KINETIQ — The Kinetic Engine of the Hyperliquid Ecosystem

KM! So excited to see Kinetiq @kinetiq_xyz

becoming the first(maybe) @HyperliquidX ecosystem project to hit $1B TVL — and in just three weeks since launch! What a milestone.

Congrats to @0xOmnia~

This is the reason why I believe that I should dig into Kinetiq, and below is my introduction about Kinetiq.

Tbh I have been curious why there are so many eyeballs on Kinetiq before it launched haha. And if I am not wrong, tons of HYPE (more than 100m HYPE) unstaked before the launch day of Kinetiq from mainnet for engaging in Kinetiq's liquid staking.

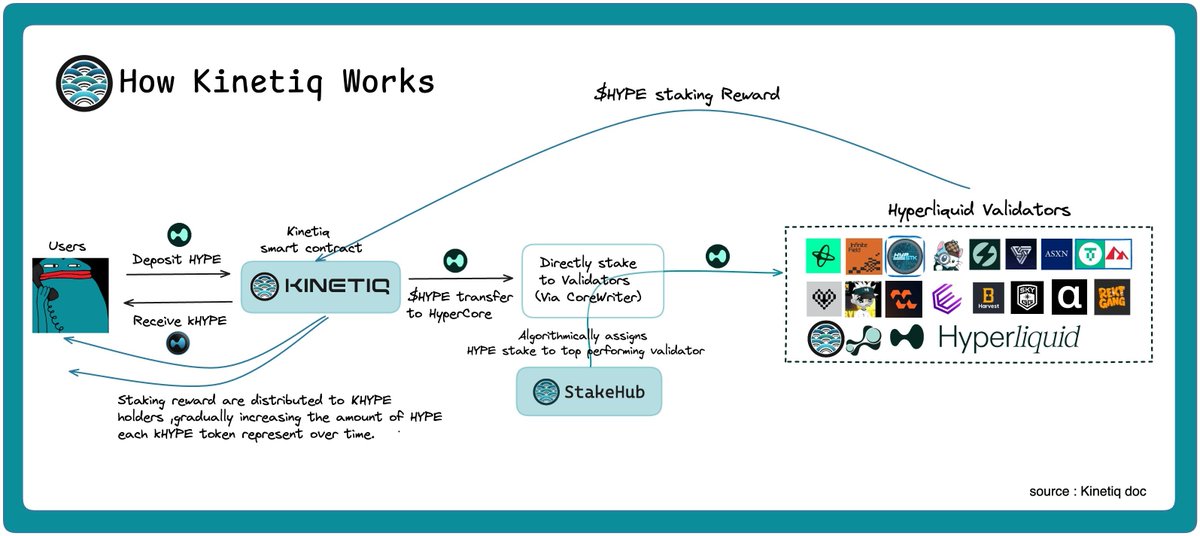

Part 1. How Kinetiq works

Kinetiq is a native Hyperliquid LST protocol designed to fully meet user needs from different aspects:

Unlike other LST projects, Kinetiq natively integrates with the Hyperliquid PoS network. Users simply stake their HYPE to Kinetiq and receive kHYPE to get liquidity while earning rewards from the PoS network.

Besides, Kinetiq’s contract autonomously delegates staked HYPE to the top-performing validator, which is ranked by StakeHub based on five key metrics: Reliability, Security, Economics, Governance, and Longevity.

You can go through their validators to know much more about the current status of Stakehub's scoring system:

One thing that makes me much more impressed is that staking to HyperCore through Kinetiq is totally powered by CoreWriter — a native Hyperliquid system feature that allows HyperEVM contracts to write directly into HyperCore. It is HUGE!!

This means all validator delegation happens fully on-chain, with no off-chain trust assumptions.

Kinetiq is one of the first HyperEVM protocols to adopt CoreWriter for validator delegation, enabling trustless, automated HYPE staking. If you want to dive deeper into CoreWriter, check out @djenn's amazing post and video.

