The stage is set for crypto's biggest bull run ever.

The industry has never experienced such a bullish set of tailwinds/rate of change.

🧵: Here are the 10 catalysts triggering the next explosive price move.👇

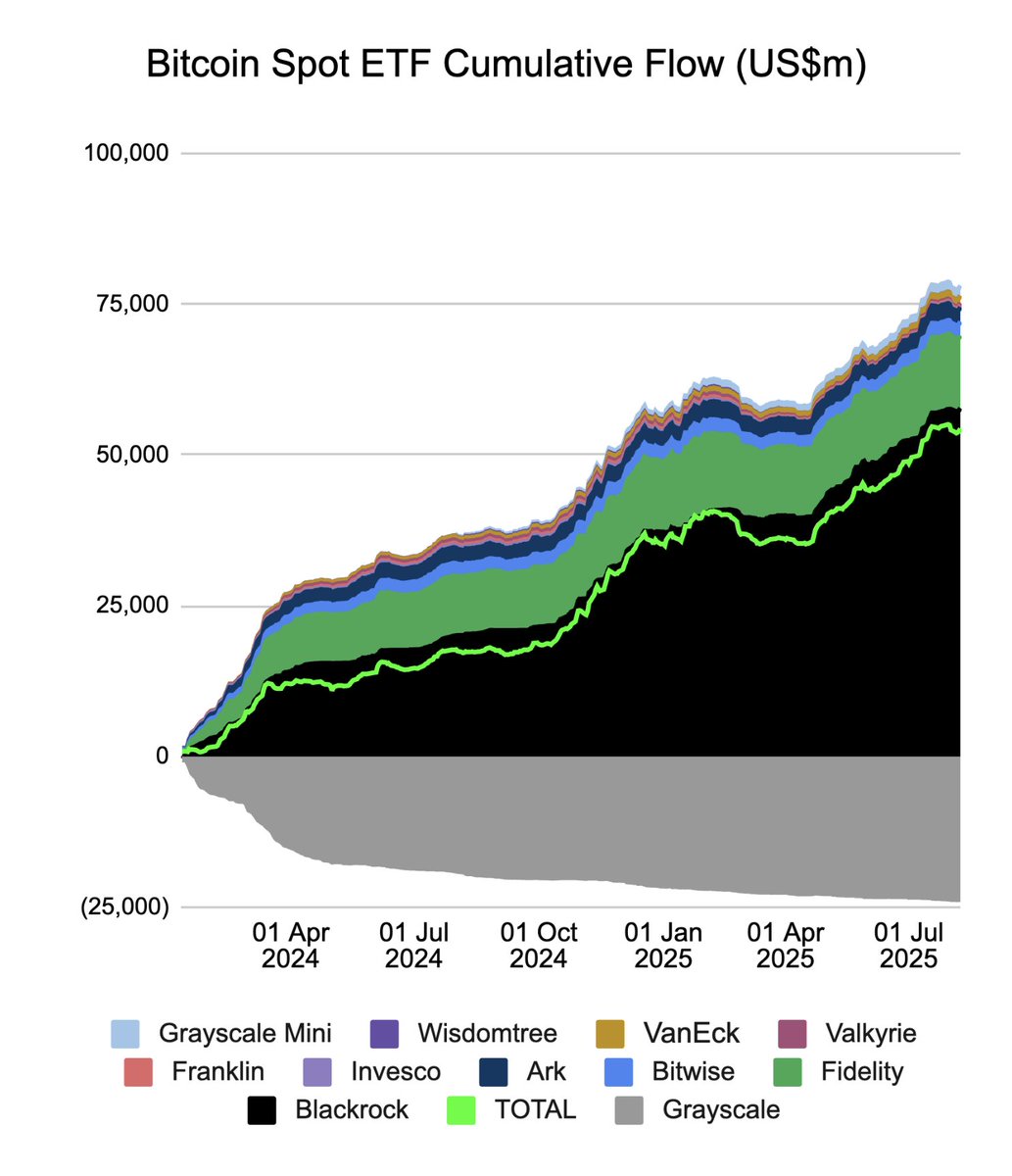

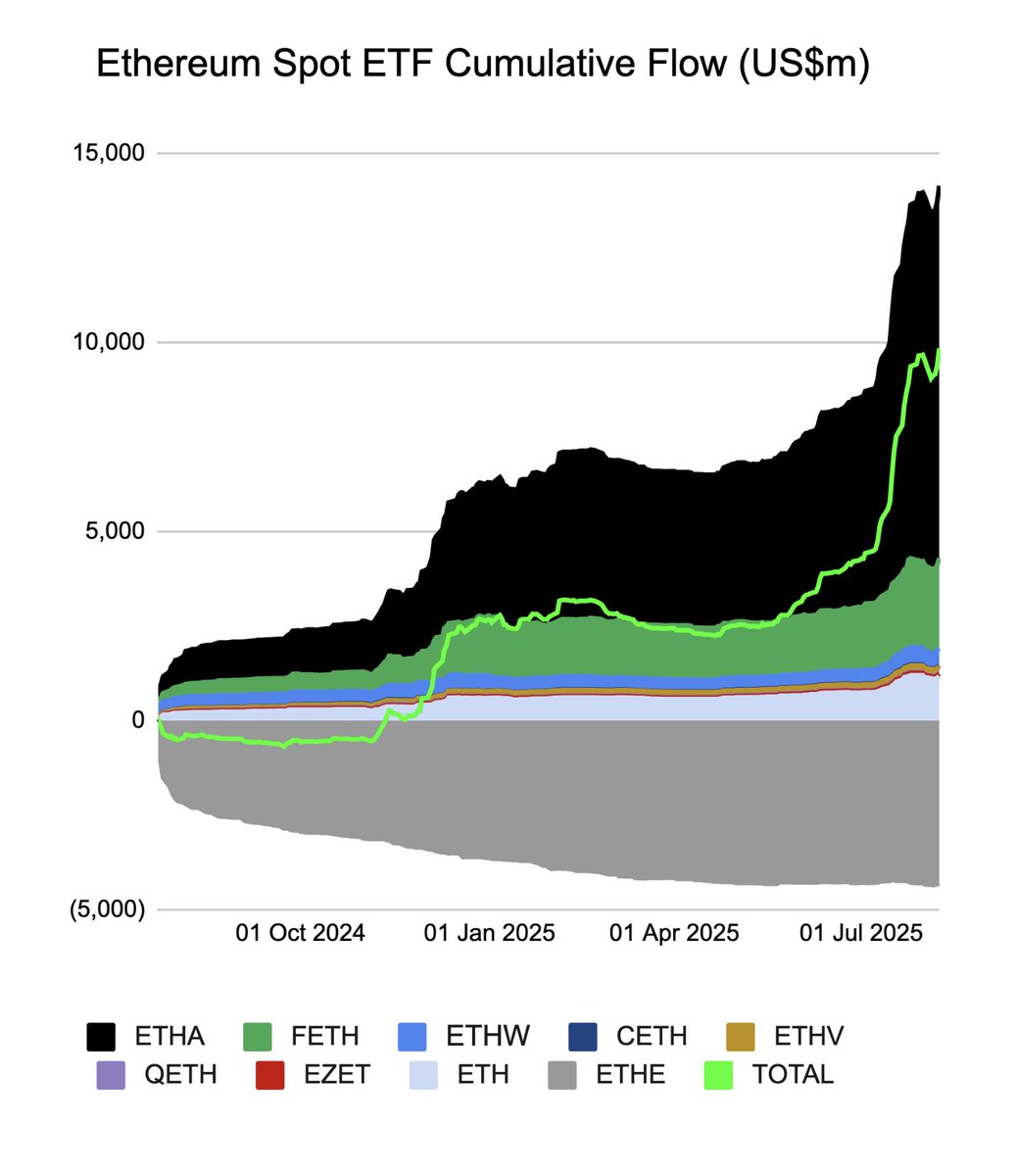

1. Spot $BTC & $ETH ETFs have pulled in $17B net over the last 60 days (>$11B in July alone).

This is bidding on an unprecedented scale.

3. The genius act was approved. This provides more regulatory clarity for stablecoins, which opens up the floodgates for blockchain/stablecoin adoption.

5. The Trump family is actively shilling ETH/crypto/tokenisation (and World Liberty launches soon).

Put this into perspective. The literal president of the United States of America (and his family) are publicly supporting crypto..

6. Harvard bought $120M of BlackRock's BTC ETF. This shows that there is real institutional demand now, that is being facilitated via the accessibility that the ETFs provide.

7. ETH has reclaimed $4,000, a multi-year level, which gives it real momentum to push back toward (and beyond) its 2021 ATH.

8. BTC & ETH refuse to break down, even with heavy FUD. This signals seller exhaustion, alongside sticky demand.

We had a small correction and traders started writing the obituaries again.

ETH/BTC has a lot of room to run and looks good on HTFs.

ETH/USD looks good and it is going to break through that $4k level eventually.

That final boss is going to get defeated.

Tom Lee has told you his company will buy 5% of the ETH supply, and you have Lubin racing to keep up, alongside other treasury companies.

With this buying pressure you also get the crypto natives jumping on the ETH bandwagon again contributing their liquidity.

Ultimately, you can keep it simple: there are more buyers than sellers for the foreseeable future.

Get off the hourly charts, zoom out and enjoy the ride up.

9. $BTC dominance looks extremely weak, for the first time since 2024.

This has been a historical trigger of "altcoin season".

10. Liquidity is more concentrated on majors/CEX, making the BTC/ETH trend cleaner (important for narrative alignment at this stage in cycle - healthier conditions for an alt rotation to happen later).

This is in contrast to late 2024, where liquidity is concentrated in the "trenches" - creating a less sustainable setup.

I hope you've found this thread helpful.

Follow me @milesdeutscher for more content like this.

Also, Like/Repost the quote below if you can. 💙

73.47K

587

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.