Because Huy predicts that Q4 will enter a strong uptrend for the breakout wave of altcoins, I am splitting my stablecoin portion to DCA until the end of Q3.

Q3 still belongs to $ETH.

Q4 bull again for mid and low cap.

SEPTEMBER IS NOT EASY TO EAT EVEN THOUGH ETH SEASON IS ON

Not long ago, I shared: ETH/BTC (D1 frame) has entered a bullish wave structure.

Since then, ETH has clearly strengthened.

But this is not yet the phase for most altcoins; to be precise, this is the season for ETH.

1) Why is "alt green" but still... losing to ETH?

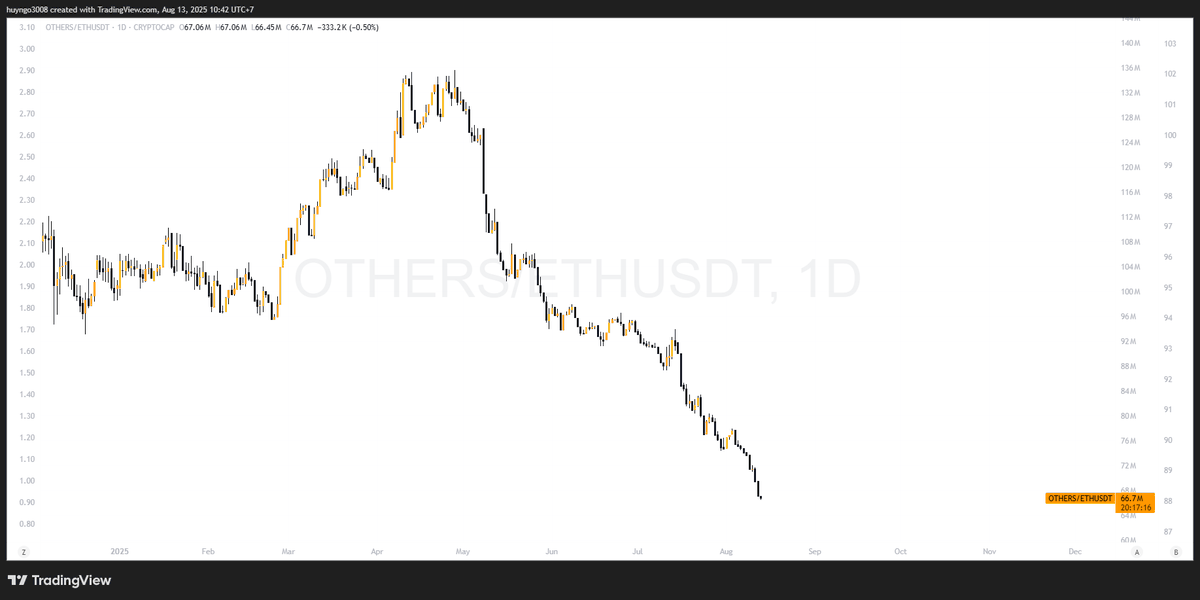

If you look at Alt/USDT, many coins are still rising.

But if you switch the measure to Alt/ETH, the price line goes down.

This means that with the same unit of risk, holding ETH is more effective than spreading capital into altcoins.

To explain simply for newcomers: USDT is the "cash measure," while ETH is currently the "performance benchmark for the alt group."

When Alt/ETH decreases, altcoins are weaker than ETH, even though they still look green against USDT.

2) History supports the scenario: August is stable, September is prone to turbulence

Looking back at the cycles after halving, August often has decent performance, but September tends to be weak, even in post-halving years.

Therefore, I wouldn't be surprised if a correction occurs in September.

During this period, avoiding leverage is a principle I strictly adhere to.

3) The scenario I follow: September slows down, October and November speed up

My view: Q3 is the phase of filtering out emotions, while Q4 is where the acceleration happens.

September: the market is prone to "shake" → slowing down, don't rush to switch to altcoins; I will gradually DCA into top altcoins in September to prepare for a breakout in Q4 this year.

From October: when the overall situation is more stable, ETH leads, and then altcoins will follow (when Alt/ETH stops decreasing, Others/ETH rises, and BTC.D cools down).

4) Execution plan (what I'm doing)

- Prioritize ETH (because the ETH/BTC D1 structure is increasing, and the monthly has two consecutive bullish setups at the support zone).

- DCA in September when the market shakes: I choose $ETH, $SUI, $UNI – three names with clear ecosystems, cash flow, and applications.

Break down orders over time, don’t "put all in one go," set prices you want to accumulate to avoid making decisions while the market is volatile.

5) A memorable image: bus & motorcycle

Imagine ETH as a big bus, and altcoins as motorcycles.

The road is crowded (high risk) → everyone gets on the bus for safety, and the bus runs steadily.

The bus arrives at a big stop (approaching the old peak), usually with a break (September).

When the road clears and the cash flow signals spread, motorcycles will start to rev up. At this point, not yet.

45.59K

82

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.