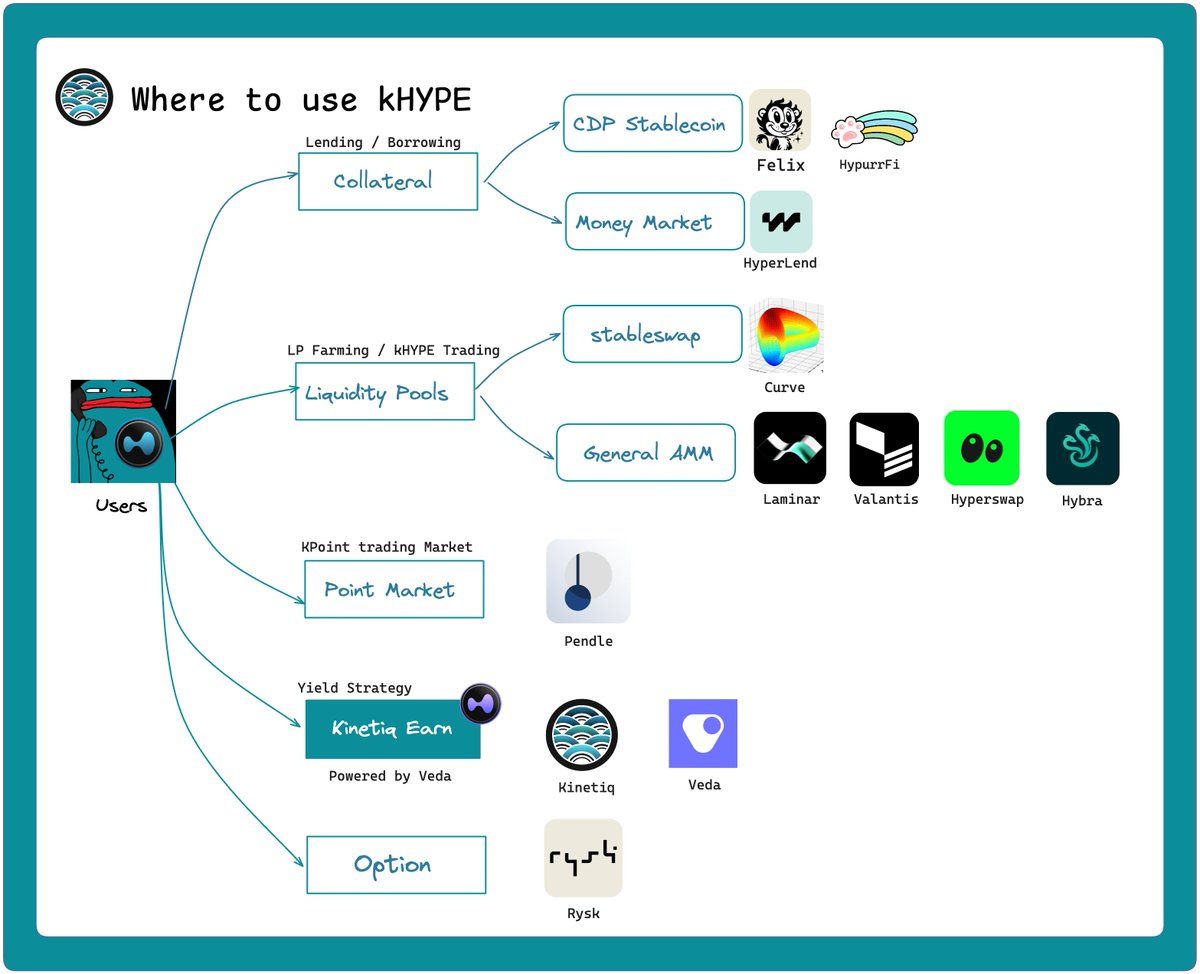

2. The Multiple Usage of kHYPE (YES from day 1)

Another massive milestone Kinetiq hit is that they almost got all the integration with the main ecosystem projects on HyperEVM on day 1. From the first day of kHYPE launch, kHYPE has been usable across the HyperEVM DeFi projects.

Below are the four sectors where kHYPE has already been accepted by the HyperEVM ecosystem projects. (Please let me know if I missed your project here)

A. Collateral

kHYPE can be accepted as collateral on money markets and CDP protocols like @felixprotocol, @HypurrFi, which means that you can use your kHYPE as collateral to mint feUSD or USDL.

Also, you can deposit your kHYPE on @hyperlendx

for lending to get yield and borrowing as adding some leverage to your HYPE if you are bullish on $HYPE.

B. Liquidity Pool

kHYPE is a liquidable asset on multiple trading platforms including @CurveFinance on the stableswap's side, and on the general AMM part, we can also provide liquidity and trade kHYPE on @laminar_xyz, @ValantisLabs, @prjx_hl, @HyperSwapX, and @HybraFinance.

As I understand from @0xOmnia, kHYPE AMM is the largest pool on @prjx_hl and @ValantisLabs.

C. Point market

on @pendle_fi. On Pendle, they have provided the point market for Kinetiq's kPoint.

Anyone who would like to get the kPOINT can purchase their yt token to pay kHYPE and earn the point. Vice versa, for PT there is a 12% Fixed APY.

@tn_pendle your team is great! Learn more about Pendle's kPOINT market here.

D. Kinetiq Earn

If Kinetiq can serve users to deposit their HYPE to the top-performing validator, why not provide an automatic strategy platform for kHYPE?

Yes, this is Kinetiq Earn powered by @veda_labs, which can put your kHYPE (also HYPE) to work across leading DeFi protocols on HyperEVM, optimizing for the best risk-adjusted returns. Currently, the TVL on Kinetiq EARN is 196m with a 6% estimated APY.

Yes, it is the largest pool on Veda so far.

Check Kinetiq Earn here:

E. Option

On @ryskfinance, you can open a 21-day length option to sell your kHYPE with 3% ~ 57.93% APR.

Now it is 30% TVL of Rysk. Also, congrats on the launch of Rysk to the public @DanDeFiEd.

