliquidity.

2. Order Size

- Order size here is the unit of each trading size. For example, if order size is 10000, it means that each trading size is 10000 tokens.

3. Number of orders

Total orders from maker and taker initially.

4. Number of seeded buy levels

Number of seeded buy levels is for initial maker order book setting (here it also charges the payment of USDC). For example, if we set 100 levels, then there will be 100 order books on the buy side. And such USDC is the liquidity which you require to pay here.

You can check my math in the Google sheet:

And also recommend reading the well-explained hyperliquid wiki.

Once you complete the hyperliquidity configuration, then the interface would ask you to review inputs and trigger genesis.

When you finish it, you can see a Purr finally and show the "Complete" for your spot deploy!

Final note: As far as I know, both @LayerZero_Core and CCIP powered by @chainlink support the bridge between HyperEVM and HyperCore.

Please do check and follow the instructions of those cross-chain solutions. For example, LayerZero asks to use their SDK for step 2 ~ step 6 instead of hyperliquid spot deploy interface.

LZ's doc

Recommended reading:

Finally, when I was writing my post, I also found a tutorial from @monprotocol. What an amazing piece!

Show original

4.85K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.