In the recent surge where Ethereum broke $4000, altcoins can be divided into two categories:

1. Some altcoins follow or exceed the rise of ETH, and these assets need to be closely monitored, paying attention to the sustainability of the catalysts, such as $PENDLE, $AERO, and $FXN;

2. Other tokens that do not follow the rise, in the context of slowing stablecoin inflows, it is wise to reduce positions in those assets that lack clear positive logic. However, $ENA is one that can still be held.

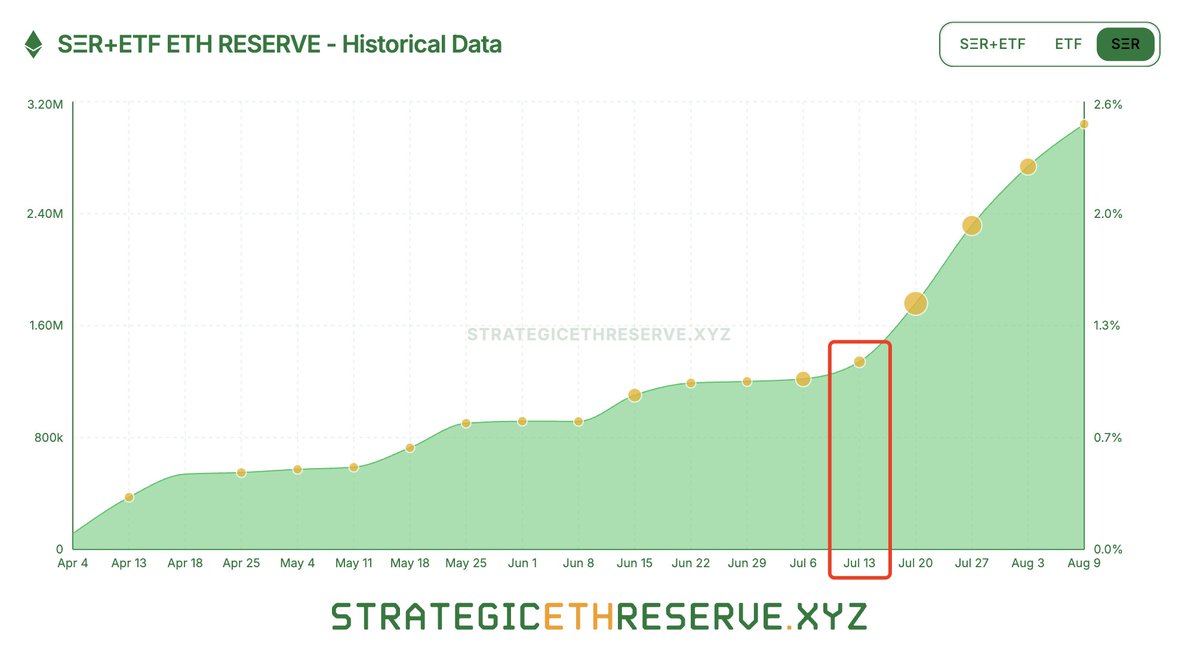

Since July 13, the market has basically been driven by the cryptocurrency stock market. In the absence of an increase in stablecoin inflows, it is very normal for altcoins to lag behind Ethereum. At this time, if you want to trade altcoins, focus on areas where market attention is concentrated for the highest risk-reward ratio.

37.33K

23

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.