Check it here:

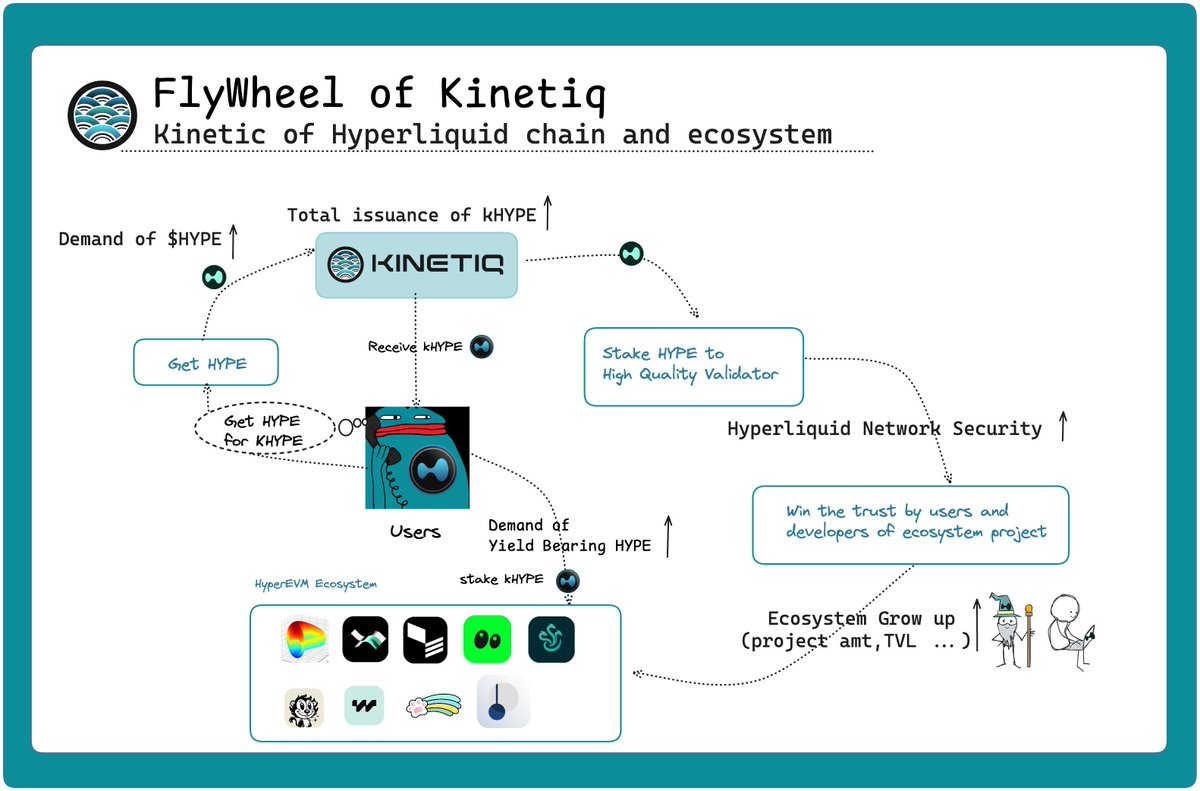

Part 3. The Kinetiq Flywheel — Kinetiq is the kinetic of the Hyperliquid Network and HyperEVM ecosystem!

With Kinetiq, all of the stakeholders on Hyperliquid including users (HYPE holders), validators of the PoS network, and the ecosystem can benefit.

Here is my analysis for the synergy and positivity led by Kinetiq.

A. User (HYPE holder)

1. YIELD: they can deposit and directly delegate their HYPE to the best validator on HyperCore and earn the yield.

2. LIQUIDITY of the asset: with kHYPE, users can earn staking rewards without giving up liquidity.

B. Validator (Network Security)

With Kinetiq, kHYPE stakers can support network security and the decentralization of the HL network — without compromise while earning high interest.

With StakeHub, Kinetiq provides a continuous incentive for outstanding validators to stay online and perform at the highest possible level, aligning with the strict criteria set by StakeHub to receive stake delegation.

When validators receive the incentive from Kinetiq, they provide the highest level validator service for the HL PoS network, which also helps Hyperliquid win the trust from ecosystem developers and users to access HyperEVM and HyperCore.

C. Ecosystem

With better service, higher confidence for developers to build applications on Hyperliquid. With the useful LST asset - kHYPE, more and more users have much more liquidity to engage in HyperEVM ecosystem projects while earning staking rewards from the HL PoS network.

Especially in the early stage now, there is still kPOINT to attract users to mint kHYPE and loop their yield on other ecosystem projects.

The design and the way to use Kinetiq as access into Hyperliquid is simple, but being simple is always not easy.

The flywheel is keeping running. I believe that there will be much more innovation and integration from Kinetiq.

Special thanks to @0xOmnia for responding to my question in a short time.

Do let me know if you are running or about to run a project on Hyperliquid (HyperEVM).

# Recommended reading

- For kPOINT's value estimation: Well read from @0xlykt's post.

Show original

243

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.